Introduction.

Candlestick patterns trading mein bohat ahmiyat rakhti hai aur traders inhein apni trading strategies mein istemal karte hain. Ek aisi candlestick pattern hai jo "Piercing Line" ke naam se jana jata hai. Is article mein hum is pattern ki tashreeh Roman Urdu mein karenge.

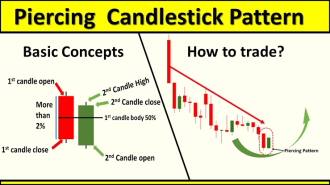

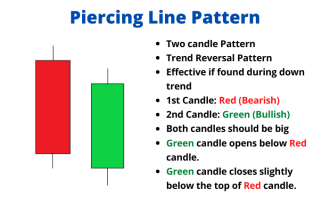

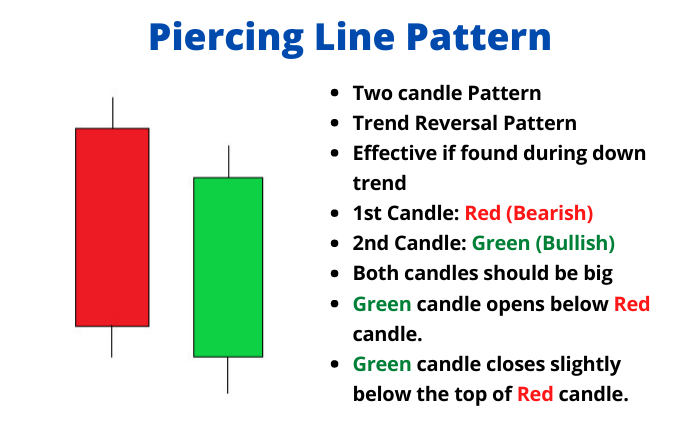

"Piercing Line" ek bullish candlestick pattern hai jo bearish trend ke baad aata hai. Is pattern mein do candles hote hain jinmein pehli candle bearish hoti hai aur dusri candle bullish hoti hai. Dusri candle pehli candle ki body ko partially cover karti hai. Is pattern ko dekh kar traders ko yeh samajh mein aata hai ke bearish trend ab khatam ho kar bullish trend shuru hone wala hai.

"Piercing Line" Candlestick Pattern Description.

Is pattern ko samajhne ke liye hum iski tashreeh Roman Urdu mein karte hain.

1st Candle Bearish.

"Piercing Line" pattern ke pehle candle mein market bearish hota hai aur iski body red color ki hoti hai. Is candle mein selling pressure zyada hoti hai.

2nd Candle Bullish.

Dusri candle "Piercing Line" pattern ki bullish candle hoti hai. Iski body green color ki hoti hai aur ismein buying pressure zyada hoti hai.

Dusri candle pehli candle ki body ko partially cover karti hai. Isse yeh samajh mein aata hai ke buyers market mein enter ho rahe hain aur bearish trend khatam hone wala hai.

Signal of Bullish Trend.

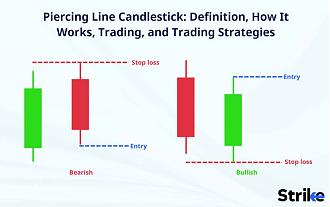

"Piercing Line" pattern ko dekh kar traders ko yeh samajh mein aata hai ke bearish trend ab khatam ho kar bullish trend shuru hone wala hai. Is pattern ko samajhne ke baad traders long positions le sakte hain.

"Piercing Line" candlestick pattern bearish trend ke baad bullish trend shuru hone ka signal deta hai. Is pattern ko samajh kar traders apni trading strategies mein istemal kar sakte hain.

Candlestick patterns trading mein bohat ahmiyat rakhti hai aur traders inhein apni trading strategies mein istemal karte hain. Ek aisi candlestick pattern hai jo "Piercing Line" ke naam se jana jata hai. Is article mein hum is pattern ki tashreeh Roman Urdu mein karenge.

"Piercing Line" ek bullish candlestick pattern hai jo bearish trend ke baad aata hai. Is pattern mein do candles hote hain jinmein pehli candle bearish hoti hai aur dusri candle bullish hoti hai. Dusri candle pehli candle ki body ko partially cover karti hai. Is pattern ko dekh kar traders ko yeh samajh mein aata hai ke bearish trend ab khatam ho kar bullish trend shuru hone wala hai.

"Piercing Line" Candlestick Pattern Description.

Is pattern ko samajhne ke liye hum iski tashreeh Roman Urdu mein karte hain.

1st Candle Bearish.

"Piercing Line" pattern ke pehle candle mein market bearish hota hai aur iski body red color ki hoti hai. Is candle mein selling pressure zyada hoti hai.

2nd Candle Bullish.

Dusri candle "Piercing Line" pattern ki bullish candle hoti hai. Iski body green color ki hoti hai aur ismein buying pressure zyada hoti hai.

Dusri candle pehli candle ki body ko partially cover karti hai. Isse yeh samajh mein aata hai ke buyers market mein enter ho rahe hain aur bearish trend khatam hone wala hai.

Signal of Bullish Trend.

"Piercing Line" pattern ko dekh kar traders ko yeh samajh mein aata hai ke bearish trend ab khatam ho kar bullish trend shuru hone wala hai. Is pattern ko samajhne ke baad traders long positions le sakte hain.

"Piercing Line" candlestick pattern bearish trend ke baad bullish trend shuru hone ka signal deta hai. Is pattern ko samajh kar traders apni trading strategies mein istemal kar sakte hain.

تبصرہ

Расширенный режим Обычный режим