Double Top Pattern Make.

Double Top Pattern ek aesa chart pattern hai jis mein do baar market ki high level ek jesi banti hai. Ye pattern baray time frame mein market ki trend reversal ko indicate karta hai.Her aik trha say trading ko continue kerna chahiye.

Double Top Pattern Shape.

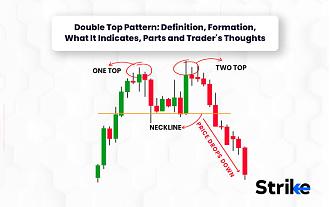

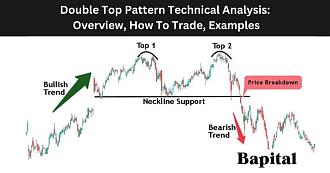

Double Top Pattern ki tashkeel do saray bante hain jin mein pehlay saray mein market ki high level banti hai aur dosray saray mein high level ek baar phir banti hai. Dono saray ek doosray se bari had tak milte julte hote hain.

Double Top Pattern Details.

Double Top Pattern ki tafseel mein market ki high level ko do baar touch karna zaruri hai. Jab market pehli baar high level touch karta hai to traders long position lete hain.

Lekin jab market dobara high level touch karta hai aur phir se neechay ata hai to traders apni positions ko close kar dete hain. Is se market mein selling pressure create hoti hai aur trend reversal ka indication hota hai.

Double Top Pattern Trading Strategy.

Double Top Pattern ki trading strategy mein traders sell position lete hain jab market dobara high level touch karta hai aur phir se neechay ata hai.

Stop loss ko high level ke above rakha jata hai aur take profit ko support level ke near rakha jata hai.

Factors.

Double Top Pattern ek powerful chart pattern hai jis ki madad se traders market ki trend reversal ko identify kar sakte hain. Is pattern ki trading strategy ko samajhna zaruri hai ta ke traders apni positions ko sahi waqt par khulwa saken.

Double Top Pattern ek aesa chart pattern hai jis mein do baar market ki high level ek jesi banti hai. Ye pattern baray time frame mein market ki trend reversal ko indicate karta hai.Her aik trha say trading ko continue kerna chahiye.

Double Top Pattern Shape.

Double Top Pattern ki tashkeel do saray bante hain jin mein pehlay saray mein market ki high level banti hai aur dosray saray mein high level ek baar phir banti hai. Dono saray ek doosray se bari had tak milte julte hote hain.

Double Top Pattern Details.

Double Top Pattern ki tafseel mein market ki high level ko do baar touch karna zaruri hai. Jab market pehli baar high level touch karta hai to traders long position lete hain.

Lekin jab market dobara high level touch karta hai aur phir se neechay ata hai to traders apni positions ko close kar dete hain. Is se market mein selling pressure create hoti hai aur trend reversal ka indication hota hai.

Double Top Pattern Trading Strategy.

Double Top Pattern ki trading strategy mein traders sell position lete hain jab market dobara high level touch karta hai aur phir se neechay ata hai.

Stop loss ko high level ke above rakha jata hai aur take profit ko support level ke near rakha jata hai.

Factors.

Double Top Pattern ek powerful chart pattern hai jis ki madad se traders market ki trend reversal ko identify kar sakte hain. Is pattern ki trading strategy ko samajhna zaruri hai ta ke traders apni positions ko sahi waqt par khulwa saken.

تبصرہ

Расширенный режим Обычный режим