Relative strength index convergence aur divergence

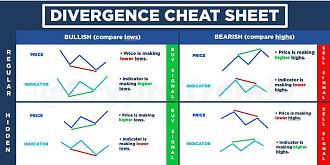

Relative strength index aik takneeki tjzyati ishara hai jo forex trading mein qeematon ke rujhanaat aur mumkina riversal ki nishandahi karne ke liye istemaal hota hai. yeh rsi relative strength index ke do mukhtalif tareeqon ko mila kar kaam karta hai

Relative strength index convergence :

jab rsi ki do linen ( aam tor par 9 aur 14 doraniye ke sath ) aik dosray ke qareeb aati hain, to yeh aik mumkina riversal ki nishandahi kar sakta hai .

Relative strength index divergence :

jab rsi ki linen qeematon ke sath mukhalif simt mein harkat karti hain, to yeh aik mazboot rujhan ki nishandahi kar sakta hai .

Relative strength index ka istemaal karte hue, aap darj zail trading mawaqay ki nishandahi kar satke hain :

Chances of buying

Relative strength index convergence : jab rsi ki linen oversold ilaqay mein aik dosray ke qareeb aati hain, to yeh aik kharidne ka mauqa ho sakta hai .

Relative strength index divergence : jab rsi ki linen qeematon se neechay ki taraf divergence karti hain, to yeh aik mazboot kharidne ka ishara ho sakta hai .

Chances of selling

Relative strength index convergence : jab rsi ki linen overbought ilaqay mein aik dosray ke qareeb aati hain, to yeh aik baichnay ka mauqa ho sakta hai .

Relative strength index divergence : jab rsi ki linen qeematon se oopar ki taraf divergence karti hain, to yeh aik mazboot baichnay ka ishara ho sakta hai .

For Examples

Relative strength index ka istemaal karte hue trading ki misaal :

agar rsi ki linen overbought ilaqay mein aik dosray ke qareeb aati hain, to yeh aik baichnay ka ishara ho sakta hai. aap eur / usd ko baichnay ka faisla kar satke hain aur riversal ki tawaqqa kar satke hain .

jab rsi ki linen neechay ki taraf mrhti hain aur qeematon ke sath convergence karna shuru karti hain, to yeh aik kharidne ka ishara ho sakta hai. aap eur / usd ko dobarah kharidne ka faisla kar satke hain aur naye rujhan ka aaghaz karne ki tawaqqa kar satke hain .

Relative strength index ke benifets :

Relative strength index ki limitations :

Relative strength index aik takneeki tjzyati ishara hai jo forex trading mein qeematon ke rujhanaat aur mumkina riversal ki nishandahi karne ke liye istemaal hota hai. yeh rsi relative strength index ke do mukhtalif tareeqon ko mila kar kaam karta hai

Relative strength index convergence :

jab rsi ki do linen ( aam tor par 9 aur 14 doraniye ke sath ) aik dosray ke qareeb aati hain, to yeh aik mumkina riversal ki nishandahi kar sakta hai .

Relative strength index divergence :

jab rsi ki linen qeematon ke sath mukhalif simt mein harkat karti hain, to yeh aik mazboot rujhan ki nishandahi kar sakta hai .

Relative strength index ka istemaal karte hue, aap darj zail trading mawaqay ki nishandahi kar satke hain :

Chances of buying

Relative strength index convergence : jab rsi ki linen oversold ilaqay mein aik dosray ke qareeb aati hain, to yeh aik kharidne ka mauqa ho sakta hai .

Relative strength index divergence : jab rsi ki linen qeematon se neechay ki taraf divergence karti hain, to yeh aik mazboot kharidne ka ishara ho sakta hai .

Chances of selling

Relative strength index convergence : jab rsi ki linen overbought ilaqay mein aik dosray ke qareeb aati hain, to yeh aik baichnay ka mauqa ho sakta hai .

Relative strength index divergence : jab rsi ki linen qeematon se oopar ki taraf divergence karti hain, to yeh aik mazboot baichnay ka ishara ho sakta hai .

For Examples

Relative strength index ka istemaal karte hue trading ki misaal :

farz karen ke eur / usd ki qeemat musalsal barh rahi hai. rsi ki linen bhi oopar ki taraf barh rahi hain, lekin qeematon se taizi se divergence kar rahi hain. yeh aik mumkina riversal ki nishandahi kar sakta hai .

agar rsi ki linen overbought ilaqay mein aik dosray ke qareeb aati hain, to yeh aik baichnay ka ishara ho sakta hai. aap eur / usd ko baichnay ka faisla kar satke hain aur riversal ki tawaqqa kar satke hain .

jab rsi ki linen neechay ki taraf mrhti hain aur qeematon ke sath convergence karna shuru karti hain, to yeh aik kharidne ka ishara ho sakta hai. aap eur / usd ko dobarah kharidne ka faisla kar satke hain aur naye rujhan ka aaghaz karne ki tawaqqa kar satke hain .

Relative strength index ke benifets :

- yeh aik nisbatan aasaan ishara hai jisay istemaal karna aasaan hai .

- yeh qeematon ke rujhanaat aur mumkina riversal ki nishandahi karne mein madad kar sakta hai .

- yeh aap ko –apne trading ke faislon mein ziyada aetmaad peda karne mein madad kar sakta hai .

Relative strength index ki limitations :

- yeh koi hatmi ishara nahi hai aur ghalat isharay day sakta hai .

- yeh deegar takneeki isharay ke sath mil kar istemaal kya jana chahiye .

- usay istemaal karne se pehlay is ki achi terhan se tehqeeq aur samjhna zaroori hai .

تبصرہ

Расширенный режим Обычный режим