Butterfly Candlestick Pattern Trading.

Candlestick patterns, jaise ke traders ke liye ahem hoti hain, Butterfly candlestick pattern ek aham technical analysis tool hai jo market trends aur reversals ko predict karne mein madad karta hai. Yeh pattern price action par mabni hota hai aur market sentiment ko samajhne mein madad deta hai.Butterfly candlestick pattern, jise kabhi kabhi Butterfly Spread bhi kaha jata hai, generally 4 candlesticks se bana hota hai. Ye pattern trend reversal ko indicate karta hai, specifically bullish ya bearish trend ke darmiyan. Is pattern ka hona ek potential trading opportunity signal karta hai.

Butterfly Pattern Formation.

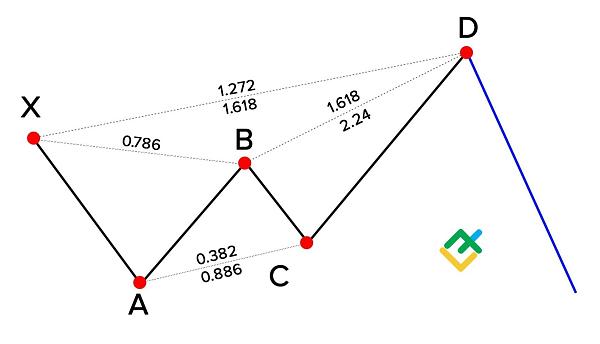

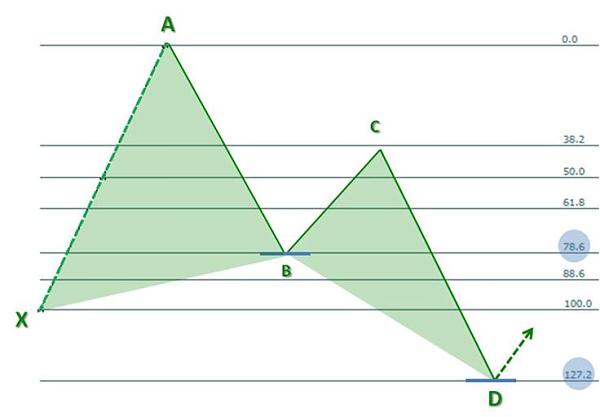

Butterfly candlestick pattern ki formation ko samajhna trading ke liye zaroori hai. Ye pattern typically 4 candlesticks se bana hota hai:

Butterfly pattern ko samajhna trading ke liye zaroori hai. Is pattern mein market sentiment ke sudden changes ko capture kiya jata hai. Agar ye pattern sahi tareeqay se samjha jaye, toh traders ko potential entry aur exit points mil sakte hain.

Trading on Butterfly Candlestick Pattern.

Butterfly candlestick pattern par trading karne ke liye, traders ko kuch zaroori cheezon ka khayal rakhna chahiye

Pattern ki confirmation ke liye, traders ko wait karna chahiye jab tak ki fourth candlestick complete na ho jaye.Volume ki analysis bhi important hai. Agar pattern ke sath volume increase hota hai, toh ye pattern aur bhi reliable ho jata hai.Har trading strategy mein stop loss aur target levels ka hona zaroori hai. Traders ko apne risk tolerance ke mutabiq stop loss aur target levels set karna chahiye.Har trade mein risk management ka hona zaroori hai. Traders ko apne capital ko protect karne ke liye proper risk management techniques istemal karna chahiye.

Butterfly candlestick pattern trading ke liye ek powerful tool hai jo market trends aur reversals ko predict karne mein madad karta hai. Is pattern ko samajhna aur sahi tarike se istemal karna traders ke liye zaroori hai. Pattern ki confirmation, volume analysis, stop loss aur target levels ka hona aur risk management techniques ka istemal karna trading success ke liye ahem hai. Agar traders ye sab cheezein dhyan mein rakhte hain, toh wo Butterfly candlestick pattern par trading mein kamyabi hasil kar sakte hain.

Candlestick patterns, jaise ke traders ke liye ahem hoti hain, Butterfly candlestick pattern ek aham technical analysis tool hai jo market trends aur reversals ko predict karne mein madad karta hai. Yeh pattern price action par mabni hota hai aur market sentiment ko samajhne mein madad deta hai.Butterfly candlestick pattern, jise kabhi kabhi Butterfly Spread bhi kaha jata hai, generally 4 candlesticks se bana hota hai. Ye pattern trend reversal ko indicate karta hai, specifically bullish ya bearish trend ke darmiyan. Is pattern ka hona ek potential trading opportunity signal karta hai.

Butterfly Pattern Formation.

Butterfly candlestick pattern ki formation ko samajhna trading ke liye zaroori hai. Ye pattern typically 4 candlesticks se bana hota hai:

- Pehla candlestick bullish trend ke doran form hota hai. Ismein price high hoti hai aur strong bullish momentum hota hai.

- Doosra candlestick pehle ke candlestick ki high ko cross karta hai aur higher high banata hai. Ye bullish candlestick hota hai aur iska body pehle candlestick ke body ke andar rehta hai.

- Teesra candlestick doosre candlestick ke high se shuru hota hai, lekin iska close pehle candlestick ke andar hota hai. Ye candlestick pehle ke bullish momentum ko rokta hai.

- Chotha aur aakhri candlestick bullish momentum ko dobara shuru karta hai. Ismein price pehle candlestick ke close ke upar jati hai.

Butterfly pattern ko samajhna trading ke liye zaroori hai. Is pattern mein market sentiment ke sudden changes ko capture kiya jata hai. Agar ye pattern sahi tareeqay se samjha jaye, toh traders ko potential entry aur exit points mil sakte hain.

Trading on Butterfly Candlestick Pattern.

Butterfly candlestick pattern par trading karne ke liye, traders ko kuch zaroori cheezon ka khayal rakhna chahiye

Pattern ki confirmation ke liye, traders ko wait karna chahiye jab tak ki fourth candlestick complete na ho jaye.Volume ki analysis bhi important hai. Agar pattern ke sath volume increase hota hai, toh ye pattern aur bhi reliable ho jata hai.Har trading strategy mein stop loss aur target levels ka hona zaroori hai. Traders ko apne risk tolerance ke mutabiq stop loss aur target levels set karna chahiye.Har trade mein risk management ka hona zaroori hai. Traders ko apne capital ko protect karne ke liye proper risk management techniques istemal karna chahiye.

Butterfly candlestick pattern trading ke liye ek powerful tool hai jo market trends aur reversals ko predict karne mein madad karta hai. Is pattern ko samajhna aur sahi tarike se istemal karna traders ke liye zaroori hai. Pattern ki confirmation, volume analysis, stop loss aur target levels ka hona aur risk management techniques ka istemal karna trading success ke liye ahem hai. Agar traders ye sab cheezein dhyan mein rakhte hain, toh wo Butterfly candlestick pattern par trading mein kamyabi hasil kar sakte hain.

تبصرہ

Расширенный режим Обычный режим