Explanation.

Forex trading mein candlesticks ki bohat ahmiyat hai. Candlesticks charts traders ko market ki movement ko samajhne mein madad karte hain. Is article mein hum candlesticks ki kya ahmiyat hai aur inka forex trading mein kirdar kya hai iske baare mein batayenge.

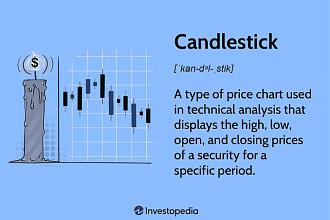

Candlesticks charts price action ko display karte hain. Har candlestick ek time period (jaise 1 minute, 5 minute, 1 hour etc.) ke liye market ki price movement ko show karta hai. Candlesticks ke 4 parts hote hain: open, high, low aur close. Ek bullish candlestick mein open price low se zyada hota hai aur close price high se zyada hota hai. Ek bearish candlestick mein open price high se zyada hota hai aur close price low se zyada hota hai.

Candlesticks Character.

Candlesticks charts forex trading mein bohat important hote hain. Ye charts traders ko market ki movement ko samajhne mein madad karte hain. Candlesticks charts se traders ki help se price action ko analyze kiya ja sakta hai aur market trend ko samajha ja sakta hai. Candlesticks charts se traders ko market ki volatility, support aur resistance levels aur trend direction ka pata lag sakta hai.

Candlesticks use in price action strategies.

Candlesticks charts se traders ko price action strategies ke liye madad milti hai. Price action strategies mein traders market ki movement ko analyze karte hain aur support aur resistance levels ko identify karte hain. Candlesticks charts se traders ko price action strategies ke signals milte hain jaise ki trend reversal, trend continuation, support aur resistance levels.

Candlesticks charts forex trading mein bohat important hote hain. Ye charts traders ko market ki movement ko samajhne mein madad karte hain. Candlesticks charts se traders ki help se price action ko analyze kiya ja sakta hai aur market trend ko samajha ja sakta hai. Candlesticks charts se traders ko market ki volatility, support aur resistance levels aur trend direction ka pata lag sakta hai.

Forex trading mein candlesticks ki bohat ahmiyat hai. Candlesticks charts traders ko market ki movement ko samajhne mein madad karte hain. Is article mein hum candlesticks ki kya ahmiyat hai aur inka forex trading mein kirdar kya hai iske baare mein batayenge.

Candlesticks charts price action ko display karte hain. Har candlestick ek time period (jaise 1 minute, 5 minute, 1 hour etc.) ke liye market ki price movement ko show karta hai. Candlesticks ke 4 parts hote hain: open, high, low aur close. Ek bullish candlestick mein open price low se zyada hota hai aur close price high se zyada hota hai. Ek bearish candlestick mein open price high se zyada hota hai aur close price low se zyada hota hai.

Candlesticks Character.

Candlesticks charts forex trading mein bohat important hote hain. Ye charts traders ko market ki movement ko samajhne mein madad karte hain. Candlesticks charts se traders ki help se price action ko analyze kiya ja sakta hai aur market trend ko samajha ja sakta hai. Candlesticks charts se traders ko market ki volatility, support aur resistance levels aur trend direction ka pata lag sakta hai.

Candlesticks use in price action strategies.

Candlesticks charts se traders ko price action strategies ke liye madad milti hai. Price action strategies mein traders market ki movement ko analyze karte hain aur support aur resistance levels ko identify karte hain. Candlesticks charts se traders ko price action strategies ke signals milte hain jaise ki trend reversal, trend continuation, support aur resistance levels.

Candlesticks charts forex trading mein bohat important hote hain. Ye charts traders ko market ki movement ko samajhne mein madad karte hain. Candlesticks charts se traders ki help se price action ko analyze kiya ja sakta hai aur market trend ko samajha ja sakta hai. Candlesticks charts se traders ko market ki volatility, support aur resistance levels aur trend direction ka pata lag sakta hai.

تبصرہ

Расширенный режим Обычный режим