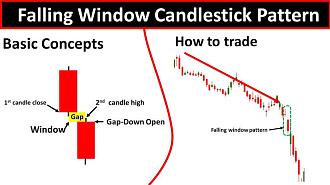

Characteristics.

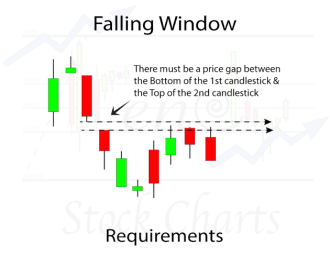

Falling Window ya Gap Down, Forex Trading main ek aham term hai jis ka matlab hai keh market main sudden aur tezi se price drop ho jati hai.

Yeh price drop itna zyada hota hai keh do consecutive days ki opening price main gap create ho jata hai. Is gap ko Falling Window kehte hain.

Falling Window How it Makes.

Falling Window ki wajah market main investors ka negative sentiment hota hai. Yeh negative sentiment market main kisi bhi wajah se paida ho sakta hai jaise koi bari khabar, economic data ya phir global events. Is negative sentiment ki wajah se investors panic main aa jatay hain aur apni positions ko close kar detay hain, jis ki wajah se market main price drop hoti hai.Yeh aik successful pattern hay is ki help say trading kerna best sabit ho sakta hay.

Falling Window impact.

Falling Window ka impact market main bari hoti hai. Yeh price drop market ki overall trend ko bhi change kar sakti hai. Agar Falling Window kisi bullish trend ke doran ho to yeh trend ko bearish trend main convert kar sakti hai aur agar yeh bearish trend ke doran ho to yeh trend ko aur zyada bearish bana sakti hai.

Falling Window How it Use.

Falling Window ko Forex Trading main use kar ke investors market ki trend ko analyze kar saktay hain. Agar Falling Window bearish trend ke doran ho to investors sell positions open kar saktay hain.

Lekin agar Falling Window bullish trend ke doran ho to investors caution ki zarurat hai aur phir bhi sell positions open karne se pehlay market ki overall trend ko analyze karna zaruri hai.

Falling Window ya Gap Down, Forex Trading main ek aham term hai jis ka matlab hai keh market main sudden aur tezi se price drop ho jati hai.

Yeh price drop itna zyada hota hai keh do consecutive days ki opening price main gap create ho jata hai. Is gap ko Falling Window kehte hain.

Falling Window How it Makes.

Falling Window ki wajah market main investors ka negative sentiment hota hai. Yeh negative sentiment market main kisi bhi wajah se paida ho sakta hai jaise koi bari khabar, economic data ya phir global events. Is negative sentiment ki wajah se investors panic main aa jatay hain aur apni positions ko close kar detay hain, jis ki wajah se market main price drop hoti hai.Yeh aik successful pattern hay is ki help say trading kerna best sabit ho sakta hay.

Falling Window impact.

Falling Window ka impact market main bari hoti hai. Yeh price drop market ki overall trend ko bhi change kar sakti hai. Agar Falling Window kisi bullish trend ke doran ho to yeh trend ko bearish trend main convert kar sakti hai aur agar yeh bearish trend ke doran ho to yeh trend ko aur zyada bearish bana sakti hai.

Falling Window How it Use.

Falling Window ko Forex Trading main use kar ke investors market ki trend ko analyze kar saktay hain. Agar Falling Window bearish trend ke doran ho to investors sell positions open kar saktay hain.

Lekin agar Falling Window bullish trend ke doran ho to investors caution ki zarurat hai aur phir bhi sell positions open karne se pehlay market ki overall trend ko analyze karna zaruri hai.

تبصرہ

Расширенный режим Обычный режим