Morning Star Candlestick Pattern ek technical analysis tool hai jo stock market mein istemal hota hai. Yeh pattern traders aur investors ko bullish reversal signals provide karta hai, especially jab market downtrend mein hota hai.

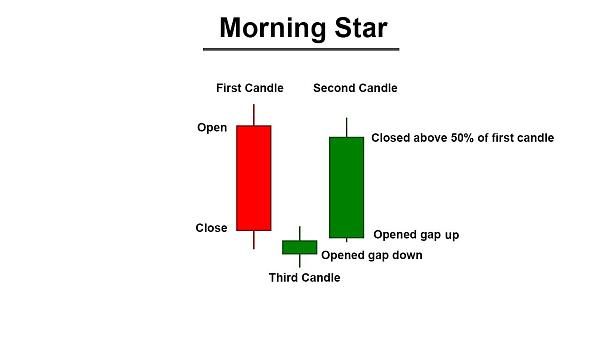

Morning Star Candlestick Pattern teen candlesticks se bana hota hai, jo ek specific sequence follow karte hain:

Morning Star Candlestick Pattern ka significance hai ke jab yeh pattern downtrend ke baad form hota hai, toh yeh bullish reversal ka strong indication deta hai. Is pattern ko confirm karne ke liye traders aur investors typically volume ki bhi analysis karte hain. Agar volume bhi increase hota hai teesri candlestick ke sath, toh yeh pattern aur bhi reliable hota hai.

Traders is pattern ko trading strategies mein istemal karte hain, jaise ki entry aur exit points identify karna ya stop loss levels set karna. Jab yeh pattern confirm ho jata hai, traders buy positions (long positions) lete hain ya existing short positions ko close karte hain.

Morning Star Candlestick Pattern ka istemal sirf ek indicator ke roop mein kiya jata hai aur iske bina bhi trading decisions liye ja sakte hain. Isliye, yeh important hai ke traders aur investors is pattern ko aur bhi technical indicators ke sath combine karein aur proper risk management ka dhyan rakhein.

Is pattern ka istemal karne se pehle, traders ko market ki overall trend ko bhi analyze karna chahiye taaki false signals se bacha ja sake. Technical analysis ke saath fundamental analysis ka bhi combination traders ke liye beneficial hota hai.

Morning Star Candlestick Pattern teen candlesticks se bana hota hai, jo ek specific sequence follow karte hain:

- Pehli Candlestick (Bearish): Yeh typically ek bearish (girawat ki taraf) candle hoti hai, jo downtrend ko reflect karti hai. Is candle ki body lambi hoti hai aur price opening aur closing ke darmiyan ki range ko darust karti hai.

- Dusri Candlestick (Indecision): Dusri candlestick chhoti body ki hoti hai aur iski upper wick extend hoti hai, indicating uncertainty or indecision market mein. Price opening aur closing ke darmiyan ki range narrow hoti hai.

- Teesri Candlestick (Bullish): Teesri candlestick bullish (bhartiye ki taraf) hoti hai aur pehli candlestick ki body ke andar close hoti hai ya usse thoda upar close hoti hai. Is candle ki body lambi hoti hai aur bull market ke indication provide karti hai.

Morning Star Candlestick Pattern ka significance hai ke jab yeh pattern downtrend ke baad form hota hai, toh yeh bullish reversal ka strong indication deta hai. Is pattern ko confirm karne ke liye traders aur investors typically volume ki bhi analysis karte hain. Agar volume bhi increase hota hai teesri candlestick ke sath, toh yeh pattern aur bhi reliable hota hai.

Traders is pattern ko trading strategies mein istemal karte hain, jaise ki entry aur exit points identify karna ya stop loss levels set karna. Jab yeh pattern confirm ho jata hai, traders buy positions (long positions) lete hain ya existing short positions ko close karte hain.

Morning Star Candlestick Pattern ka istemal sirf ek indicator ke roop mein kiya jata hai aur iske bina bhi trading decisions liye ja sakte hain. Isliye, yeh important hai ke traders aur investors is pattern ko aur bhi technical indicators ke sath combine karein aur proper risk management ka dhyan rakhein.

Is pattern ka istemal karne se pehle, traders ko market ki overall trend ko bhi analyze karna chahiye taaki false signals se bacha ja sake. Technical analysis ke saath fundamental analysis ka bhi combination traders ke liye beneficial hota hai.

تبصرہ

Расширенный режим Обычный режим