Introduction to Capital Management

Trading mein capital management ka tajziya karna lambay arsay tak financial markets mein kamiyabi aur munafa hasil karne ka aham pehlu hai. Yeh trader dwara istemal kye jane wale strategies aur techniques ko shamil karta hai jo unhe apne trading capital ko behtareen tareeqay se allocate aur manage karne mein madad dete hain taake wo returns ko ziada karein aur risks ko kam karein. Durust capital management market ki tabdeeliyon aur uncertainty ke doran capital ko preserve karna ke liye bohot zaroori hai aur profitable trading opportunities ka faida uthana bhi.

Foundation of Capital Management

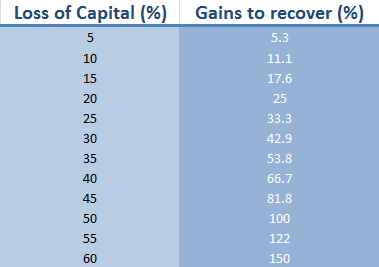

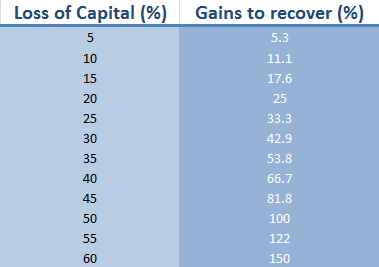

Risk management trading mein capital management ka bunyadi asool hai. Yeh process hai jis mein traders trading activities ke sath jude hue potential risks ko pehchan, assess aur mitigate karte hain. Risk management ka aik ahem asool hai kabhi bhi predetermined percentage se zyada capital ko kisi bhi single trade par risk mein daalne ki ijazat nahi deni chahiye. Yeh percentage, jo ke risk per trade ya risk per position ke tor par zikar hoti hai, aam tor par total trading capital ka 1% se lekar 3% tak hoti hai. Capital ko har trade par risk mein daal kar traders catastrophic losses se bach sakte hain aur apne capital ko long term mein preserve kar sakte hain.

Position Sizing

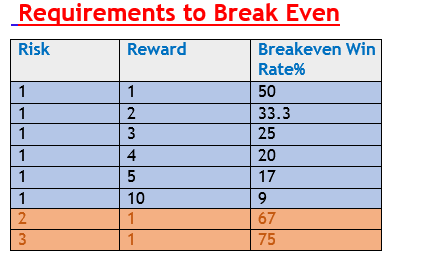

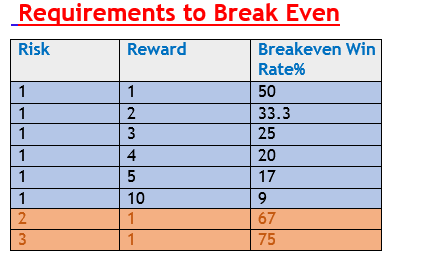

Position sizing bhi capital management ka aham pehlu hai jo ke risk management ke sath juda hua hai. Is mein har trade ka munasib size determine karna shamil hai jo ke risk level aur trader ki risk tolerance par mabni hota hai. Position sizing aam tor par aik formula ka istemal karte hue calculate kiya jata hai jo ke entry price, stop-loss level, aur har trade par risk mein daali gayi percentage ko shamil karta hai. Sahi position sizing ke zariye, traders apne risk-reward ratio ko optimize kar sakte hain aur apne trades par potential returns ko ziada karte hue downside risk ko control kar sakte hain.

Leverage

Leverage trading mein aik doosri taraf ki churi hai aur iska ta'alluq capital management ke saath mazbooti se hai. Iska mafhoom yeh hai ke chhoti raqam se bari position ko market mein control karne ki salahiyat hai. Jabke leverage munafa ko ziada kar sakta hai, wahi yeh nuksan ko bhi barha sakta hai. Is liye, traders ko leverage ko hoshiyarana tareeqay se istemal karna chahiye aur iska asar apne overall capital management strategy par bhi ghor karna chahiye. Zyada leverage achanak market volatility ya unexpected price movements ke doran trading capital ko jald khatam kar sakta hai.

Diversification

Diversification capital management ka aik aur ahem asool hai jo ke risk ko mukhtalif asset classes, markets, ya trading strategies mein taqseem karne ka hai. Diversification ka faida ek trader ki portfolio mein overall risk ko kam karne mein hota hai jahan ek area mein nuksan ko doosri area mein faida se compensate kiya jata hai. Traders ko sirf mukhtalif assets ke beech hi nahi balki mukhtalif time frames aur trading strategies ke beech bhi diversify karna chahiye taake correlation ko kam kiya ja sake aur risk-adjusted returns ko behtar banaya ja sake.

Psychological Factors

Psychological factors capital management aur trading mein kamiyabi ke liye bohot ahem hoti hain. Emotional discipline, sabr, aur resilience effective capital management ke liye zaroori traits hain. Traders ko apne emotions ko control karna, impulsive decisions se bachna, aur apne trading plan ko follow karna chahiye, khaaskar market turbulence ke doran. Overconfidence, fear, aur greed irrational behavior aur poor capital management ka sabab ban sakte hain, jo ke nuksan ka baais ban sakte hain.

Tools and Techniques for Capital Management

Iske ilawa risk management, position sizing, leverage, diversification, aur psychological factors ke saath saath, traders mukhtalif tools aur techniques ka bhi istemal kar sakte hain apne capital management strategies ko enhance karne ke liye. Inmein stop-loss orders ko losses ko limit karne ke liye, trailing stops ko profits ko lock karne ke liye, position scaling ko winning positions mein izafa karne ke liye, aur risk-reward analysis ko potential returns ko assess karne ke liye shamil kiya ja sakta hai.

Evaluation of Capital Management Strategies

Iske ilawa traders ko regular tor par apni capital management strategies ko review aur evaluate karna chahiye taake wo changing market conditions ko adapt kar sakein, apne approach ko refine kar sakein, aur apne overall performance ko behtar ban sakein. Trades ka detailed record rakhna, performance metrics ko analyze karna, aur dono taraf se seekhna (successes aur failures se) continuous improvement aur capital management ki optimization ke essential steps hain trading mein.

Forex trading mein capital management aik mukhtalif mizaj ka ilm hai jo ke risk management, position sizing, leverage, diversification, psychological factors, aur tools aur techniques ka istemal karke trading performance ko optimize karta hai. Durust capital management practices ko adopt karke, traders apne capital ko effectively protect aur grow kar sakte hain, market fluctuations ko bardasht kar sakte hain, aur financial markets mein long term kamiyabi hasil kar sakte hain.

Trading mein capital management ka tajziya karna lambay arsay tak financial markets mein kamiyabi aur munafa hasil karne ka aham pehlu hai. Yeh trader dwara istemal kye jane wale strategies aur techniques ko shamil karta hai jo unhe apne trading capital ko behtareen tareeqay se allocate aur manage karne mein madad dete hain taake wo returns ko ziada karein aur risks ko kam karein. Durust capital management market ki tabdeeliyon aur uncertainty ke doran capital ko preserve karna ke liye bohot zaroori hai aur profitable trading opportunities ka faida uthana bhi.

Foundation of Capital Management

Risk management trading mein capital management ka bunyadi asool hai. Yeh process hai jis mein traders trading activities ke sath jude hue potential risks ko pehchan, assess aur mitigate karte hain. Risk management ka aik ahem asool hai kabhi bhi predetermined percentage se zyada capital ko kisi bhi single trade par risk mein daalne ki ijazat nahi deni chahiye. Yeh percentage, jo ke risk per trade ya risk per position ke tor par zikar hoti hai, aam tor par total trading capital ka 1% se lekar 3% tak hoti hai. Capital ko har trade par risk mein daal kar traders catastrophic losses se bach sakte hain aur apne capital ko long term mein preserve kar sakte hain.

Position Sizing

Position sizing bhi capital management ka aham pehlu hai jo ke risk management ke sath juda hua hai. Is mein har trade ka munasib size determine karna shamil hai jo ke risk level aur trader ki risk tolerance par mabni hota hai. Position sizing aam tor par aik formula ka istemal karte hue calculate kiya jata hai jo ke entry price, stop-loss level, aur har trade par risk mein daali gayi percentage ko shamil karta hai. Sahi position sizing ke zariye, traders apne risk-reward ratio ko optimize kar sakte hain aur apne trades par potential returns ko ziada karte hue downside risk ko control kar sakte hain.

Leverage

Leverage trading mein aik doosri taraf ki churi hai aur iska ta'alluq capital management ke saath mazbooti se hai. Iska mafhoom yeh hai ke chhoti raqam se bari position ko market mein control karne ki salahiyat hai. Jabke leverage munafa ko ziada kar sakta hai, wahi yeh nuksan ko bhi barha sakta hai. Is liye, traders ko leverage ko hoshiyarana tareeqay se istemal karna chahiye aur iska asar apne overall capital management strategy par bhi ghor karna chahiye. Zyada leverage achanak market volatility ya unexpected price movements ke doran trading capital ko jald khatam kar sakta hai.

Diversification

Diversification capital management ka aik aur ahem asool hai jo ke risk ko mukhtalif asset classes, markets, ya trading strategies mein taqseem karne ka hai. Diversification ka faida ek trader ki portfolio mein overall risk ko kam karne mein hota hai jahan ek area mein nuksan ko doosri area mein faida se compensate kiya jata hai. Traders ko sirf mukhtalif assets ke beech hi nahi balki mukhtalif time frames aur trading strategies ke beech bhi diversify karna chahiye taake correlation ko kam kiya ja sake aur risk-adjusted returns ko behtar banaya ja sake.

Psychological Factors

Psychological factors capital management aur trading mein kamiyabi ke liye bohot ahem hoti hain. Emotional discipline, sabr, aur resilience effective capital management ke liye zaroori traits hain. Traders ko apne emotions ko control karna, impulsive decisions se bachna, aur apne trading plan ko follow karna chahiye, khaaskar market turbulence ke doran. Overconfidence, fear, aur greed irrational behavior aur poor capital management ka sabab ban sakte hain, jo ke nuksan ka baais ban sakte hain.

Tools and Techniques for Capital Management

Iske ilawa risk management, position sizing, leverage, diversification, aur psychological factors ke saath saath, traders mukhtalif tools aur techniques ka bhi istemal kar sakte hain apne capital management strategies ko enhance karne ke liye. Inmein stop-loss orders ko losses ko limit karne ke liye, trailing stops ko profits ko lock karne ke liye, position scaling ko winning positions mein izafa karne ke liye, aur risk-reward analysis ko potential returns ko assess karne ke liye shamil kiya ja sakta hai.

Evaluation of Capital Management Strategies

Iske ilawa traders ko regular tor par apni capital management strategies ko review aur evaluate karna chahiye taake wo changing market conditions ko adapt kar sakein, apne approach ko refine kar sakein, aur apne overall performance ko behtar ban sakein. Trades ka detailed record rakhna, performance metrics ko analyze karna, aur dono taraf se seekhna (successes aur failures se) continuous improvement aur capital management ki optimization ke essential steps hain trading mein.

Forex trading mein capital management aik mukhtalif mizaj ka ilm hai jo ke risk management, position sizing, leverage, diversification, psychological factors, aur tools aur techniques ka istemal karke trading performance ko optimize karta hai. Durust capital management practices ko adopt karke, traders apne capital ko effectively protect aur grow kar sakte hain, market fluctuations ko bardasht kar sakte hain, aur financial markets mein long term kamiyabi hasil kar sakte hain.

تبصرہ

Расширенный режим Обычный режим