Capital Market: Ek Introduction

Capital market wo market hai jahan corporations, governments aur individuals apna capital raise aur invest karte hain. Yeh ek important financial system component hai jo economy ke liye vital hai. Is market mein long-term securities jaise ke stocks, bonds, aur debentures trade hoti hain.

Capital Market Ke Types

- Primary Market (Awaleen Market): Yahan new securities issue hoti hain, jaise ke IPOs (Initial Public Offerings) aur rights issues. Corporations apna capital yahan raise karte hain, jo ke long-term investments ke liye use hota hai.

- Secondary Market (Doosri Market): Is market mein already issued securities trade hoti hain. Investors aur traders yahan securities ko buy aur sell karte hain, jo ke existing owners se hoti hain.

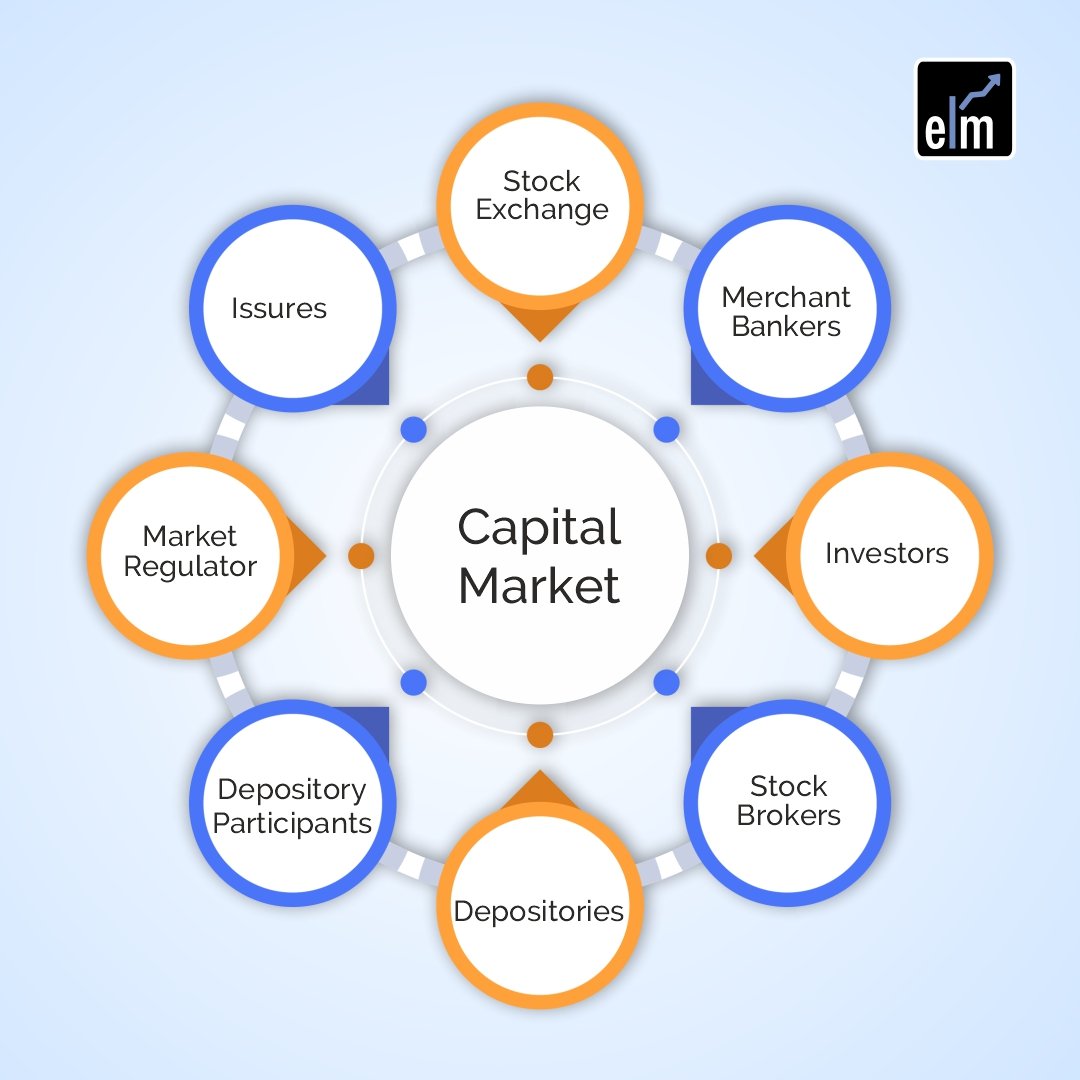

Capital Market Ke Participants

- Corporations: Companies capital market mein apna capital raise karte hain. Yeh funds ke liye stocks, bonds, aur debentures issue karte hain.

- Investors: Investors yani individuals, institutions, aur funds jo securities ko khareedte hain taki unka investment grow kare. Yeh capital market mein apna money invest karte hain.

- Regulators: Government aur regulatory bodies jaise SECP (Securities and Exchange Commission of Pakistan) capital market ko regulate karte hain. Inka kaam hai investor protection aur market stability ko ensure karna.

- Intermediaries: Brokers, investment banks, aur financial advisors jaise intermediaries investors aur corporations ke beech transactions ko facilitate karte hain.

Capital Market Ka Maqsad

- Capital Formation: Capital market companies ko funds provide karta hai jo unhe apne projects aur expansions ke liye chahiye hote hain. Is tarah economic growth aur employment opportunities generate hoti hain.

- Wealth Creation: Investors ko capital market mein investment karke wealth create karne ka mauqa milta hai. Stocks aur bonds ke through long-term returns aur dividends milte hain.

- Liquidity: Capital market mein securities ki liquidity hoti hai, jiski wajah se investors apne investments ko easily buy aur sell kar sakte hain.

- Risk Diversification: Investors capital market mein apna investment diversify karke risk ko spread kar sakte hain. Stocks, bonds, aur other securities ke combinations se risk manage kiya ja sakta hai.

Capital Market Aur Economy

Capital market ka strong hona ek healthy economy ke liye zaroori hai. Jab corporations ko easily funds milte hain, tab wo new projects start karte hain aur jobs create karte hain. Investors ko bhi diverse investment opportunities milte hain jo unki wealth ko grow karte hain. Is tarah capital market aur economy ka mutually beneficial relationship hota hai.

Conclusion

Capital market ek essential financial system component hai jo corporations, investors, aur economy ke liye vital hai. Is market mein long-term securities trade hoti hain jo economic growth, wealth creation, aur risk diversification mein madad karti hain. Regulators ka role market stability aur investor protection ko ensure karna hota hai. Capital market ka proper functioning ek strong aur sustainable economy ke liye zaroori hai.

|

تبصرہ

Расширенный режим Обычный режим