Hedging Strategy

Hedging, ya tijarati hifazati amal, ek ahem aur mufeed tareeqa hai jo forex trading mein istemal hota hai. Is tareeqay mein traders apne investments ko nuqsan se bachane ke liye do tarah ke positions ya transactions lete hain. Yeh unko market ke fluctuations se hifazat faraham karta hai.

Kya Hai Hedging?

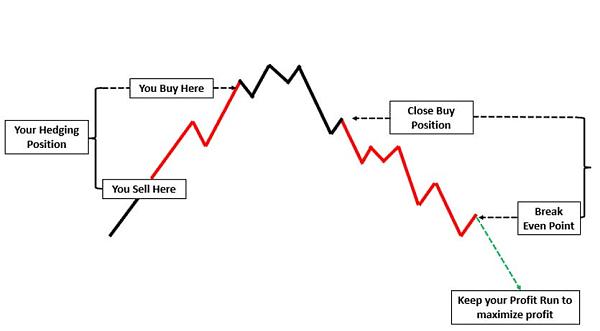

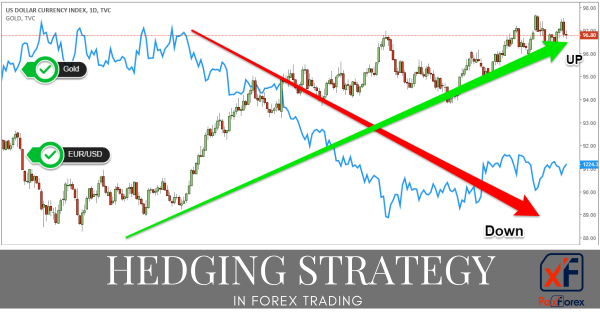

Hedging ek risk management technique hai jisme traders apne positions ko protect karne ke liye opposing positions lete hain. Agar ek trade mein nuqsan hota hai, toh doosri trade usko compensate karti hai. Hedging ka maqsad mukhtalif ho sakta hai jaise ke currency exposure ko kam karna, ya market volatility se bachna.

Kis Tarah Kaam Karta Hai?

Hedging kaam karta hai do tarah ke positions lekar. Ek taraf, trader original position ya investment lekar market mein enter karta hai. Doosri taraf, wo opposing position lekar jata hai jo original position ke khilaaf hai. Agar original position mein nuqsan hota hai, toh opposing position us nuqsan ko compensate kar sakta hai.

Hedging Ke Tareeqay

Hedging ke kai tareeqay hote hain jinme se kuch mashhoor hain:

Hedging Ke Faide

Hedging ka istemal kai tareeqon se faydemand hota hai:

Hedging strategy ko samajhna aur theek tareeqay se istemal karna forex traders ke liye zaroori hai, taake unki investments ko market ke changing conditions se hifazat mile aur consistent returns hasil kiye ja sakein.

Hedging, ya tijarati hifazati amal, ek ahem aur mufeed tareeqa hai jo forex trading mein istemal hota hai. Is tareeqay mein traders apne investments ko nuqsan se bachane ke liye do tarah ke positions ya transactions lete hain. Yeh unko market ke fluctuations se hifazat faraham karta hai.

Kya Hai Hedging?

Hedging ek risk management technique hai jisme traders apne positions ko protect karne ke liye opposing positions lete hain. Agar ek trade mein nuqsan hota hai, toh doosri trade usko compensate karti hai. Hedging ka maqsad mukhtalif ho sakta hai jaise ke currency exposure ko kam karna, ya market volatility se bachna.

Kis Tarah Kaam Karta Hai?

Hedging kaam karta hai do tarah ke positions lekar. Ek taraf, trader original position ya investment lekar market mein enter karta hai. Doosri taraf, wo opposing position lekar jata hai jo original position ke khilaaf hai. Agar original position mein nuqsan hota hai, toh opposing position us nuqsan ko compensate kar sakta hai.

Hedging Ke Tareeqay

Hedging ke kai tareeqay hote hain jinme se kuch mashhoor hain:

- Spot Contracts aur Future Contracts: Traders spot contracts aur future contracts ka istemal karke hedging karte hain. Spot contracts mein, assets ya currencies foran kharid ya bech liye jate hain, jabke future contracts mein future date ke liye transaction fix kiya jata hai.

- Options Trading: Options trading mein traders kisi asset ko ek fix price par kharidne ya bechne ka haq rakhte hain, lekin unko majboor nahi kia jata. Yeh unko flexibility deta hai nuqsan se bachne mein.

- Forward Contracts: Forward contracts mein do parties ke darmiyan agreement hota hai future mein currency exchange karne ka. Yeh unko currency exchange rate par tayyi demand supply ke fluctuations se hifazat faraham karta hai.

Hedging Ke Faide

Hedging ka istemal kai tareeqon se faydemand hota hai:

- Risk Reduction: Hedging market risks ko kam karne mein madad karta hai.

- Capital Protection: Hedging investors ki investments ko nuqsan se bachata hai.

- Volatility Control: Hedging market volatility se bachne mein madad deta hai.

Hedging strategy ko samajhna aur theek tareeqay se istemal karna forex traders ke liye zaroori hai, taake unki investments ko market ke changing conditions se hifazat mile aur consistent returns hasil kiye ja sakein.

تبصرہ

Расширенный режим Обычный режим