Introduction.

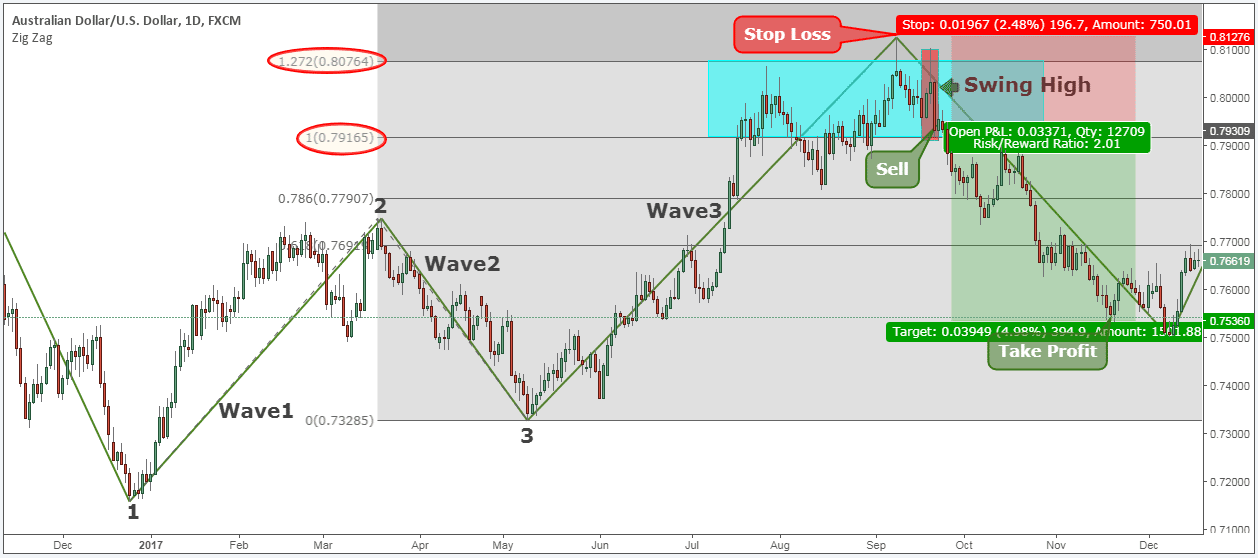

Forex mein Zigzag Pattern, market mein price movement ki shape hai. Ye pattern price movements ki highs aur lows ko connect karta hai aur ek zigzag shape banta hai. Zigzag Pattern traders ke liye market analysis ke liye useful hai.

Zigzag Pattern works.

Zigzag Pattern traders ke liye market mein trend aur reversal points ki identification ke liye helpful hai. Is pattern ko use karke traders support aur resistance levels ko identify kar sakte hain. Ye pattern market mein reversal points ki identification ke liye bhi helpful hai.

Zigzag Pattern Benefits.

Zigzag Pattern traders ke liye market movements ke analysis mein helpful hota hai. Is pattern se traders market mein price movements ki direction aur momentum ko identify kar sakte hain. Ye pattern traders ko market mein profitable trades karne mein help karta hai.

Zigzag Pattern har market mein applicable nahi hota hai. Is pattern ki accuracy market conditions par depend karta hai. Kuch markets mein ye pattern useful ho sakta hai jabki kuch markets mein ye pattern inaccurate ho sakta hai.

Market Anylesis.

Zigzag Pattern Forex traders ke liye market mein profitable trades karne mein helpful hai. Is pattern se traders market movements ko analyze kar sakte hain aur market mein profitable trades kar sakte hain. Lekin ye pattern ki accuracy market conditions par depend karta hai.

In strategies ka use kr k traders apni trading skills ko improve kr sakty hain or forex market main successful trading kar sakty hain or strategies ka use ker leny say achi trading waqea ho jati hay nahi to phir loss lazmi hota hay loss say safe rehna chahiye kyun k yeh achi cheez nahi hoti.

Forex mein Zigzag Pattern, market mein price movement ki shape hai. Ye pattern price movements ki highs aur lows ko connect karta hai aur ek zigzag shape banta hai. Zigzag Pattern traders ke liye market analysis ke liye useful hai.

Zigzag Pattern works.

Zigzag Pattern traders ke liye market mein trend aur reversal points ki identification ke liye helpful hai. Is pattern ko use karke traders support aur resistance levels ko identify kar sakte hain. Ye pattern market mein reversal points ki identification ke liye bhi helpful hai.

Zigzag Pattern Benefits.

Zigzag Pattern traders ke liye market movements ke analysis mein helpful hota hai. Is pattern se traders market mein price movements ki direction aur momentum ko identify kar sakte hain. Ye pattern traders ko market mein profitable trades karne mein help karta hai.

Zigzag Pattern har market mein applicable nahi hota hai. Is pattern ki accuracy market conditions par depend karta hai. Kuch markets mein ye pattern useful ho sakta hai jabki kuch markets mein ye pattern inaccurate ho sakta hai.

Market Anylesis.

Zigzag Pattern Forex traders ke liye market mein profitable trades karne mein helpful hai. Is pattern se traders market movements ko analyze kar sakte hain aur market mein profitable trades kar sakte hain. Lekin ye pattern ki accuracy market conditions par depend karta hai.

In strategies ka use kr k traders apni trading skills ko improve kr sakty hain or forex market main successful trading kar sakty hain or strategies ka use ker leny say achi trading waqea ho jati hay nahi to phir loss lazmi hota hay loss say safe rehna chahiye kyun k yeh achi cheez nahi hoti.

تبصرہ

Расширенный режим Обычный режим