Double Bottom Candlestick Pattern.

Double Bottom Candlestick pattern ek mukhtasar aur asan tareeqa hai market trend ko analyze karne ka. Is pattern ki madad se traders market mein behtar trade decisions le sakte hain aur munafa kamane ka imkaan barhate hain. Magar, is pattern ko istemal karte waqt, traders ko confirmation aur risk management par bhi dhyan dena zaroori hai.

Double Bottom Candlestick Pattern kya hai?

Double Bottom Candlestick pattern ek chart pattern hai jo market trend ko analyze karne ke liye istemal hota hai. Ye pattern downtrend ko uptrend mein tabdeel hone ki sambhavna ko durust karta hai.

Double Bottom Candlestick Pattern Formation.

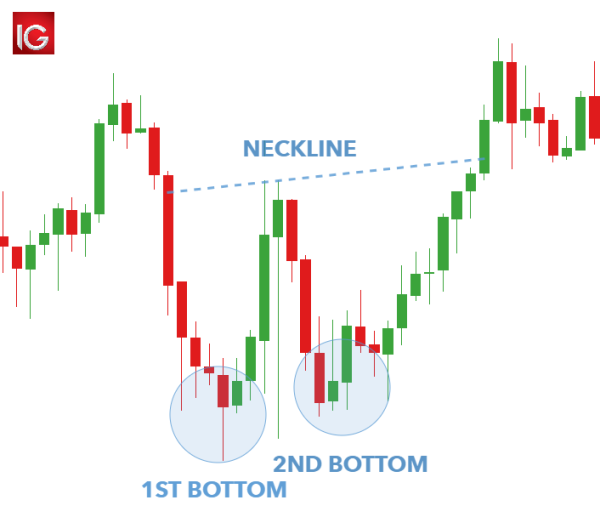

Double Bottom Candlestick pattern do neeche ki taraf milti julti low points se bana hota hai. Jab market ek downtrend se guzarta hai, pehle low point ke baad dobara neeche jaata hai, phir doosra low point banata hai jo pehle se kam hota hai. Phir market uptrend ki taraf mud kar chalta hai.Is pattern ki pehchan karne ke liye, traders ko do neeche ki taraf milti julti low points par dhyan dena hota hai. Har low point ko ek "bottom" kaha jata hai.

Jab doosra bottom pehle se kam hota hai aur phir market uptrend mein chala jata hai, to ye Double Bottom Candlestick pattern kehlata hai.Double Bottom Candlestick pattern ka matlab hota hai ke market ka trend change hone wala hai. Jab ye pattern ban jata hai, to yeh darust karta hai ke downtrend khatam ho chuka hai aur ab market mein uptrend shuru hone wala hai.

Double Bottom Candlestick Pattern Trading Strategy.

Is pattern ko trade karne ki strategy mein, traders ko confirmation ke liye wait karna hota hai. Jab market doosra bottom banata hai aur phir se upar ki taraf chalne lagta hai, tab traders entry ka signal lete hain. Stop loss order pehle bottom ke neeche set kiya jata hai taake nuksan ko kam kiya ja sake aur profit target set kiya jata hai upar ki taraf.Double Bottom Candlestick pattern ek mukhtasir samay mein market trend ko durust karne ki salahiyat rakhta hai. Iske sath hi, traders dusre technical indicators aur chart patterns ka bhi istemal karte hain taake behtar trade decisions le sakein.

Double Bottom Candlestick pattern ek mukhtasar aur asan tareeqa hai market trend ko analyze karne ka. Is pattern ki madad se traders market mein behtar trade decisions le sakte hain aur munafa kamane ka imkaan barhate hain. Magar, is pattern ko istemal karte waqt, traders ko confirmation aur risk management par bhi dhyan dena zaroori hai.

Double Bottom Candlestick Pattern kya hai?

Double Bottom Candlestick pattern ek chart pattern hai jo market trend ko analyze karne ke liye istemal hota hai. Ye pattern downtrend ko uptrend mein tabdeel hone ki sambhavna ko durust karta hai.

Double Bottom Candlestick Pattern Formation.

Double Bottom Candlestick pattern do neeche ki taraf milti julti low points se bana hota hai. Jab market ek downtrend se guzarta hai, pehle low point ke baad dobara neeche jaata hai, phir doosra low point banata hai jo pehle se kam hota hai. Phir market uptrend ki taraf mud kar chalta hai.Is pattern ki pehchan karne ke liye, traders ko do neeche ki taraf milti julti low points par dhyan dena hota hai. Har low point ko ek "bottom" kaha jata hai.

Jab doosra bottom pehle se kam hota hai aur phir market uptrend mein chala jata hai, to ye Double Bottom Candlestick pattern kehlata hai.Double Bottom Candlestick pattern ka matlab hota hai ke market ka trend change hone wala hai. Jab ye pattern ban jata hai, to yeh darust karta hai ke downtrend khatam ho chuka hai aur ab market mein uptrend shuru hone wala hai.

Double Bottom Candlestick Pattern Trading Strategy.

Is pattern ko trade karne ki strategy mein, traders ko confirmation ke liye wait karna hota hai. Jab market doosra bottom banata hai aur phir se upar ki taraf chalne lagta hai, tab traders entry ka signal lete hain. Stop loss order pehle bottom ke neeche set kiya jata hai taake nuksan ko kam kiya ja sake aur profit target set kiya jata hai upar ki taraf.Double Bottom Candlestick pattern ek mukhtasir samay mein market trend ko durust karne ki salahiyat rakhta hai. Iske sath hi, traders dusre technical indicators aur chart patterns ka bhi istemal karte hain taake behtar trade decisions le sakein.

تبصرہ

Расширенный режим Обычный режим