Take Profit trading mein aik ahem tool hai jo traders ko predefined levels par faida hasool karne ki ijazat deta hai. Ye ek risk management strategy ka hissa hai jo tafteeshi asarat ko faida uthane ke sath sath nuqsan ko kam karne ke liye banaya gaya hai.

Take Profit ka pehla faida hai ke ye munafa mahfooz karne ki salahiyat rakhta hai. Trade se bahar nikalne ke liye ek maqami keemat ko set karke, traders ye ensure karte hain ke wo market ke ulte hone se pehle faida le sakte hain. Is se aik lambi chalti hui munafa ke nuqsan se bachne ka khatra kam ho jata hai. Mazeed, Take Profit traders ko predefined trading plans aur maqasid ka follow karne mein madad karta hai.

Risk Management

Take Profit aik bara risk management strategy ka aham hissa hai. Ye Stop Loss orders ke sath mil kar risk ko mukammal taur par manage karne mein madad karta hai. Jabke Stop Loss nuqsan ko predefined level par exit karke rokta hai, Take Profit munafa ko predefined level par exit karke mahfooz karta hai. Sath hi sath, ye tools traders ko risk ko control karne aur unke paisay ko mehfooz karne mein madad karte hain.

Psychological Impact

Take Profit ka traders par aik barra nafsiyati asar bhi hota hai. Ye janne ke baad ke munafa kisi khaas level par mehfooz hai, ye anxiety aur emosional faislay ko kam kar sakta hai. Ye traders ko aik target par focused rahne mein madad karta hai bina ke wo short-term market fluctuations ya potential gains ko miss karne ke dar se dabe.

Implementation Strategies

Take Profit ko effectively implement karne ke liye kuch strategies hain. Aik tareeqa ye hai ke technical analysis indicators ka istemal kiya jaye, jaise support aur resistance levels, Fibonacci retracements, ya moving averages, ta ke potential target prices ko pehchana ja sake. Traders Take Profit levels ko profit-to-risk ratios par bhi base kar sakte hain, ta ke potential gains trade mein liye gaye risk ko justify karein.

Considerations for Effective Take Profit

Take Profit levels set karte waqt, traders ko market volatility, liquidity, aur news events ko bhi madde nazar rakhte hue tay karna chahiye jo ke price movements par asar daal sakte hain. Ye zaroori hai ke market conditions ke mutabiq Take Profit levels ko adjust kiya jaye aur trades ko nazdeek se monitor kiya jaye ta ke agar zarurat pesh aaye to timely adjustments kiye ja sakein. Mazeed, Take Profit levels ko multiple trades mein taqseem karke risk ko spread karna aur overall profit potential ko optimize karna bhi mumkin hai.

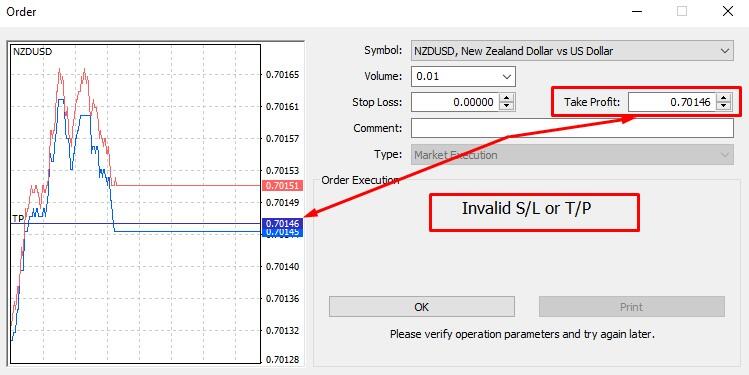

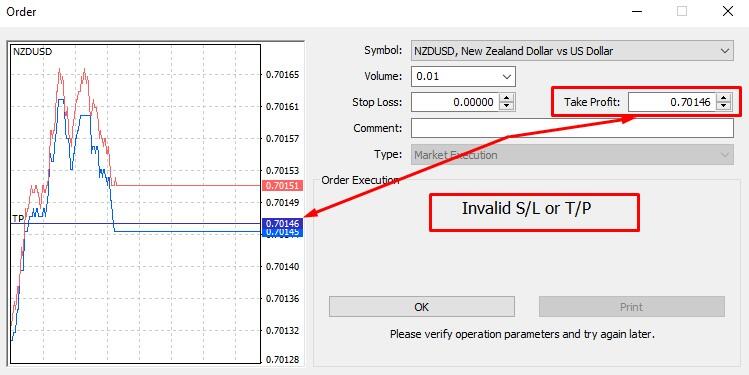

Examples of Take Profit in Action

Agar ek trader currency pair par $1.2000 par long position enter karta hai aur Take Profit level $1.2200 par set karta hai. Jab price $1.2200 tak pohanchti hai, to trade automatically close ho jati hai, 200 pips ka munafa mahfooz hota hai. Isi tarah, aik stock trade mein agar ek trader shares $50 par buy karta hai aur Take Profit level $60 par set karta hai, to trade $60 tak pohanchne par close ho jati hai, $10 per share ka munafa mahfooz hota hai.

Limitations and Risks

Jabke Take Profit ko bohot faide hain, lekin iske sath sath hadood aur associated khatray bhi hain. Take Profit levels ko entry points ke bohot qareeb set karne se premature exits ka khatra hota hai, potential extended gains ko miss karne ka. Dosri taraf, Take Profit levels ko bohot door set karne se market ulte hone ka khatra barh jata hai, jis se missed opportunities ya kam profits ho sakti hain. Take Profit trading mein aik ahem tool hai jo ke bohot se faide deta hai, jaise ke munafa mahfooz karna, risk management, nafsiyati mustaqil pan, aur strategic planning. Iski ahmiyat ko samajh kar aur effective strategies ko implement karke, traders apni trading performance ko behtar bana sakte hain, nuqsan ko kam kar sakte hain, aur mukhtalif maaliyat ke markets mein munafa ko maximize kar sakte hain.

Take Profit ka pehla faida hai ke ye munafa mahfooz karne ki salahiyat rakhta hai. Trade se bahar nikalne ke liye ek maqami keemat ko set karke, traders ye ensure karte hain ke wo market ke ulte hone se pehle faida le sakte hain. Is se aik lambi chalti hui munafa ke nuqsan se bachne ka khatra kam ho jata hai. Mazeed, Take Profit traders ko predefined trading plans aur maqasid ka follow karne mein madad karta hai.

Risk Management

Take Profit aik bara risk management strategy ka aham hissa hai. Ye Stop Loss orders ke sath mil kar risk ko mukammal taur par manage karne mein madad karta hai. Jabke Stop Loss nuqsan ko predefined level par exit karke rokta hai, Take Profit munafa ko predefined level par exit karke mahfooz karta hai. Sath hi sath, ye tools traders ko risk ko control karne aur unke paisay ko mehfooz karne mein madad karte hain.

Psychological Impact

Take Profit ka traders par aik barra nafsiyati asar bhi hota hai. Ye janne ke baad ke munafa kisi khaas level par mehfooz hai, ye anxiety aur emosional faislay ko kam kar sakta hai. Ye traders ko aik target par focused rahne mein madad karta hai bina ke wo short-term market fluctuations ya potential gains ko miss karne ke dar se dabe.

Implementation Strategies

Take Profit ko effectively implement karne ke liye kuch strategies hain. Aik tareeqa ye hai ke technical analysis indicators ka istemal kiya jaye, jaise support aur resistance levels, Fibonacci retracements, ya moving averages, ta ke potential target prices ko pehchana ja sake. Traders Take Profit levels ko profit-to-risk ratios par bhi base kar sakte hain, ta ke potential gains trade mein liye gaye risk ko justify karein.

Considerations for Effective Take Profit

Take Profit levels set karte waqt, traders ko market volatility, liquidity, aur news events ko bhi madde nazar rakhte hue tay karna chahiye jo ke price movements par asar daal sakte hain. Ye zaroori hai ke market conditions ke mutabiq Take Profit levels ko adjust kiya jaye aur trades ko nazdeek se monitor kiya jaye ta ke agar zarurat pesh aaye to timely adjustments kiye ja sakein. Mazeed, Take Profit levels ko multiple trades mein taqseem karke risk ko spread karna aur overall profit potential ko optimize karna bhi mumkin hai.

Examples of Take Profit in Action

Agar ek trader currency pair par $1.2000 par long position enter karta hai aur Take Profit level $1.2200 par set karta hai. Jab price $1.2200 tak pohanchti hai, to trade automatically close ho jati hai, 200 pips ka munafa mahfooz hota hai. Isi tarah, aik stock trade mein agar ek trader shares $50 par buy karta hai aur Take Profit level $60 par set karta hai, to trade $60 tak pohanchne par close ho jati hai, $10 per share ka munafa mahfooz hota hai.

Limitations and Risks

Jabke Take Profit ko bohot faide hain, lekin iske sath sath hadood aur associated khatray bhi hain. Take Profit levels ko entry points ke bohot qareeb set karne se premature exits ka khatra hota hai, potential extended gains ko miss karne ka. Dosri taraf, Take Profit levels ko bohot door set karne se market ulte hone ka khatra barh jata hai, jis se missed opportunities ya kam profits ho sakti hain. Take Profit trading mein aik ahem tool hai jo ke bohot se faide deta hai, jaise ke munafa mahfooz karna, risk management, nafsiyati mustaqil pan, aur strategic planning. Iski ahmiyat ko samajh kar aur effective strategies ko implement karke, traders apni trading performance ko behtar bana sakte hain, nuqsan ko kam kar sakte hain, aur mukhtalif maaliyat ke markets mein munafa ko maximize kar sakte hain.

تبصرہ

Расширенный режим Обычный режим