Diamond Chart Pattern:

Dear my friends Diamond chart pattern aik technical analysis tool hai jo stock market mein use hota hai.Iska naam is pattern ke appearance se juda hua hai,qk yeh pattern diamond jaisa dikhta hai jab aap price action ko dekhte hain.Is pattern mein market mein aik indecision phase hota hai,jahan buyers aur sellers ke darmiyan struggle hota hai, aur price consolidate hoti hai.Yeh pattern usually uptrend ya downtrend ke baad ata hai aur indicate karta hai ki market mein trend reversal hone ke chances hain.Diamond pattern ko spot karne ke liye aapko price chart par aik series of higher highs aur lower lows dekhna hoga, jo aik diamond shape banate hain.Jab yeh pattern complete ho jata hai,traders is se aik potential reversal signal ke roop mein dekhte hain.Diamond chart pattern ko trade karte waqt,traders usually entry aur stop-loss levels set karte hain taki unka risk minimize ho.Is pattern ko samjhna aur sahi tareeke se use karna traders ke liye mahatvapurn ho sakta hai kyunki is se future price movements ka idea mil sakta hai.

Information about Diamond Chart Pattern:

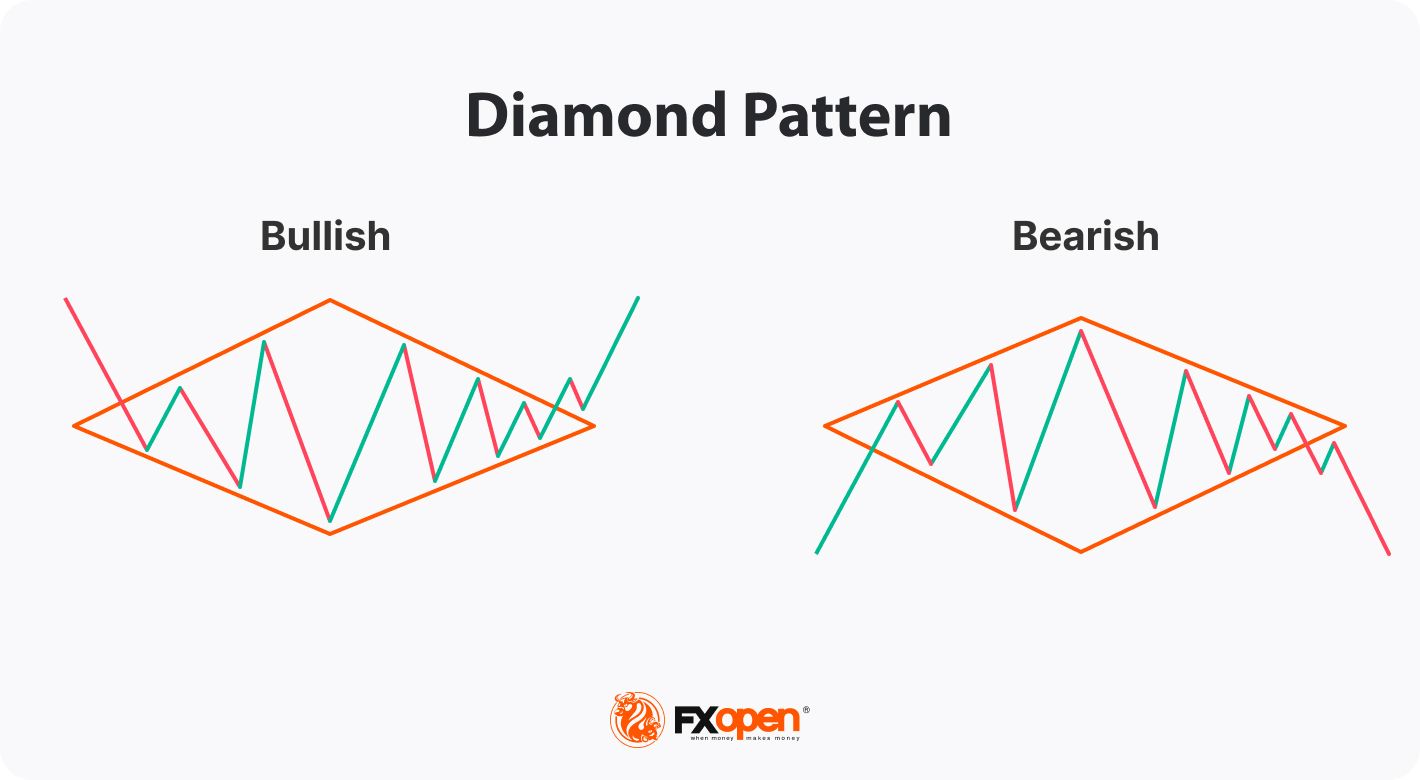

Dear forex traders Diamond Chart Pattern ki tafsilaat ke mutabiq, jab price movements bearish trend se bullish trend mein shift karte hein to yeh bullish diamond pattern kehlata hai aur jab price movements bullish trend se bearish trend mein shift karte hain to yeh bearish diamond pattern kehlata hai. Agar bullish diamond pattern dekha jata hai to iska matlab hai ke price levels neek tarah se stabilize ho chuke hain aur ab market mein buying pressure increase ho rahi hai.Iski wajah se traders aur investors ki demand bhi increase ho jati hai.Isi tarah, agar bearish diamond pattern dekha jata hai to iska matlab hai ke price levels neek tarah se stabilize ho chuke hain aur ab market mein selling pressure increase ho rahi hai.Iski wajah se traders aur investors ki supply bhi increase ho jati hai.

Conclusion:

Dear my friends Diamond Chart Pattern aik bohot ahem technical analysis tool hai jo traders aur investors ke liye market movements ko analyze karne mein madad deta hai.Yeh tool bearish aur bullish diamond pattern ki formation ke zariye price movements ko analyze karta hai.Diamond chart pattern forex mein traders ke liye bahut useful hota hai. Is pattern ko dekh kar traders ko market ke future movements ka idea milta hai.Traders ko diamond chart pattern ke trade entry aur exit ke liye kuch points follow karna chahiye.

Dear my friends Diamond chart pattern aik technical analysis tool hai jo stock market mein use hota hai.Iska naam is pattern ke appearance se juda hua hai,qk yeh pattern diamond jaisa dikhta hai jab aap price action ko dekhte hain.Is pattern mein market mein aik indecision phase hota hai,jahan buyers aur sellers ke darmiyan struggle hota hai, aur price consolidate hoti hai.Yeh pattern usually uptrend ya downtrend ke baad ata hai aur indicate karta hai ki market mein trend reversal hone ke chances hain.Diamond pattern ko spot karne ke liye aapko price chart par aik series of higher highs aur lower lows dekhna hoga, jo aik diamond shape banate hain.Jab yeh pattern complete ho jata hai,traders is se aik potential reversal signal ke roop mein dekhte hain.Diamond chart pattern ko trade karte waqt,traders usually entry aur stop-loss levels set karte hain taki unka risk minimize ho.Is pattern ko samjhna aur sahi tareeke se use karna traders ke liye mahatvapurn ho sakta hai kyunki is se future price movements ka idea mil sakta hai.

Information about Diamond Chart Pattern:

Dear forex traders Diamond Chart Pattern ki tafsilaat ke mutabiq, jab price movements bearish trend se bullish trend mein shift karte hein to yeh bullish diamond pattern kehlata hai aur jab price movements bullish trend se bearish trend mein shift karte hain to yeh bearish diamond pattern kehlata hai. Agar bullish diamond pattern dekha jata hai to iska matlab hai ke price levels neek tarah se stabilize ho chuke hain aur ab market mein buying pressure increase ho rahi hai.Iski wajah se traders aur investors ki demand bhi increase ho jati hai.Isi tarah, agar bearish diamond pattern dekha jata hai to iska matlab hai ke price levels neek tarah se stabilize ho chuke hain aur ab market mein selling pressure increase ho rahi hai.Iski wajah se traders aur investors ki supply bhi increase ho jati hai.

Conclusion:

Dear my friends Diamond Chart Pattern aik bohot ahem technical analysis tool hai jo traders aur investors ke liye market movements ko analyze karne mein madad deta hai.Yeh tool bearish aur bullish diamond pattern ki formation ke zariye price movements ko analyze karta hai.Diamond chart pattern forex mein traders ke liye bahut useful hota hai. Is pattern ko dekh kar traders ko market ke future movements ka idea milta hai.Traders ko diamond chart pattern ke trade entry aur exit ke liye kuch points follow karna chahiye.

:max_bytes(150000):strip_icc()/Clipboard01-29242c27adde4be4a504c0a018072c1f.jpg)

تبصرہ

Расширенный режим Обычный режим