Inverted Hammer Candlestick Pattern

Forex trading mein candlestick patterns ka istemal aham hota hai jo ke traders ko market ki movement ko samajhne mein madad karta hai. Ek aham aur popular candlestick pattern jo traders istemal karte hain, woh hai "Inverted Hammer". Inverted Hammer ek reversal pattern hai jo ke bearish trend ke baad aksar dekha jata hai aur bullish reversal ka indication deta hai.

Inverted Hammer Kya Hai?

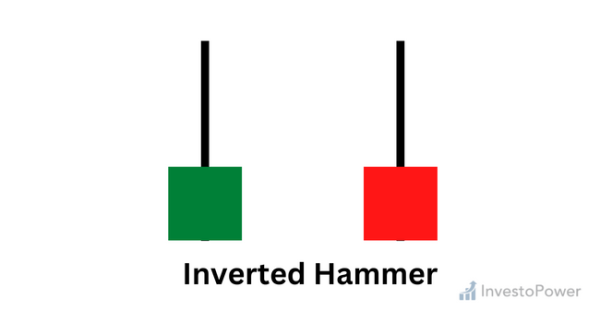

Inverted Hammer candlestick pattern ek single candlestick pattern hai jo bearish trend ke end par hota hai. Iski shape ek lambi upper shadow aur choti body hoti hai, jo ke lower shadow ke bina hoti hai. Yeh candlestick pattern bullish reversal ko represent karta hai.

Inverted Hammer Ki Pechan Kaise Hoti Hai?

Inverted Hammer ki pehchan karne ke liye, traders ko kuch factors par ghor karna hota hai:

Uses:

Forex trading mein Inverted Hammer ka istemal karne se pehle traders ko kuch zaroori points par ghor karna hota hai:

Inverted Hammer And Market Analysis

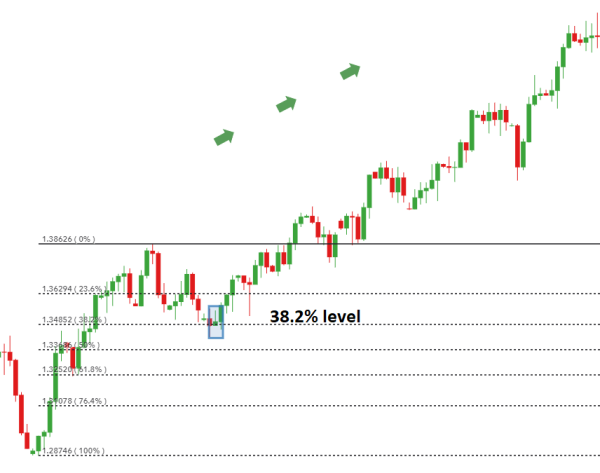

Market analysis mein Inverted Hammer ek tool hai jo ke traders ko market sentiment ka ek idea deta hai. Is pattern ke signals ke saath, traders ko aur bhi technical aur fundamental analysis ka istemal karna chahiye, jaise ke trend lines, support aur resistance levels, aur economic indicators.

Conclusion

Inverted Hammer candlestick pattern ek powerful tool hai jo bearish trend ke end par bullish reversal ka indication deta hai. Lekin, is pattern ke signals par pura bharosa karne se pehle, traders ko market context, volume, aur doosre factors ko bhi dhyan mein rakhna zaroori hai. Saath hi, risk management strategies ka bhi istemal karna important hai taake trading mein losses ko minimize kiya ja sake aur consistent profits hasil kiya ja sake.

Forex trading mein candlestick patterns ka istemal aham hota hai jo ke traders ko market ki movement ko samajhne mein madad karta hai. Ek aham aur popular candlestick pattern jo traders istemal karte hain, woh hai "Inverted Hammer". Inverted Hammer ek reversal pattern hai jo ke bearish trend ke baad aksar dekha jata hai aur bullish reversal ka indication deta hai.

Inverted Hammer Kya Hai?

Inverted Hammer candlestick pattern ek single candlestick pattern hai jo bearish trend ke end par hota hai. Iski shape ek lambi upper shadow aur choti body hoti hai, jo ke lower shadow ke bina hoti hai. Yeh candlestick pattern bullish reversal ko represent karta hai.

Inverted Hammer Ki Pechan Kaise Hoti Hai?

Inverted Hammer ki pehchan karne ke liye, traders ko kuch factors par ghor karna hota hai:

- Body aur Shadows: Inverted Hammer ki body choti hoti hai aur upper shadow lambi hoti hai, jo ke price ke upper end tak extend hoti hai. Lower shadow ideally ya toh chhoti hoti hai ya bilkul na hoti hai.

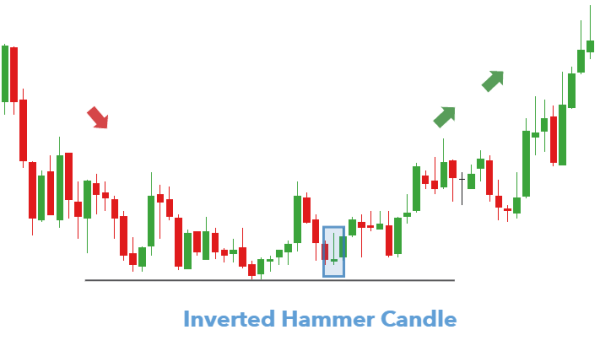

- Price Context: Inverted Hammer bearish trend ke end par aksar dekha jata hai aur isse pehle price mein downtrend hota hai.

- Volume: Ideal scenario mein, Inverted Hammer ke sath volume increase hota hai, jo ke bullish reversal ko confirm karta hai.

Uses:

Forex trading mein Inverted Hammer ka istemal karne se pehle traders ko kuch zaroori points par ghor karna hota hai:

- Confirmation: Inverted Hammer ek indication hai, lekin iski confirmation ke liye doosre indicators aur factors ka bhi istemal kiya jata hai.

- Risk Management: Har trade mein risk management ka dhyan rakhna zaroori hai. Inverted Hammer ke signals par bharosa karte waqt bhi, stop loss aur risk management strategies ka istemal karna zaroori hai.

- Market Context: Inverted Hammer signals ko samajhne ke liye market context ko bhi dhyan mein rakhna zaroori hai. Sirf ek pattern par bharosa na karke, market ke overall trend aur indicators ko bhi dekha jana chahiye.

Inverted Hammer And Market Analysis

Market analysis mein Inverted Hammer ek tool hai jo ke traders ko market sentiment ka ek idea deta hai. Is pattern ke signals ke saath, traders ko aur bhi technical aur fundamental analysis ka istemal karna chahiye, jaise ke trend lines, support aur resistance levels, aur economic indicators.

Conclusion

Inverted Hammer candlestick pattern ek powerful tool hai jo bearish trend ke end par bullish reversal ka indication deta hai. Lekin, is pattern ke signals par pura bharosa karne se pehle, traders ko market context, volume, aur doosre factors ko bhi dhyan mein rakhna zaroori hai. Saath hi, risk management strategies ka bhi istemal karna important hai taake trading mein losses ko minimize kiya ja sake aur consistent profits hasil kiya ja sake.

تبصرہ

Расширенный режим Обычный режим