Explained.

Forex (foreign exchange) trading, jisay currency trading bhi kehtay hain, dunya bhar mein logon ke darmiyan chalnay wali aik exchange system hai jahan par har rooz kai trillions dollars ki transaction hoti hain. Forex mein trading karnay ke liye, aapko behtareen techniques aur strategies use karnay ki zaroorat hoti hai. Yeh techniques aapko trading mein successful bananay mein madad karengi. Is article mein hum aapko kuch behtareen trading techniques ke baray mein batayenge.

Technical analysis.

Technical analysis forex trading ka sab se popular technique hai jahan par traders charts aur graphs ki madad se market trends aur patterns ko samajhtay hain. In charts aur graphs mein aapko market ki price movement aur volume ki information milti hai.

Technical analysis aapko market ki movements ko sahi tarah se samajhnay mein madad karta hai. Is technique ki madad se traders aik currency pair ke future price movements ka andaza lagatay hain.

Fundamental analysis.

Fundamental analysis forex trading ke liye aik aur important technique hai. Yeh technique economic, social aur political news aur events ko samajhnay ke upar based hai. Is technique ki madad se traders market ki movements ko samajhtay hain aur future price movements ka andaza lagatay hain.

Is technique mein traders economic indicators, news reports aur events ke baray mein jankari rakhtay hain.

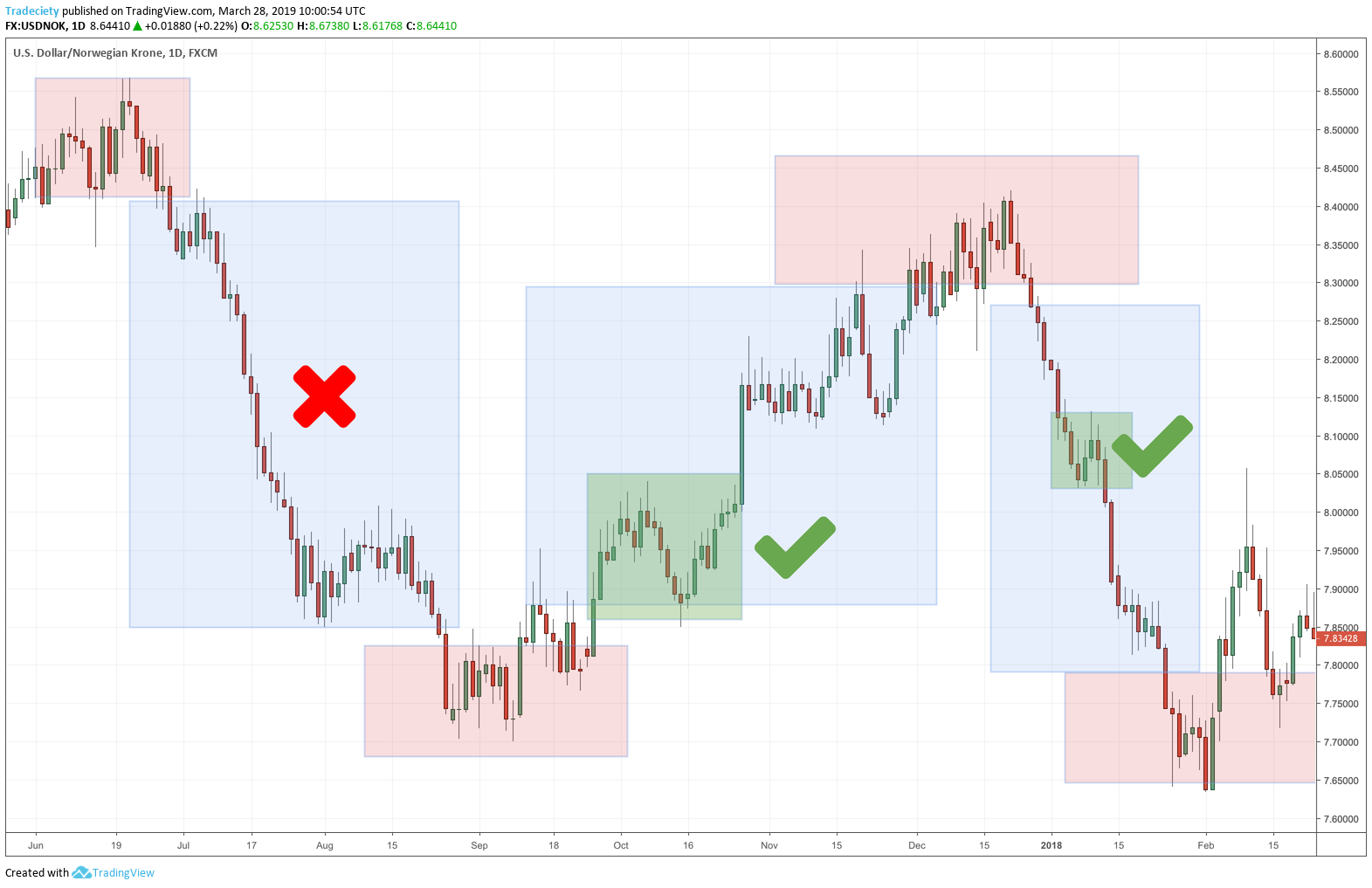

Price action trading.

Price action trading aik simple aur effective trading technique hai jahan par traders market ki price movements aur patterns ko samajhtay hain. Is technique mein traders charts aur graphs ki madad se price movements ko analyze karte hain aur trading decisions letay hain. Price action trading mein traders price action patterns ko recognize karte hain aur in patterns ke upar trading karte hain.

Forex (foreign exchange) trading, jisay currency trading bhi kehtay hain, dunya bhar mein logon ke darmiyan chalnay wali aik exchange system hai jahan par har rooz kai trillions dollars ki transaction hoti hain. Forex mein trading karnay ke liye, aapko behtareen techniques aur strategies use karnay ki zaroorat hoti hai. Yeh techniques aapko trading mein successful bananay mein madad karengi. Is article mein hum aapko kuch behtareen trading techniques ke baray mein batayenge.

Technical analysis.

Technical analysis forex trading ka sab se popular technique hai jahan par traders charts aur graphs ki madad se market trends aur patterns ko samajhtay hain. In charts aur graphs mein aapko market ki price movement aur volume ki information milti hai.

Technical analysis aapko market ki movements ko sahi tarah se samajhnay mein madad karta hai. Is technique ki madad se traders aik currency pair ke future price movements ka andaza lagatay hain.

Fundamental analysis.

Fundamental analysis forex trading ke liye aik aur important technique hai. Yeh technique economic, social aur political news aur events ko samajhnay ke upar based hai. Is technique ki madad se traders market ki movements ko samajhtay hain aur future price movements ka andaza lagatay hain.

Is technique mein traders economic indicators, news reports aur events ke baray mein jankari rakhtay hain.

Price action trading.

Price action trading aik simple aur effective trading technique hai jahan par traders market ki price movements aur patterns ko samajhtay hain. Is technique mein traders charts aur graphs ki madad se price movements ko analyze karte hain aur trading decisions letay hain. Price action trading mein traders price action patterns ko recognize karte hain aur in patterns ke upar trading karte hain.

تبصرہ

Расширенный режим Обычный режим