Introduction.

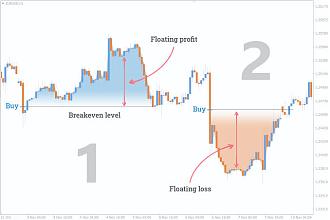

Forex trading mein Break Even Point (BEP) ka matlab hota hai ke aap apni trade ke liye kisi bhi profit ya loss ke beech mein khareedne aur bechne ke liye taiyaar ho jaate hain. Yeh ek bahut important concept hai, kyunki yeh aapko loss se bacha sakta hai aur aapki trade ko profitable bana sakta hai.

Break Even Point ka matlab hota hai ke aap apni trade ke liye kisi bhi profit ya loss ke beech mein khareedne aur bechne ke liye taiyaar ho jaate hain. Yeh aapki trade ke liye ek critical point hota hai, jahan aap apni trade ko save kar sakte hain aur profitable bana sakte hain.

Break Even Point Calculation.

Break Even Point ki calculation bahut simple hai. Iske liye aapko apni entry price se apni stop loss price ko subtract karna hota hai. Agar aapki trade ka result zero ho jaata hai, toh yeh aapka Break Even Point hota hai.Break Even Point ka importance yeh hai ke jab aap apni trade ko Break Even Point tak le jaate hain, toh aapko kisi bhi loss ka dar nahi rehta hai. Agar aapki trade profitable ho jaati hai, toh aap kafi kama sakte hain. Agar trade loss mein bhi jaati hai, toh aapka loss zero ho jata hai. Isliye Break Even Point bahut important hai.

Break Even Point Strategy.

Break Even Point ki strategy yeh hai ke aap apni trade ko Break Even Point tak le jaayein aur phir stop loss ko adjust karke apni trade ko profitable banaayein. Aap apni trade ke liye ek trailing stop loss bhi set kar sakte hain, jisse aapki trade ko profitable banane mein madad milegi.

Break Even Point forex trading mein bahut important concept hai. Iske zariye aap apni trade ko profitable bana sakte hain aur loss se bacha sakte hain. Isliye Break Even Point ki calculation aur strategy ko samajhna bahut zaroori hai.

Forex trading mein Break Even Point (BEP) ka matlab hota hai ke aap apni trade ke liye kisi bhi profit ya loss ke beech mein khareedne aur bechne ke liye taiyaar ho jaate hain. Yeh ek bahut important concept hai, kyunki yeh aapko loss se bacha sakta hai aur aapki trade ko profitable bana sakta hai.

Break Even Point ka matlab hota hai ke aap apni trade ke liye kisi bhi profit ya loss ke beech mein khareedne aur bechne ke liye taiyaar ho jaate hain. Yeh aapki trade ke liye ek critical point hota hai, jahan aap apni trade ko save kar sakte hain aur profitable bana sakte hain.

Break Even Point Calculation.

Break Even Point ki calculation bahut simple hai. Iske liye aapko apni entry price se apni stop loss price ko subtract karna hota hai. Agar aapki trade ka result zero ho jaata hai, toh yeh aapka Break Even Point hota hai.Break Even Point ka importance yeh hai ke jab aap apni trade ko Break Even Point tak le jaate hain, toh aapko kisi bhi loss ka dar nahi rehta hai. Agar aapki trade profitable ho jaati hai, toh aap kafi kama sakte hain. Agar trade loss mein bhi jaati hai, toh aapka loss zero ho jata hai. Isliye Break Even Point bahut important hai.

Break Even Point Strategy.

Break Even Point ki strategy yeh hai ke aap apni trade ko Break Even Point tak le jaayein aur phir stop loss ko adjust karke apni trade ko profitable banaayein. Aap apni trade ke liye ek trailing stop loss bhi set kar sakte hain, jisse aapki trade ko profitable banane mein madad milegi.

Break Even Point forex trading mein bahut important concept hai. Iske zariye aap apni trade ko profitable bana sakte hain aur loss se bacha sakte hain. Isliye Break Even Point ki calculation aur strategy ko samajhna bahut zaroori hai.

تبصرہ

Расширенный режим Обычный режим