Zigzag pattern ke saath trading karna ek technique hai jo traders ko maaliyati markets mein trends ko pehchanna aur unko follow karna allow karta hai. Zigzag pattern ek technical analysis tool hai jo traders ko madad karta hai ki wo smaller price movements ko filter out kar sakein aur bade price swings ya trends par focus kar sakein.

Zigzag Formation

Formation

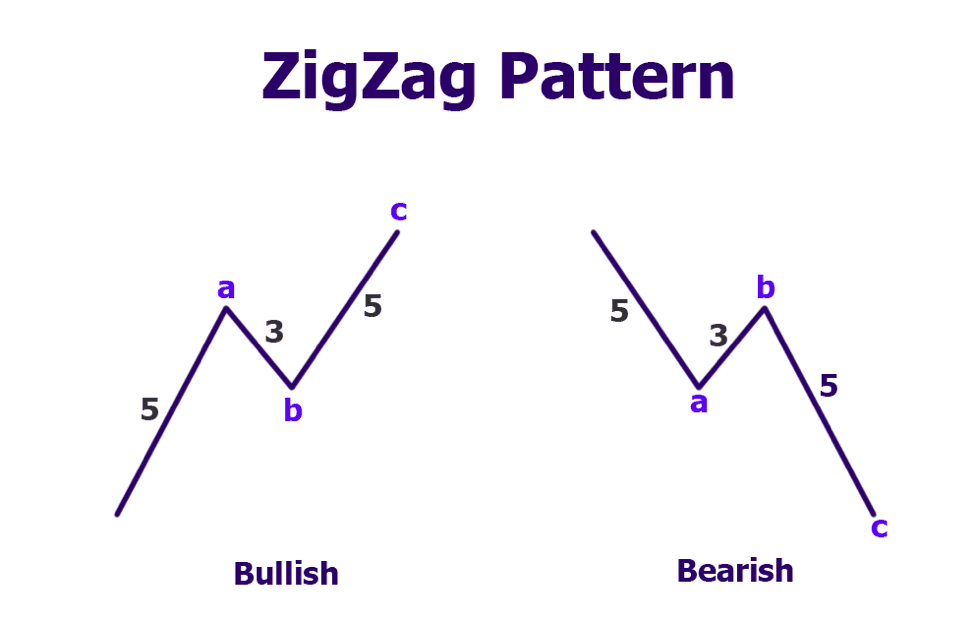

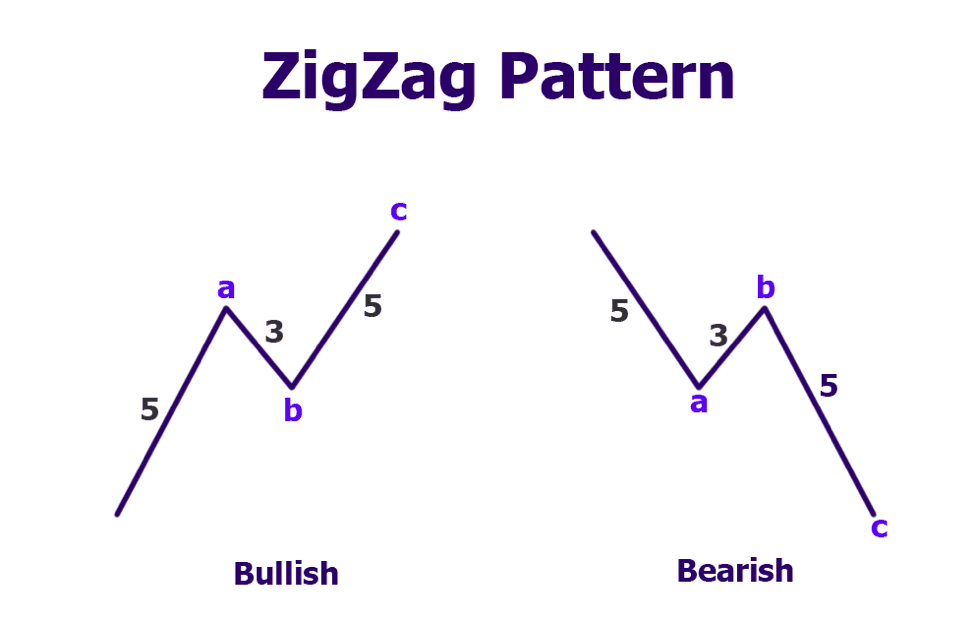

Zigzag pattern ek tarah ka technical analysis tool hai jo price chart mein significant highs aur lows ko connect karke kaam karta hai. Ye isey lines ya segments se jodta hai jo in points ko represent karte hain, ek zigzag pattern banate hue jo visually price movements ko dikhata hai. Zigzag pattern typically customizable hota hai, jo traders ko parameters jaise ke minimum price change ko adjust karne ki ijazat deta hai jo ek naye segment banane ke liye zaroori hota hai.

Zigzag pattern often dusre technical analysis tools ke saath istemal hota hai, jaise moving averages ya oscillators, taake trends aur trading signals ko confirm kiya ja sake. Traders Zigzag pattern ka istemal karte hain taake potential entry aur exit points ko identify kar sakein jo pattern dwara indicate kiye gaye trend ke direction par based hota hai.

Advantages of Trading with the Zigzag Pattern

Zigzag

Formation

FormationZigzag pattern ek tarah ka technical analysis tool hai jo price chart mein significant highs aur lows ko connect karke kaam karta hai. Ye isey lines ya segments se jodta hai jo in points ko represent karte hain, ek zigzag pattern banate hue jo visually price movements ko dikhata hai. Zigzag pattern typically customizable hota hai, jo traders ko parameters jaise ke minimum price change ko adjust karne ki ijazat deta hai jo ek naye segment banane ke liye zaroori hota hai.

Zigzag pattern often dusre technical analysis tools ke saath istemal hota hai, jaise moving averages ya oscillators, taake trends aur trading signals ko confirm kiya ja sake. Traders Zigzag pattern ka istemal karte hain taake potential entry aur exit points ko identify kar sakein jo pattern dwara indicate kiye gaye trend ke direction par based hota hai.

Advantages of Trading with the Zigzag Pattern

- Filtering Noise: Zigzag pattern ka ek mukhya faida ye hai ke ye noise ko filter out karke significant price movements par focus karne mein madad karta hai. Ye traders ko market mein minor fluctuations se distracted hone se bachata hai aur unhe bade picture par concentrate karne mein madad deta hai.

- Identifying Trends: Zigzag pattern market mein trends ko pehchanna mein kargar hota hai, chahe wo upward, downward, ya sideways ho. Traders pattern ka istemal karte hain taake trend ke direction ko determine kar sakein aur apni trading strategies ko uske mutabiq adjust kar sakein.

- Entry and Exit Points: Zigzag pattern ka istemal karke, traders potential entry aur exit points ko identify kar sakte hain jo pattern dwara indicate kiye gaye trend ke direction par based hota hai. Maslan, ek trader long position mein dakhil ho sakta hai jab Zigzag pattern ek upward trend ko indicate karta hai aur exit kar sakta hai jab pattern mein reversal ya correction ka indication hota hai.

- Customizable Parameters: Zigzag pattern customizable hota hai, jo traders ko parameters jaise ke minimum price change ko adjust karne ki ijazat deta hai. Ye flexibility traders ko alag-alag market conditions aur trading strategies ke liye pattern ko adapt karne mein madad karta hai.

- Delay in Signals: Zigzag pattern ka ek hadood ye hai ke kabhi-kabhi wo actual price movements ke peeche reh sakta hai, khaaskar jab market mein zyada volatility hoti hai. Ye signals mein deri ka natija deta hai jo missed trading opportunities ya late entries aur exits ka shikar ban sakta hai.

- Whipsaws: Zigzag pattern whipsaws ke liye prone ho sakta hai, jahan wo false signals generate karta hai short-term price fluctuations ki wajah se. Traders ko savdhani baratni chahiye aur additional confirmation tools ka istemal karna chahiye taake whipsaws se bach sakein.

- Not Suitable for All Markets: Jabki Zigzag pattern trend mein achha perform karta hai, lekin ye choppy ya sideways markets mein jo price movements erratic aur unpredictable hote hain, wahan kaam nahi karta hai.

- Identify Significant Highs and Lows: Shuruwat mein, significant highs aur lows ko price chart mein pehchann. Ye points hain jahan price ne ek substantial move kiya hai pehle ke reversal ya correction se pehle.

- Apply the Zigzag Pattern: Zigzag pattern tool ko apne trading platform mein istemal karein in significant highs aur lows ko connect karne ke liye. Zigzag pattern ke parameters, jaise minimum price change, ko apni trading preferences ke mutabiq adjust karein.

- Confirm with Other Indicators: Zigzag pattern dwara generate kiye gaye signals ko validate karne ke liye, dusre technical indicators ya analysis tools ka istemal karein. Ye moving averages, trendlines, aur oscillators shamil ho sakte hain jo trend ke direction aur potential entry aur exit points ko confirm karte hain.

- Implement Risk Management: Jaise koi bhi trading strategy, risk management Zigzag pattern ka istemal karte waqt crucial hai. Stop-loss orders set karein takay potential losses ko limit kiya ja sake aur sahi position sizing ka istemal karke risk ko effectively manage kiya ja sake.

- Monitor and Adjust: Zigzag pattern ko continuously monitor karein aur apni trading strategy ko market conditions ke evolve hone ke saath adjust karein. Flexible rahein aur changing trends aur volatility ko optimize karne ke liye apni trading performance ko enhance karein.

تبصرہ

Расширенный режим Обычный режим