Spreadsheets, yaanee keh pages ke falto say bachnay walay electronic dastaweez, mukhtalif sanatiyon mein istemaal hotay hain taakee data ko tarteeb daina, ussay tajziya karna aur numaindagi mein paish karna aasani se mumkin ho. Trading mein, spreadsheets ka istemal financial maloomat ko manage karnay, market ke trends ka tajziya karnay aur maqool inayat faisalay karnay mein khaas ahmiyat rakhta hai.

Data Organization

Trading mein spreadsheets ka istemal baray paimanay par data tarteeb karne ke liye hota hai. Traders aksar data ko mukhtalif asoolon se jama karte hain jaise ke market data providers, trading platforms, aur maali databases. Is data mein stocks ke prices, trading volumes, ma'ashiyati daleelain, company ki maaliyat aur zyada shamil hoti hai.

Excel, Google Sheets, aur dusri spreadsheet software mein mukhtalif tools moujood hain jo data ko tarteeb denay mein madad karte hain. Masalan, traders aik saath mukhtalif stocks ki performance ko track kar saktay hain, key metrics ko mawazna kar saktay hain, aur trends ya patterns ko pehchankar faida utha saktay hain.

Financial Modeling

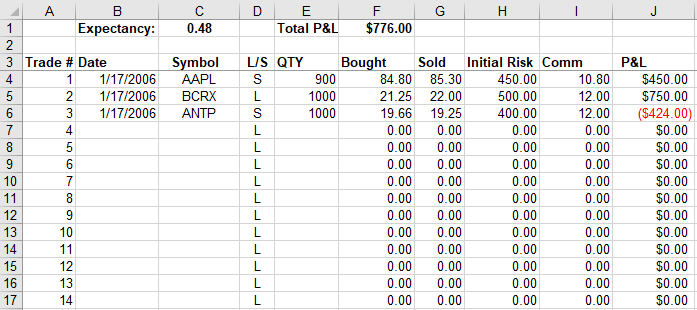

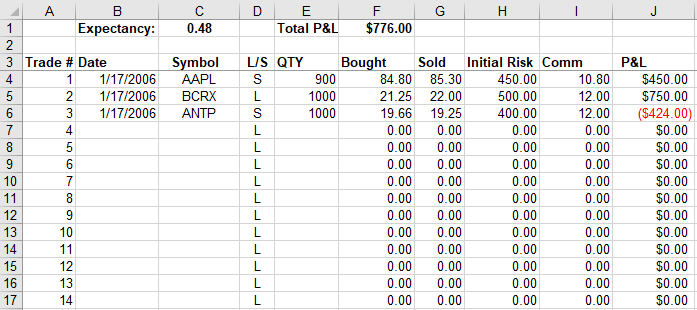

Spreadsheets trading mein financial modeling ke liye istemal hotay hain. Traders spreadsheets mein models banatay hain jo mukhtalif financial scenarios ko simulate karte hain, investment opportunities ka tajziya karte hain, aur portfolio performance par mukhtalif factors ka asar dekhtay hain.

Financial models trading mein aam tor par seedha calculations jaise ke munafa aur nuqsan ka tajziya se le kar complex models tak ka istemal hota hai jese ke options pricing, risk assessment, aur portfolio optimization. Spreadsheet functions jaise ke SUM, AVERAGE, IF statements, VLOOKUP, aur zyada aam tor par istemal hotay hain calculations aur data manipulation ke liye.

Risk Management

Effficient risk management trading mein zaroori hai taakee nuqsan ko kam kia ja sake aur capital ki hifazat ki ja sake. Spreadsheets risk analysis aur faisalay karne wale processes mein traders ke liye bohot ahem hai. Risk management spreadsheets mein aksar shaamil features hain jese ke:

Spreadsheets ka istemal risk management mein traders ko informed decisions lene mein madad deta hai, risk limits set karne mein madad karta hai, aur risk mitigation strategies ko effectively implement karne mein madad deta hai.

Trading Strategies

Spreadsheets trading strategies develop karne, backtest karne, aur analyze karne mein ahem kirdar ada karte hain. Traders spreadsheets ka istemal karte hain:

Spreadsheets ka istemal trading strategies mein traders ko unke approaches ko refine karne, performance ko optimize karne, aur changing market conditions ke mutabiq adapt karne mein madad deta hai.

Portfolio Management

Spreadsheets trading mein portfolio management ke liye widely used hote hain. Traders multiple assets ko track aur manage kar saktay hain, holdings ko diversify kar saktay hain, performance ko monitor kar saktay hain, aur portfolios ko rebalance kar saktay hain spreadsheets ka istemal karke. Portfolio management spreadsheets ke key features mein shaamil hain:

Portfolio management spreadsheets maintain karne se, traders data-driven decisions lene, asset allocations ko optimize karne, aur long-term investment outcomes ko enhance karne mein madad pa sakte hain.

Reporting and Visualization

Spreadsheets trading data ko report aur visualize karne ke liye bohot ahem hote hain. Traders customized reports, charts, graphs, aur dashboards create kar saktay hain spreadsheets mein taakee information ko effectively communicate kiya ja sake. Aam reporting aur visualization features mein shaamil hain:

Spreadsheets ka istemal reporting aur visualization mein, traders insights gain kar sakte hain, progress track kar sakte hain, aur results ko stakeholders tak effectively communicate kar sakte hain.

Automation and Integration

Spreadsheets ko automate aur dusri trading tools aur platforms ke saath integrate karne se processes ko streamline kiya ja sakta hai aur productivity ko improve kiya ja sakta hai. Traders macros, scripts, aur add-ons ka istemal karke repetitive tasks ko automate kar saktay hain, external sources se data ko import kar saktay hain, aur trading strategies ko execute kar saktay hain.

Trading APIs, data feeds, aur analytics platforms ke saath integration spreadsheets ko real-time data access karne, advanced analysis karne, aur trades ko spreadsheets se directly execute karne mein madad deta hai. Ye integration decision-making capabilities ko enhance karta hai, manual errors ko reduce karta hai, aur trading operations mein efficiency ko barhata hai.

Spread sheets trading mein data tarteeb, maali modeling, risk ka nigrani, trading strategies, portfolio management, reporting, visualization, automation, aur integration mein khaas ahmiyat rakhtay hain. Traders spreadsheets ka istemal karke market data ko analyze karte hain, informed decisions lete hain, risks ka nigrani karte hain, portfolios ko optimize karte hain, aur apne trading objectives ko effectively achieve karte hain. Spreadsheets ke zariye, traders competitive edge hasil kar sakte hain, dynamic market conditions ke mutabiq adapt kar sakte hain, aur overall performance ko financial markets mein enhance kar sakte hain.

Data Organization

Trading mein spreadsheets ka istemal baray paimanay par data tarteeb karne ke liye hota hai. Traders aksar data ko mukhtalif asoolon se jama karte hain jaise ke market data providers, trading platforms, aur maali databases. Is data mein stocks ke prices, trading volumes, ma'ashiyati daleelain, company ki maaliyat aur zyada shamil hoti hai.

Excel, Google Sheets, aur dusri spreadsheet software mein mukhtalif tools moujood hain jo data ko tarteeb denay mein madad karte hain. Masalan, traders aik saath mukhtalif stocks ki performance ko track kar saktay hain, key metrics ko mawazna kar saktay hain, aur trends ya patterns ko pehchankar faida utha saktay hain.

Financial Modeling

Spreadsheets trading mein financial modeling ke liye istemal hotay hain. Traders spreadsheets mein models banatay hain jo mukhtalif financial scenarios ko simulate karte hain, investment opportunities ka tajziya karte hain, aur portfolio performance par mukhtalif factors ka asar dekhtay hain.

Financial models trading mein aam tor par seedha calculations jaise ke munafa aur nuqsan ka tajziya se le kar complex models tak ka istemal hota hai jese ke options pricing, risk assessment, aur portfolio optimization. Spreadsheet functions jaise ke SUM, AVERAGE, IF statements, VLOOKUP, aur zyada aam tor par istemal hotay hain calculations aur data manipulation ke liye.

Risk Management

Effficient risk management trading mein zaroori hai taakee nuqsan ko kam kia ja sake aur capital ki hifazat ki ja sake. Spreadsheets risk analysis aur faisalay karne wale processes mein traders ke liye bohot ahem hai. Risk management spreadsheets mein aksar shaamil features hain jese ke:

- Risk metrics ka calculation: Spreadsheets risk metrics jaise ke Value at Risk (VaR), Sharpe ratio, volatility, drawdowns, aur maximum loss potential ka calculation kar saktay hain.

- Position sizing: Traders spreadsheets ka istemal karke position size ko determine karte hain based on risk tolerance, account size, aur stop-loss levels.

- Scenario analysis: Traders spreadsheets mein scenarios create kar saktay hain taakee market events, volatility ke changes, ya portfolio adjustments ka asar risk exposure par analyze kiya ja sake.

Spreadsheets ka istemal risk management mein traders ko informed decisions lene mein madad deta hai, risk limits set karne mein madad karta hai, aur risk mitigation strategies ko effectively implement karne mein madad deta hai.

Trading Strategies

Spreadsheets trading strategies develop karne, backtest karne, aur analyze karne mein ahem kirdar ada karte hain. Traders spreadsheets ka istemal karte hain:

- Trading rules banane ke liye: Spreadsheets traders ko entry aur exit criteria, position sizing rules, stop-loss levels, aur profit targets define karne mein madad karte hain.

- Backtesting: Traders apni strategies ko historical data ka istemal karke backtest karte hain taakee performance ko evaluate kar sake, strengths aur weaknesses ko identify kar sake, aur improvements kar sake.

- Performance analysis: Spreadsheets traders ko apni trading strategies ki performance ko time ke saath analyze karne mein madad dete hain, jese ke profitability, win rate, drawdowns, aur risk-adjusted returns.

Spreadsheets ka istemal trading strategies mein traders ko unke approaches ko refine karne, performance ko optimize karne, aur changing market conditions ke mutabiq adapt karne mein madad deta hai.

Portfolio Management

Spreadsheets trading mein portfolio management ke liye widely used hote hain. Traders multiple assets ko track aur manage kar saktay hain, holdings ko diversify kar saktay hain, performance ko monitor kar saktay hain, aur portfolios ko rebalance kar saktay hain spreadsheets ka istemal karke. Portfolio management spreadsheets ke key features mein shaamil hain:

- Portfolio tracking: Spreadsheets individual assets, asset classes, aur overall portfolio ki performance ko track kar saktay hain.

- Allocation analysis: Traders spreadsheets ka istemal karke portfolio allocations, sector exposure, geographic diversification, aur risk distribution ko analyze kar saktay hain.

- Rebalancing: Spreadsheets traders ko determine karne mein madad karte hain ke kab portfolios ko rebalance karna chahiye taakee desired asset allocations aur risk levels maintain kiye ja sakein.

Portfolio management spreadsheets maintain karne se, traders data-driven decisions lene, asset allocations ko optimize karne, aur long-term investment outcomes ko enhance karne mein madad pa sakte hain.

Reporting and Visualization

Spreadsheets trading data ko report aur visualize karne ke liye bohot ahem hote hain. Traders customized reports, charts, graphs, aur dashboards create kar saktay hain spreadsheets mein taakee information ko effectively communicate kiya ja sake. Aam reporting aur visualization features mein shaamil hain:

- Financial statements: Traders income statements, balance sheets, cash flow statements, aur performance reports generate kar saktay hain spreadsheets mein.

- Charts aur graphs: Spreadsheets mein mukhtalif chart types jese ke line charts, bar charts, pie charts, aur scatter plots moujood hote hain trading data aur trends ko visualize karne ke liye.

- Dashboards: Traders interactive dashboards create kar saktay hain spreadsheets mein jo key metrics, KPIs, aur performance indicators ko display karne mein madad karte hain taakee quick analysis ki ja sake.

Spreadsheets ka istemal reporting aur visualization mein, traders insights gain kar sakte hain, progress track kar sakte hain, aur results ko stakeholders tak effectively communicate kar sakte hain.

Automation and Integration

Spreadsheets ko automate aur dusri trading tools aur platforms ke saath integrate karne se processes ko streamline kiya ja sakta hai aur productivity ko improve kiya ja sakta hai. Traders macros, scripts, aur add-ons ka istemal karke repetitive tasks ko automate kar saktay hain, external sources se data ko import kar saktay hain, aur trading strategies ko execute kar saktay hain.

Trading APIs, data feeds, aur analytics platforms ke saath integration spreadsheets ko real-time data access karne, advanced analysis karne, aur trades ko spreadsheets se directly execute karne mein madad deta hai. Ye integration decision-making capabilities ko enhance karta hai, manual errors ko reduce karta hai, aur trading operations mein efficiency ko barhata hai.

Spread sheets trading mein data tarteeb, maali modeling, risk ka nigrani, trading strategies, portfolio management, reporting, visualization, automation, aur integration mein khaas ahmiyat rakhtay hain. Traders spreadsheets ka istemal karke market data ko analyze karte hain, informed decisions lete hain, risks ka nigrani karte hain, portfolios ko optimize karte hain, aur apne trading objectives ko effectively achieve karte hain. Spreadsheets ke zariye, traders competitive edge hasil kar sakte hain, dynamic market conditions ke mutabiq adapt kar sakte hain, aur overall performance ko financial markets mein enhance kar sakte hain.

تبصرہ

Расширенный режим Обычный режим