Introduction.

Elliot Wave Theory forex trading mai ek popular technical analysis tool hai. Is theory ko Ralph Nelson Elliot ne develop kiya tha aur iske through woh stock market trends aur price movements ko predict karne ki koshish karte the. Is theory ke through aap forex market ke price movements ko analyze kar sakte hai aur future ke price movements ko bhi predict kar sakte hai. Is article mai hum Elliot Wave Theory ke baare mai detail mai discuss karenge.

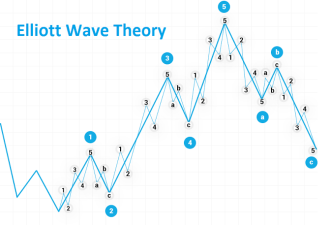

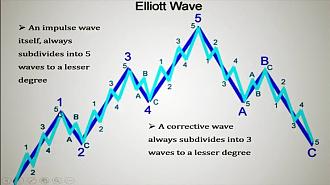

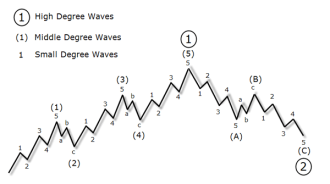

Elliot Wave Theory ek technical analysis tool hai jo stock market aur forex market ke price movements ko analyze karne ke liye use kiya jata hai. Is theory ke through aap market ke trend ko samajh sakte hai aur future ke price movements ko predict kar sakte hai. Is theory ke according market ke price movements mai 5 waves aur 3 corrective waves hote hai.

Market Anylesis.

Elliot Wave Theory ke 5 waves bullish trend ko represent karte hai aur iske 3 corrective waves bearish trend ko represent karte hai. Is theory ke through aap market ke trend ko samajh sakte hai aur future ke price movements ko predict kar sakte hai.

Elliot Wave Theory Principles.

Elliot Wave Theory ke kuch principles hai jo is theory ko follow karte hai. In principles ko follow karke aap market ke trend ko samajh sakte hai aur future ke price movements ko predict kar sakte hai. Elliot Wave Theory ke principles niche diye gaye hai:

Wave 1:

Ye wave bullish trend ko represent karta hai jisme investors apne positions ko build karte hai.

Wave 2:

Ye wave corrective wave hai jisme market ke price mai kuch drop hota hai.

Wave 3:

Ye wave sabse strong aur longest wave hota hai jisme market ke price mai bahut bada movement hota hai.

Wave 4:

Ye wave corrective wave hai jisme market ke price mai kuch drop hota hai.

Wave 5:

Ye wave bullish trend ko represent karta hai jisme market ke price mai bahut bada movement hota hai.

Corrective waves:

Ye waves bearish trend ko represent karte hai jisme market ke price mai kuch drop hota hai.

Elliot Wave Theory forex trading mai ek popular technical analysis tool hai. Is theory ko Ralph Nelson Elliot ne develop kiya tha aur iske through woh stock market trends aur price movements ko predict karne ki koshish karte the. Is theory ke through aap forex market ke price movements ko analyze kar sakte hai aur future ke price movements ko bhi predict kar sakte hai. Is article mai hum Elliot Wave Theory ke baare mai detail mai discuss karenge.

Elliot Wave Theory ek technical analysis tool hai jo stock market aur forex market ke price movements ko analyze karne ke liye use kiya jata hai. Is theory ke through aap market ke trend ko samajh sakte hai aur future ke price movements ko predict kar sakte hai. Is theory ke according market ke price movements mai 5 waves aur 3 corrective waves hote hai.

Market Anylesis.

Elliot Wave Theory ke 5 waves bullish trend ko represent karte hai aur iske 3 corrective waves bearish trend ko represent karte hai. Is theory ke through aap market ke trend ko samajh sakte hai aur future ke price movements ko predict kar sakte hai.

Elliot Wave Theory Principles.

Elliot Wave Theory ke kuch principles hai jo is theory ko follow karte hai. In principles ko follow karke aap market ke trend ko samajh sakte hai aur future ke price movements ko predict kar sakte hai. Elliot Wave Theory ke principles niche diye gaye hai:

Wave 1:

Ye wave bullish trend ko represent karta hai jisme investors apne positions ko build karte hai.

Wave 2:

Ye wave corrective wave hai jisme market ke price mai kuch drop hota hai.

Wave 3:

Ye wave sabse strong aur longest wave hota hai jisme market ke price mai bahut bada movement hota hai.

Wave 4:

Ye wave corrective wave hai jisme market ke price mai kuch drop hota hai.

Wave 5:

Ye wave bullish trend ko represent karta hai jisme market ke price mai bahut bada movement hota hai.

Corrective waves:

Ye waves bearish trend ko represent karte hai jisme market ke price mai kuch drop hota hai.

تبصرہ

Расширенный режим Обычный режим