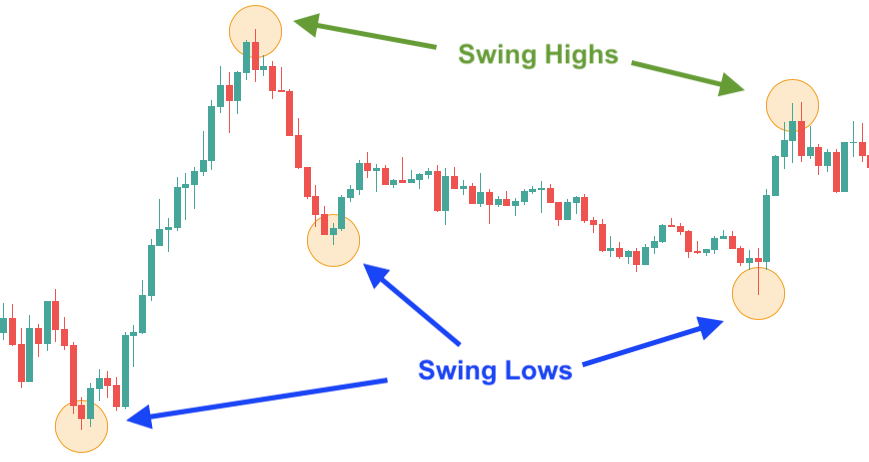

Swing High aur Swing Low patterns technical analysis mein zaroori concepts hain jo traders istemal karte hain taake market ki direction mein potential tabdeeliyon ko pehchaan sakein. Ye patterns is idea par mabni hote hain ke markets waves ya cycles mein move karte hain, jahan upward momentum ke dauran corrections ya reversals hoti hain. In patterns ko samajhna traders ko unke trading strategies mein entry aur exit points ke baare mein mutanaffi faislay karne mein madadgar hota hai.

Definition of Swing High and Swing Low

Aik Swing High tab hota hai jab kisi asset ki price ek peak ko touch karti hai jo pehle ke peaks se ziada hai aur iske baad ek downward movement hoti hai. Ye peak ek temporary resistance level ko darust karta hai jahan selling pressure barh sakti hai, jo price ko girne ka samna karwa sakta hai. Traders aksar Swing Highs ko pehchaanne ke liye dekhte hain taake potential areas of price reversal ya short positions ke liye profit targets set kar sakein.

Importance of Swing Highs and Swing Lows in Trading

Dusri taraf, aik Swing Low tab hota hai jab kisi asset ki price ek trough ko touch karti hai jo pehle ke troughs se kam hai aur iske baad ek upward movement hoti hai. Ye trough ek temporary support level ko darust karta hai jahan buying pressure barh sakti hai, jo price ko barhne ka samna karwa sakta hai. Traders aksar Swing Lows ko pehchaanne ke liye dekhte hain taake potential areas of price reversal ya long positions ke liye profit targets set kar sakein.

Identifying Swing Highs and Swing Lows

Swing Highs aur Swing Lows ka aik ahem asool hai market swings ya fluctuations ka concept. Ye swings market prices ka natural ebb aur flow darust karte hain jab buyers aur sellers interact karte hain. Swing Highs aur Swing Lows ko pehchaan kar traders market trends ki strength ko measure kar sakte hain, market sentiment ko assess kar sakte hain, aur zyada informed trading decisions le sakte hain.

Tools and Indicators for Analyzing Swing Highs and Swing Lows

Traders Swing Highs aur Swing Lows ko darust taur par pehchaanne ke liye mukhtalif technical indicators aur tools ka istemal karte hain. Aik popular tool trendlines ka istemal hai, jo consecutive Swing Highs ya Swing Lows ko connect karke banayi jati hain. Ek upward sloping trendline Swing Lows ko connect karti hai, jo ek uptrend ko darust karti hai, jabke ek downward sloping trendline Swing Highs ko connect karti hai, jo ek downtrend ko darust karti hai. Ye trendlines traders ko market ki direction aur potential areas of support aur resistance ko visualize karne mein madadgar hoti hain.

Traders ka dusra tool Fibonacci retracement levels hota hai, jo Fibonacci sequence par mabni hote hain aur market trend mein potential reversal levels ko pehchaanne ke liye istemal hotay hain. Traders aksar Fibonacci levels aur Swing Highs ya Swing Lows ke darmiyan confluence ko dekhte hain taake potential reversal zones ko confirm kar sakein.

Ye note karna zaroori hai ke Swing Highs aur Swing Lows market direction ka foolproof indicator nahi hote. Market conditions tezi se badal sakti hain, aur doosre factors jaise ke news events, economic data releases, aur geopolitical developments price movements ko influence kar sakte hain. Traders ko Swing Highs aur Swing Lows ko doosre technical aur fundamental analysis tools ke saath istemal karne ki zaroorat hai taake woh well-rounded trading decisions le sakein.

Using Swing Highs and Swing Lows in Trading Strategies

Aik common strategy jo traders istemal karte hain woh Swing Trading strategy hai, jo kuch dinon se lekar kuch hafton tak positions ko hold karke short- to medium-term price movements ko capitalize karne mein madadgar hoti hai. Swing traders aksar apne trades ke liye entry aur exit points ke tor par Swing Highs aur Swing Lows ka istemal karte hain, taake woh market fluctuations ke dauran profits capture kar sakein.

Risk Management

Risk management bhi zaroori hai jab Swing Highs aur Swing Lows par trading ki jaati hai. Traders ko stop-loss orders ka istemal karke potential losses ko limit karna chahiye aur sahi position sizing ko follow karna chahiye taake woh market volatility se bach sakein. Technical analysis aur risk management practices ko combine karke traders apne market mein success ke chances ko barha sakte hain.

Swing Highs aur Swing Lows technical analysis mein bunyadi concepts hain jo traders ko potential areas of price reversal ya continuation ko pehchaanne mein madadgar hote hain. In patterns ko samajhne aur doosre technical tools aur risk management strategies ke saath istemal karke, traders zyada informed trading decisions le sakte hain aur apne overall trading performance ko behtar banane mein kamiyabi haasil kar sakte hain

Definition of Swing High and Swing Low

Aik Swing High tab hota hai jab kisi asset ki price ek peak ko touch karti hai jo pehle ke peaks se ziada hai aur iske baad ek downward movement hoti hai. Ye peak ek temporary resistance level ko darust karta hai jahan selling pressure barh sakti hai, jo price ko girne ka samna karwa sakta hai. Traders aksar Swing Highs ko pehchaanne ke liye dekhte hain taake potential areas of price reversal ya short positions ke liye profit targets set kar sakein.

Importance of Swing Highs and Swing Lows in Trading

Dusri taraf, aik Swing Low tab hota hai jab kisi asset ki price ek trough ko touch karti hai jo pehle ke troughs se kam hai aur iske baad ek upward movement hoti hai. Ye trough ek temporary support level ko darust karta hai jahan buying pressure barh sakti hai, jo price ko barhne ka samna karwa sakta hai. Traders aksar Swing Lows ko pehchaanne ke liye dekhte hain taake potential areas of price reversal ya long positions ke liye profit targets set kar sakein.

Identifying Swing Highs and Swing Lows

Swing Highs aur Swing Lows ka aik ahem asool hai market swings ya fluctuations ka concept. Ye swings market prices ka natural ebb aur flow darust karte hain jab buyers aur sellers interact karte hain. Swing Highs aur Swing Lows ko pehchaan kar traders market trends ki strength ko measure kar sakte hain, market sentiment ko assess kar sakte hain, aur zyada informed trading decisions le sakte hain.

Tools and Indicators for Analyzing Swing Highs and Swing Lows

Traders Swing Highs aur Swing Lows ko darust taur par pehchaanne ke liye mukhtalif technical indicators aur tools ka istemal karte hain. Aik popular tool trendlines ka istemal hai, jo consecutive Swing Highs ya Swing Lows ko connect karke banayi jati hain. Ek upward sloping trendline Swing Lows ko connect karti hai, jo ek uptrend ko darust karti hai, jabke ek downward sloping trendline Swing Highs ko connect karti hai, jo ek downtrend ko darust karti hai. Ye trendlines traders ko market ki direction aur potential areas of support aur resistance ko visualize karne mein madadgar hoti hain.

Traders ka dusra tool Fibonacci retracement levels hota hai, jo Fibonacci sequence par mabni hote hain aur market trend mein potential reversal levels ko pehchaanne ke liye istemal hotay hain. Traders aksar Fibonacci levels aur Swing Highs ya Swing Lows ke darmiyan confluence ko dekhte hain taake potential reversal zones ko confirm kar sakein.

Ye note karna zaroori hai ke Swing Highs aur Swing Lows market direction ka foolproof indicator nahi hote. Market conditions tezi se badal sakti hain, aur doosre factors jaise ke news events, economic data releases, aur geopolitical developments price movements ko influence kar sakte hain. Traders ko Swing Highs aur Swing Lows ko doosre technical aur fundamental analysis tools ke saath istemal karne ki zaroorat hai taake woh well-rounded trading decisions le sakein.

Using Swing Highs and Swing Lows in Trading Strategies

Aik common strategy jo traders istemal karte hain woh Swing Trading strategy hai, jo kuch dinon se lekar kuch hafton tak positions ko hold karke short- to medium-term price movements ko capitalize karne mein madadgar hoti hai. Swing traders aksar apne trades ke liye entry aur exit points ke tor par Swing Highs aur Swing Lows ka istemal karte hain, taake woh market fluctuations ke dauran profits capture kar sakein.

Risk Management

Risk management bhi zaroori hai jab Swing Highs aur Swing Lows par trading ki jaati hai. Traders ko stop-loss orders ka istemal karke potential losses ko limit karna chahiye aur sahi position sizing ko follow karna chahiye taake woh market volatility se bach sakein. Technical analysis aur risk management practices ko combine karke traders apne market mein success ke chances ko barha sakte hain.

Swing Highs aur Swing Lows technical analysis mein bunyadi concepts hain jo traders ko potential areas of price reversal ya continuation ko pehchaanne mein madadgar hote hain. In patterns ko samajhne aur doosre technical tools aur risk management strategies ke saath istemal karke, traders zyada informed trading decisions le sakte hain aur apne overall trading performance ko behtar banane mein kamiyabi haasil kar sakte hain

تبصرہ

Расширенный режим Обычный режим