Candlestick Patterns

Doji Pattern

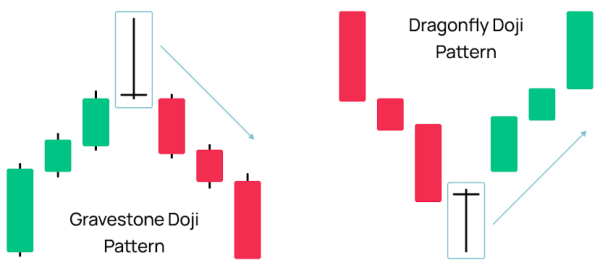

Doji pattern ek aham candlestick pattern hai jo market mein uncertainty ya indecision ko darust karti hai. Yeh pattern ek single candlestick se bana hota hai jismein opening price aur closing price barabar ya qareeb hoti hai. Doji pattern mein price range ki lambai kam hoti hai aur iski wajah se candlestick ki body bohot patli hoti hai, jo ek line ya chhori si shape mein nazar aati hai.

Doji Types

Doji patterns do mukhtalif types mein aate hain.

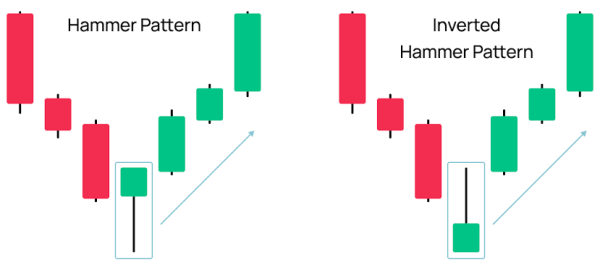

Hammer pattern ek bullish reversal pattern hai jo downtrend ke doran dekha jata hai. Yeh pattern ek single candlestick se bana hota hai jo neeche di gayi characteristics ko follow karta hai.

Hammer pattern ko aksar market ke bottom par dekha jata hai aur yeh bullish reversal ke liye ek potential signal hai. Iska matlab hai ke market ka trend neeche se upar ki taraf badal sakta hai.

Engulfing Pattern

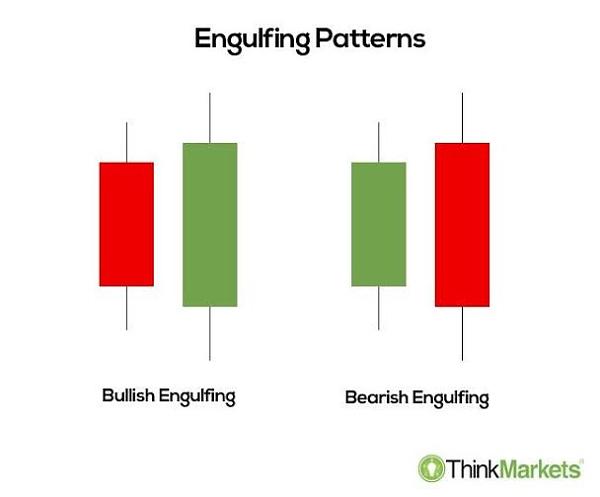

Engulfing pattern ek powerful reversal pattern hai jo do candlesticks se banta hai. Is pattern mein pehli candlestick ki body dusri candlestick ki body ko poori tarah se engulf karti hai. Agar pehli candlestick bearish hai aur dusri bullish hai, toh yeh bullish engulfing pattern kehlata hai, jo bullish reversal ka signal hai. Aur agar pehli candlestick bullish hai aur dusri bearish hai, toh yeh bearish engulfing pattern kehlata hai, jo bearish reversal ka signal hai.

Engulfing Pattern Types

Engulfing pattern do mukhtalif types mein aate hain.

In mukhtalif candlestick patterns, yani doji, hammer, aur engulfing patterns, market ke trends aur reversals ko identify karne mein madad karti hain. Doji pattern market ki uncertainty ko darust karta hai, hammer pattern downtrend ke doran bullish reversal ka signal deta hai, aur engulfing pattern bullish ya bearish reversal ke liye strong indicators hote hain. In patterns ko samajh kar, traders aur investors market ke movements ko samajh sakte hain aur better trading decisions le sakte hain. Lekin, in patterns ke saath dusre technical aur fundamental analysis tools ka istemal bhi zaroori hai market ke puri understanding ke liye.

Doji Pattern

Doji pattern ek aham candlestick pattern hai jo market mein uncertainty ya indecision ko darust karti hai. Yeh pattern ek single candlestick se bana hota hai jismein opening price aur closing price barabar ya qareeb hoti hai. Doji pattern mein price range ki lambai kam hoti hai aur iski wajah se candlestick ki body bohot patli hoti hai, jo ek line ya chhori si shape mein nazar aati hai.

Doji Types

Doji patterns do mukhtalif types mein aate hain.

- Neutral Doji: Jab opening price aur closing price barabar hoti hai, tab yeh neutral doji kehlata hai. Yeh market ke future direction ke liye uncertainty indicate karta hai.

- Long-legged Doji: Long-legged doji mein price range zyada hoti hai jiski wajah se candlestick ki body chhoti nazar aati hai aur lambi shadows hoti hain. Yeh bhi uncertainty ko darust karta hai.

- Gravestone Doji: Agar ek doji ka opening aur closing price market ke session ke neeche ho, toh woh gravestone doji kehlata hai. Yeh bearish reversal ke liye ek signal hai.

Hammer pattern ek bullish reversal pattern hai jo downtrend ke doran dekha jata hai. Yeh pattern ek single candlestick se bana hota hai jo neeche di gayi characteristics ko follow karta hai.

- Ek chhoti si body, jo upper shadow se zyada lambi hoti hai.

- Lower shadow, jo body se zyada lambi hoti hai aur neeche price ki taraf extend hoti hai.

- Opening price aur closing price ke darmiyan ki strong gap.

Hammer pattern ko aksar market ke bottom par dekha jata hai aur yeh bullish reversal ke liye ek potential signal hai. Iska matlab hai ke market ka trend neeche se upar ki taraf badal sakta hai.

Engulfing Pattern

Engulfing pattern ek powerful reversal pattern hai jo do candlesticks se banta hai. Is pattern mein pehli candlestick ki body dusri candlestick ki body ko poori tarah se engulf karti hai. Agar pehli candlestick bearish hai aur dusri bullish hai, toh yeh bullish engulfing pattern kehlata hai, jo bullish reversal ka signal hai. Aur agar pehli candlestick bullish hai aur dusri bearish hai, toh yeh bearish engulfing pattern kehlata hai, jo bearish reversal ka signal hai.

Engulfing Pattern Types

Engulfing pattern do mukhtalif types mein aate hain.

- Bullish Engulfing Pattern: Jab ek bearish candlestick ki body ek bullish candlestick ki body ko poori tarah se cover karti hai, toh yeh bullish engulfing pattern hota hai. Yeh bullish reversal ke liye ek strong signal hai.

- Bearish Engulfing Pattern: Agar ek bullish candlestick ki body ek bearish candlestick ki body ko poori tarah se cover karti hai, toh yeh bearish engulfing pattern hota hai. Yeh bearish reversal ke liye ek strong signal hai.

In mukhtalif candlestick patterns, yani doji, hammer, aur engulfing patterns, market ke trends aur reversals ko identify karne mein madad karti hain. Doji pattern market ki uncertainty ko darust karta hai, hammer pattern downtrend ke doran bullish reversal ka signal deta hai, aur engulfing pattern bullish ya bearish reversal ke liye strong indicators hote hain. In patterns ko samajh kar, traders aur investors market ke movements ko samajh sakte hain aur better trading decisions le sakte hain. Lekin, in patterns ke saath dusre technical aur fundamental analysis tools ka istemal bhi zaroori hai market ke puri understanding ke liye.

تبصرہ

Расширенный режим Обычный режим