;;;;;Forex Trading Mein Horizontal Channel;;;;;

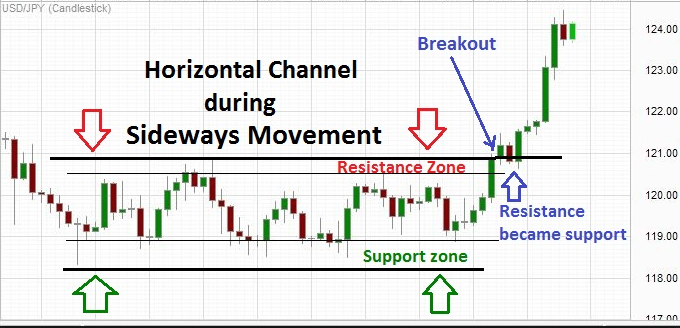

Forex trading mein, horizontal channel ek technical analysis concept hai jo price action ko analyze karne ka ek tareeqa hai. Horizontal channel ek price pattern hai jismein price ek certain range ke andar move karta hai aur phir wapas is range ke andar hi rehta hai, bar-bar upper limit (resistance) aur lower limit (support) ke darmiyan oscillate karta hai.

Horizontal channel ko identify karne ke liye, traders price chart par ek horizontal line draw karte hain jise resistance aur ek line draw karte hain jo support ke roop mein kaam karti hai. Jab price yeh lines ke darmiyan range mein rehta hai aur regular intervals par upper aur lower limits ko touch karta hai, toh woh ek horizontal channel banata hai.

;;;;;Forex Trading Mein Horizontal Channel Ke Main Nukaat;;;;;

Horizontal channel trading mein, traders ko kuch important points ka dhyan rakhna chahiye:

Forex trading mein, horizontal channel ek technical analysis concept hai jo price action ko analyze karne ka ek tareeqa hai. Horizontal channel ek price pattern hai jismein price ek certain range ke andar move karta hai aur phir wapas is range ke andar hi rehta hai, bar-bar upper limit (resistance) aur lower limit (support) ke darmiyan oscillate karta hai.

Horizontal channel ko identify karne ke liye, traders price chart par ek horizontal line draw karte hain jise resistance aur ek line draw karte hain jo support ke roop mein kaam karti hai. Jab price yeh lines ke darmiyan range mein rehta hai aur regular intervals par upper aur lower limits ko touch karta hai, toh woh ek horizontal channel banata hai.

;;;;;Forex Trading Mein Horizontal Channel Ke Main Nukaat;;;;;

Horizontal channel trading mein, traders ko kuch important points ka dhyan rakhna chahiye:

- Support aur Resistance Levels: Horizontal channel mein, support aur resistance levels ko sahi tarah se identify karna zaroori hai. Support level woh price point hota hai jahan se price ko bounce milta hai aur upar jaata hai, jabki resistance level woh point hota hai jahan se price ko bounce milta hai aur neeche jaata hai.

- Entry aur Exit Points: Traders ko sahi entry aur exit points ka chayan karna chahiye. Entry point ko determine karne ke liye, traders ko support level ke paas long positions ya resistance level ke paas short positions lena chahiye. Exit points ko define karne ke liye, traders ko profit targets aur stop-loss levels ko set karna chahiye.

- Volume Analysis: Volume analysis bhi important hai horizontal channel trading mein. Agar price ek range mein oscillate kar raha hai aur volume bhi stable hai, toh yeh indicate karta hai ki market mein stability hai aur channel trading ki possibilities hai. Lekin agar volume suddenly increase ho jaata hai, toh yeh ek potential breakout ya breakdown ka indication ho sakta hai.

- Confirmation Signals: Traders ko confirmation signals ka istemal karna chahiye. Agar price ek channel mein hai aur ek breakout ya breakdown hone ka indication milta hai, toh traders ko confirmatory signals jaise ki price action patterns, technical indicators (jaise ki RSI, MACD, etc.), ya fundamental analysis ka istemal karke trade ko confirm karna chahiye.

- Risk Management: Har trade mein risk management ka dhyan rakhna zaroori hai. Traders ko apne risk tolerance ke hisaab se position sizes ko control karna chahiye aur stop-loss orders ka istemal karke apne losses ko minimize karna chahiye.

- Market Conditions: Market conditions ko analyze karna bhi important hai. Agar overall market trend bullish ya bearish hai, toh horizontal channel trading strategies accordingly adjust ki jani chahiye.

تبصرہ

Расширенный режим Обычный режим