Details.

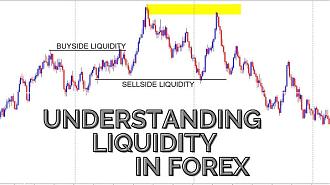

Forex Trading mein, Liquidity Trading Strategy aik aham tareeqa hai jis se traders apni trading ko improve kar sakte hain. Is strategy se traders ko market ke liquidity levels par nazar rakhne ki zaroorat hoti hai. Is article mein hum aap ko Liquidity Trading Strategy ke bare mein roman urdu mein batayenge.

Liquidity Purpose.

Liquidity ka matlab hota hai kisi bhi asset ya security ko kisi bhi waqt bechne ya khareedne ki aasani. Forex Trading mein, liquidity se muraad hota hai market mein available currency pairs ke volume par. Agar koi currency pair zyada traded hota hai to us ka liquidity level zyada hota hai.

Liquidity Trading Strategy.

Liquidity Trading Strategy ka matlab hota hai traders ko market ke liquidity levels par nazar rakhne ke liye aik trading approach istemal karna. Is approach ke istemal se traders ko market ke fluctuations par nazar rakhne mein asani hoti hai.

Liquidity Trading Strategy Tips.

Major Currency Pairs Ke Sath Trade Karein.

Major currency pairs ke sath trading karna liquidity level ko improve karta hai. Major currency pairs mein USD, EUR, JPY, GBP aur CHF shamil hote hain.

Economic Calendars Ko Follow Karein:

Economic calendars ko follow karne se traders ko market mein hone wale economic events ke bare mein pata chalta hai. Is se traders ko market ki fluctuations par nazar rakhne mein asani hoti hai.

Market Volatility Ko Monitor Karein:

Market volatility ko monitor karne se traders ko market ki fluctuations par nazar rakhne mein asani hoti hai. Is se traders ko market mein hone wale changes par nazar rakhne mein asani hoti hai.

Liquidity Providers Ko Istemal Karein:

Liquidity providers ko istemal karne se traders ko market mein available currency pairs ke bare mein pata chalta hai. Is se traders ko market ki fluctuations par nazar rakhne mein asani hoti hai.

More Facts.

Forex Trading mein Liquidity Trading Strategy aik aham tareeqa hai jis se traders apni trading ko improve kar sakte hain. Is strategy se traders ko market ke liquidity levels par nazar rakhne ki zaroorat hoti hai. Humne is article mein Liquidity Trading Strategy ke bare mein roman urdu mein bataya hai.

Forex Trading mein, Liquidity Trading Strategy aik aham tareeqa hai jis se traders apni trading ko improve kar sakte hain. Is strategy se traders ko market ke liquidity levels par nazar rakhne ki zaroorat hoti hai. Is article mein hum aap ko Liquidity Trading Strategy ke bare mein roman urdu mein batayenge.

Liquidity Purpose.

Liquidity ka matlab hota hai kisi bhi asset ya security ko kisi bhi waqt bechne ya khareedne ki aasani. Forex Trading mein, liquidity se muraad hota hai market mein available currency pairs ke volume par. Agar koi currency pair zyada traded hota hai to us ka liquidity level zyada hota hai.

Liquidity Trading Strategy.

Liquidity Trading Strategy ka matlab hota hai traders ko market ke liquidity levels par nazar rakhne ke liye aik trading approach istemal karna. Is approach ke istemal se traders ko market ke fluctuations par nazar rakhne mein asani hoti hai.

Liquidity Trading Strategy Tips.

Major Currency Pairs Ke Sath Trade Karein.

Major currency pairs ke sath trading karna liquidity level ko improve karta hai. Major currency pairs mein USD, EUR, JPY, GBP aur CHF shamil hote hain.

Economic Calendars Ko Follow Karein:

Economic calendars ko follow karne se traders ko market mein hone wale economic events ke bare mein pata chalta hai. Is se traders ko market ki fluctuations par nazar rakhne mein asani hoti hai.

Market Volatility Ko Monitor Karein:

Market volatility ko monitor karne se traders ko market ki fluctuations par nazar rakhne mein asani hoti hai. Is se traders ko market mein hone wale changes par nazar rakhne mein asani hoti hai.

Liquidity Providers Ko Istemal Karein:

Liquidity providers ko istemal karne se traders ko market mein available currency pairs ke bare mein pata chalta hai. Is se traders ko market ki fluctuations par nazar rakhne mein asani hoti hai.

More Facts.

Forex Trading mein Liquidity Trading Strategy aik aham tareeqa hai jis se traders apni trading ko improve kar sakte hain. Is strategy se traders ko market ke liquidity levels par nazar rakhne ki zaroorat hoti hai. Humne is article mein Liquidity Trading Strategy ke bare mein roman urdu mein bataya hai.

تبصرہ

Расширенный режим Обычный режим