Evening Star Candlestick Pattern.

Sham ki Taara Candlestick pattern forex trading mein ek bohat ahem pattern hai. Is pattern ki madad se traders future price movements ka andaza lagate hain aur apni trading decisions bana lete hain. Is article mein hum sham ki taara candlestick pattern ko roman urdu mein explain karenge.

Candlestick patterns, forex trading mein bohat ahem hote hain. Ye patterns traders ko price movements ke bare mein information dete hain. Candlestick patterns ko reading karne ke liye, traders ko candlestick chart ki zarurat hoti hai. Candlestick chart mein, har candlestick ek din ya ek hafta ke price movements ko represent karta hai.

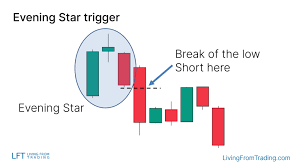

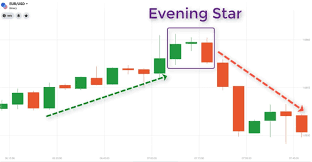

Evening Star Candlestick Pattern Anylesis.

Sham ki taara candlestick pattern, ek bullish reversal pattern hai. Is pattern ko dekh kar traders samajh sakte hain ke market bearish se bullish mein change hone wala hai. Is pattern mein, pehle ek long red candlestick hota hai, phir ek short green candlestick aur phir ek long green candlestick hota hai.

Sham ki taara candlestick pattern ko samajhne ke liye, traders ko is pattern ke components ko samajhna zaruri hai. Pehle component mein, ek long red candlestick hota hai jo bearish trend ko represent karta hai. Doosre component mein, ek short green candlestick hota hai jo pehle candlestick ko confirm karta hai. Teesre component mein, ek long green candlestick hota hai jo bullish trend ko represent karta hai.

Agar traders sham ki taara candlestick pattern ko dekhte hain, to wo ye samajh sakte hain ke market bearish se bullish mein change hone wala hai. Ye pattern, traders ko buy signals deta hai aur wo is pattern ko follow kar ke trading decisions bana sakte hain.

Baiscs of Pattern.

Sham ki taara candlestick pattern, forex trading mein ek bohat ahem pattern hai. Is pattern ko samajh kar traders future price movements ko predict kar sakte hain aur apni trading decisions bana sakte hain. Is pattern ko dekh kar traders ko buy signals milte hain aur wo is pattern ko follow kar ke apni trading strategies bana sakte hain.

Sham ki Taara Candlestick pattern forex trading mein ek bohat ahem pattern hai. Is pattern ki madad se traders future price movements ka andaza lagate hain aur apni trading decisions bana lete hain. Is article mein hum sham ki taara candlestick pattern ko roman urdu mein explain karenge.

Candlestick patterns, forex trading mein bohat ahem hote hain. Ye patterns traders ko price movements ke bare mein information dete hain. Candlestick patterns ko reading karne ke liye, traders ko candlestick chart ki zarurat hoti hai. Candlestick chart mein, har candlestick ek din ya ek hafta ke price movements ko represent karta hai.

Evening Star Candlestick Pattern Anylesis.

Sham ki taara candlestick pattern, ek bullish reversal pattern hai. Is pattern ko dekh kar traders samajh sakte hain ke market bearish se bullish mein change hone wala hai. Is pattern mein, pehle ek long red candlestick hota hai, phir ek short green candlestick aur phir ek long green candlestick hota hai.

Sham ki taara candlestick pattern ko samajhne ke liye, traders ko is pattern ke components ko samajhna zaruri hai. Pehle component mein, ek long red candlestick hota hai jo bearish trend ko represent karta hai. Doosre component mein, ek short green candlestick hota hai jo pehle candlestick ko confirm karta hai. Teesre component mein, ek long green candlestick hota hai jo bullish trend ko represent karta hai.

Agar traders sham ki taara candlestick pattern ko dekhte hain, to wo ye samajh sakte hain ke market bearish se bullish mein change hone wala hai. Ye pattern, traders ko buy signals deta hai aur wo is pattern ko follow kar ke trading decisions bana sakte hain.

Baiscs of Pattern.

Sham ki taara candlestick pattern, forex trading mein ek bohat ahem pattern hai. Is pattern ko samajh kar traders future price movements ko predict kar sakte hain aur apni trading decisions bana sakte hain. Is pattern ko dekh kar traders ko buy signals milte hain aur wo is pattern ko follow kar ke apni trading strategies bana sakte hain.

تبصرہ

Расширенный режим Обычный режим