Introduction.

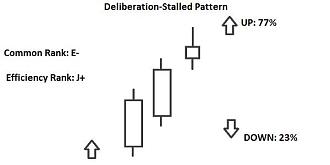

Deliberation Candlestick Pattern ek bullish ya bearish trend ke bich ke samay me dikhai dene wala ek candlestick pattern hai. Ye pattern traders ke liye important hota hai kyonki isse price ke future movement ka pata chalta hai.

Deliberation Candlestick Pattern composition.

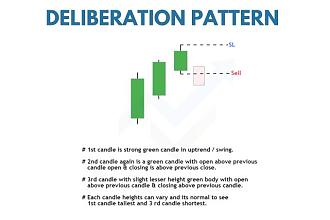

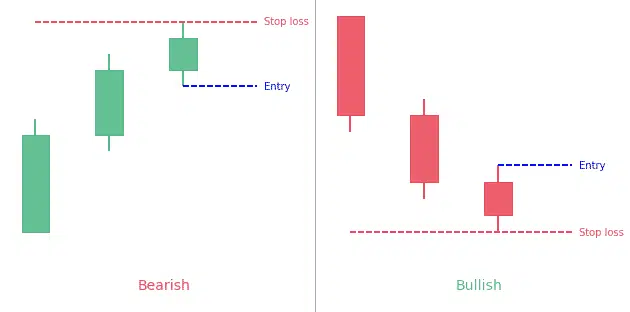

Deliberation Candlestick Pattern me 3 candlesticks hote hai - pehla candlestick bullish ya bearish trend ke according hota hai, dusra candlestick long hai aur iske open aur close price me koi significant difference nahi hota hai, teesra candlestick bhi long hai lekin isme pehle dono candlesticks ke bich ke gap ke barabar ya usse kam ka gap hota hai.

Deliberation Candlestick Pattern Learnings.

Agar pehla candlestick bullish trend me hai to iska matlab hai ki buyers control me hai. Agar pehla candlestick bearish trend me hai to iska matlab hai ki sellers control me hai.

Dusra candlestick long hone ke bawajood open aur close price me koi significant difference nahi hone se ye indicate karta hai ki market me confusion hai aur koi clear trend nahi hai.Teesra candlestick ka gap pehle dono candlesticks ke gap ke barabar ya usse kam hone se ye indicate karta hai ki market me balance hai aur koi ek party dominate nahi kar rahi hai.

Method of working.

Agar ye pattern bullish trend ke baad aata hai to iska matlab hai ki market me profit booking hone ke chances hai aur iska opposite bearish trend ke baad aane par hai.

More Facts.

Deliberation Candlestick Pattern ek important candlestick pattern hai jo traders ke liye useful hai. Iske through traders price movement ke future me kya hoga iska pata laga sakte hai aur iske accordingly trades place kar sakte hai.

Deliberation Candlestick Pattern ek bullish ya bearish trend ke bich ke samay me dikhai dene wala ek candlestick pattern hai. Ye pattern traders ke liye important hota hai kyonki isse price ke future movement ka pata chalta hai.

Deliberation Candlestick Pattern composition.

Deliberation Candlestick Pattern me 3 candlesticks hote hai - pehla candlestick bullish ya bearish trend ke according hota hai, dusra candlestick long hai aur iske open aur close price me koi significant difference nahi hota hai, teesra candlestick bhi long hai lekin isme pehle dono candlesticks ke bich ke gap ke barabar ya usse kam ka gap hota hai.

Deliberation Candlestick Pattern Learnings.

Agar pehla candlestick bullish trend me hai to iska matlab hai ki buyers control me hai. Agar pehla candlestick bearish trend me hai to iska matlab hai ki sellers control me hai.

Dusra candlestick long hone ke bawajood open aur close price me koi significant difference nahi hone se ye indicate karta hai ki market me confusion hai aur koi clear trend nahi hai.Teesra candlestick ka gap pehle dono candlesticks ke gap ke barabar ya usse kam hone se ye indicate karta hai ki market me balance hai aur koi ek party dominate nahi kar rahi hai.

Method of working.

Agar ye pattern bullish trend ke baad aata hai to iska matlab hai ki market me profit booking hone ke chances hai aur iska opposite bearish trend ke baad aane par hai.

More Facts.

Deliberation Candlestick Pattern ek important candlestick pattern hai jo traders ke liye useful hai. Iske through traders price movement ke future me kya hoga iska pata laga sakte hai aur iske accordingly trades place kar sakte hai.

تبصرہ

Расширенный режим Обычный режим