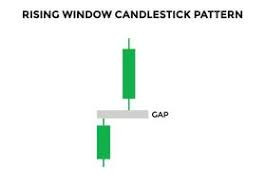

Rising Window candlestick pattern:

Dear my friends and follows Rising Window candlestick pattern aik bullish candlestick pattern hai,jis se price action analysis mein use kiya jata hai. Is pattern mein aik single candlestick formation hoti hai, jis mein price gap up karta hai aur previous candlestick ke high se neechy open hota hai.Is pattern ki wazahat aur characteristics niche diye gaye hain.Rising Window pattern mein, price gap up karta hai, jiske wajah se previous candlestick ke high se neeche open hota hai.Yani, current candlestick ka low previous candlestick ke high se neeche hota hai. Is pattern mein, gap up ke wajah se price range widen ho jata hai.Rising Window pattern,bullish momentum ki strong indication deta hai. Is pattern mein, buyers dominate karte hain aur price ko up move karte hain. Gap up, market sentiment mein positive change ki indication hai aur bullish trend ke continuation ki possibility dikhata hai.

Confirmation Rising Window candlestick pattern:

Dear forex traders Rising Window pattern ka confirmation, next candlestick ki price action se hota hai. Agar next candlestick gap up ke wajah se high se neeche open hota hai aur price up move karta hai, toh pattern ka confirmation hota hai. Confirmation ke baad traders ko buy signal milta hai.Support/Resistance Level ky process mein Rising Window pattern per, gap up ke wajah se previous resistance level support level ban sakta hai. Agar price gap up ke baad previous resistance level se up move karta hai, toh ye resistance level support level ban sakta hai.

Trading Strategy with Rising Window candlestick pattern:

Dear forex members Rising Window pattern ka use trading strategy mein kiya ja sakta hai.Traders gap up ke baad long position lete hain aur stop loss order gap down ke neeche set karte hain. Target price ko previous resistance level ke paas ya higher levels par set kiya jata hai.Rising Window pattern ka sahi interpretation,overall market context aur trend analysis ke saath karna zaruri hai.Agar pattern uptrend ke baad dikhta hai, toh ye trend continuation ki indication ho sakta hai. Lekin downtrend ke baad dikhta hai, toh ye trend reversal ki indication ho sakta hai.Rising Window pattern, bullish momentum aur trend continuation ki indication deta hai. Lekin isko samajhna aur interpret karna traders ke liye zaruri hai.Is liye, professional advice aur market research ke saath is pattern ka use karna behtar hoga.

Dear my friends and follows Rising Window candlestick pattern aik bullish candlestick pattern hai,jis se price action analysis mein use kiya jata hai. Is pattern mein aik single candlestick formation hoti hai, jis mein price gap up karta hai aur previous candlestick ke high se neechy open hota hai.Is pattern ki wazahat aur characteristics niche diye gaye hain.Rising Window pattern mein, price gap up karta hai, jiske wajah se previous candlestick ke high se neeche open hota hai.Yani, current candlestick ka low previous candlestick ke high se neeche hota hai. Is pattern mein, gap up ke wajah se price range widen ho jata hai.Rising Window pattern,bullish momentum ki strong indication deta hai. Is pattern mein, buyers dominate karte hain aur price ko up move karte hain. Gap up, market sentiment mein positive change ki indication hai aur bullish trend ke continuation ki possibility dikhata hai.

Confirmation Rising Window candlestick pattern:

Dear forex traders Rising Window pattern ka confirmation, next candlestick ki price action se hota hai. Agar next candlestick gap up ke wajah se high se neeche open hota hai aur price up move karta hai, toh pattern ka confirmation hota hai. Confirmation ke baad traders ko buy signal milta hai.Support/Resistance Level ky process mein Rising Window pattern per, gap up ke wajah se previous resistance level support level ban sakta hai. Agar price gap up ke baad previous resistance level se up move karta hai, toh ye resistance level support level ban sakta hai.

Trading Strategy with Rising Window candlestick pattern:

Dear forex members Rising Window pattern ka use trading strategy mein kiya ja sakta hai.Traders gap up ke baad long position lete hain aur stop loss order gap down ke neeche set karte hain. Target price ko previous resistance level ke paas ya higher levels par set kiya jata hai.Rising Window pattern ka sahi interpretation,overall market context aur trend analysis ke saath karna zaruri hai.Agar pattern uptrend ke baad dikhta hai, toh ye trend continuation ki indication ho sakta hai. Lekin downtrend ke baad dikhta hai, toh ye trend reversal ki indication ho sakta hai.Rising Window pattern, bullish momentum aur trend continuation ki indication deta hai. Lekin isko samajhna aur interpret karna traders ke liye zaruri hai.Is liye, professional advice aur market research ke saath is pattern ka use karna behtar hoga.

تبصرہ

Расширенный режим Обычный режим