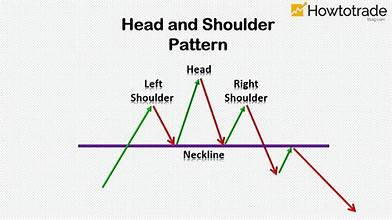

Head and Shoulders Candlestick pattern:

Dear my friends and follows Head and Shoulders Candlestick pattern aik reversal pattern hai, jo price action analysis mein use kiya jata hai.Head and Shoulders Candlestick pattern ki wazahat aur characteristics niche diye gaye hain.Head and Shoulders Candlestick pattern mein, price chart pe aik "head" aur dusri"shoulders" form hoti hy. Head aik higher high hota hai, jabki shoulders lower highs hota hain. Is pattern mein, head aur shoulders ke beech aik neckline hoti hai, jo horizontal ya slopping ho sakti hai.

Interpretation of Head and Shoulders Candlestick pattern:

Dear my students Head and Shoulders Candlestick pattern bullish trend ki reversal ki indication deta hai. Is pattern mein, higher high (head) ke baad lower highs (shoulders) form hote hain, indicating ki buying pressure kam ho rahi hai aur selling pressure dominant ho rahi hai. Neckline ko break karne ke baad, downtrend ka confirmation hota hai.Head and Shoulders Candlestick pattern ka confirmation, neckline ko break karne ke saath hota hai. Agar price neckline ko neeche break karke close karta hai, toh pattern ka confirmation hota hai.Confirmation ke baad traders ko sell signal milta hai.Head and Shoulders Candlestick pattern ka sahi interpretation,overall market context aur trend analysis ke saath karna zaruri hai. Agar Head and Shoulders pattern strong uptrend ke baad dikhta hai, toh ye trend reversal ki indication ho sakta hai.Lekin downtrend ke baad dikhta hai,toh ye trend continuation ki indication ho sakta hai. Head and Shoulders Candlestick pattern, bullish trend ki reversal ki indication deta hai aur traders ko sell signal provide karta hai.Lekin is ko samajhna aur interpret karna traders ke liye zaruri hai.Is liye, professional advice aur market research ke saath is pattern ka istemal karna behtar hoga.

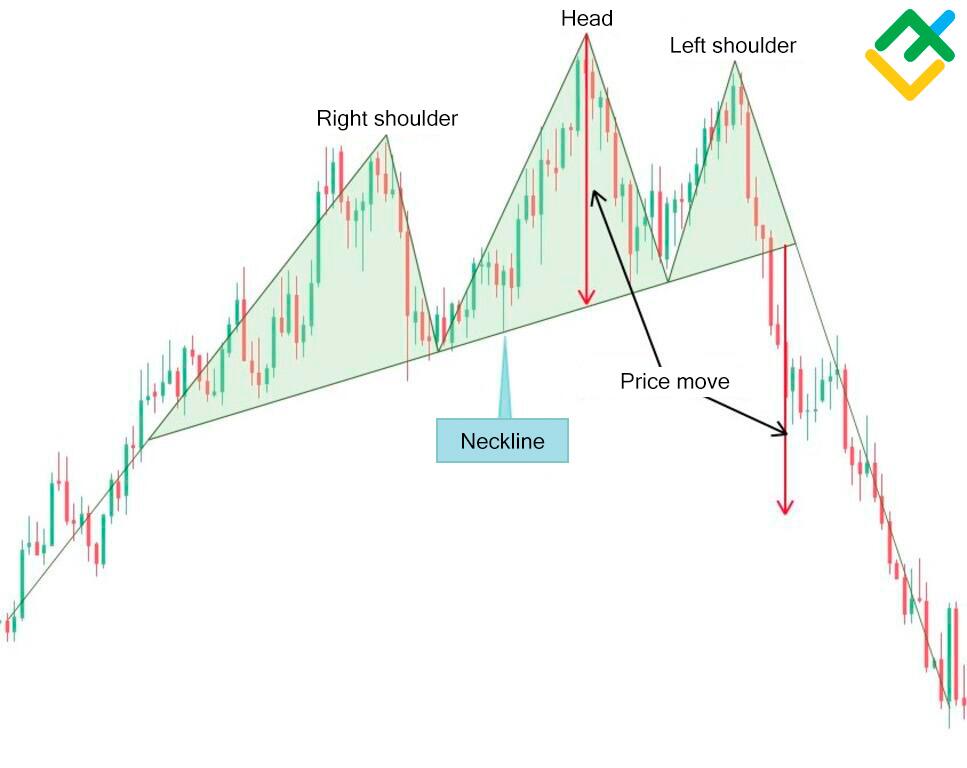

Trading Strategy Head and Shoulders Candlestick pattern:

Dear forex traders Head and Shoulders Candlestick pattern ka use trading strategy mein kiya ja sakta hai. Agar Head and Shoulders pattern uptrend ke baad dikhta hai, toh traders short position lete hain aur stop loss order pattern ke high point se thoda upar set karte hain. Target price ko previous support level ke paas ya lower levels par set kiya jata hai.

Dear my friends and follows Head and Shoulders Candlestick pattern aik reversal pattern hai, jo price action analysis mein use kiya jata hai.Head and Shoulders Candlestick pattern ki wazahat aur characteristics niche diye gaye hain.Head and Shoulders Candlestick pattern mein, price chart pe aik "head" aur dusri"shoulders" form hoti hy. Head aik higher high hota hai, jabki shoulders lower highs hota hain. Is pattern mein, head aur shoulders ke beech aik neckline hoti hai, jo horizontal ya slopping ho sakti hai.

Interpretation of Head and Shoulders Candlestick pattern:

Dear my students Head and Shoulders Candlestick pattern bullish trend ki reversal ki indication deta hai. Is pattern mein, higher high (head) ke baad lower highs (shoulders) form hote hain, indicating ki buying pressure kam ho rahi hai aur selling pressure dominant ho rahi hai. Neckline ko break karne ke baad, downtrend ka confirmation hota hai.Head and Shoulders Candlestick pattern ka confirmation, neckline ko break karne ke saath hota hai. Agar price neckline ko neeche break karke close karta hai, toh pattern ka confirmation hota hai.Confirmation ke baad traders ko sell signal milta hai.Head and Shoulders Candlestick pattern ka sahi interpretation,overall market context aur trend analysis ke saath karna zaruri hai. Agar Head and Shoulders pattern strong uptrend ke baad dikhta hai, toh ye trend reversal ki indication ho sakta hai.Lekin downtrend ke baad dikhta hai,toh ye trend continuation ki indication ho sakta hai. Head and Shoulders Candlestick pattern, bullish trend ki reversal ki indication deta hai aur traders ko sell signal provide karta hai.Lekin is ko samajhna aur interpret karna traders ke liye zaruri hai.Is liye, professional advice aur market research ke saath is pattern ka istemal karna behtar hoga.

Trading Strategy Head and Shoulders Candlestick pattern:

Dear forex traders Head and Shoulders Candlestick pattern ka use trading strategy mein kiya ja sakta hai. Agar Head and Shoulders pattern uptrend ke baad dikhta hai, toh traders short position lete hain aur stop loss order pattern ke high point se thoda upar set karte hain. Target price ko previous support level ke paas ya lower levels par set kiya jata hai.

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_How_to_Trade_the_Head_and_Shoulders_Pattern_Jul_2020-02-694fa56fd5aa47d4877ff9a29d669563.jpg)

تبصرہ

Расширенный режим Обычный режим