RSI Indicator

RSI Indicator forex mein ek popular technical analysis tool hai. RSI ka matlab hai Relative Strength Index. Yeh indicator momentum ko measure karne ke liye use hota hai. RSI (Relative Strength Index) Indicator ek technical analysis ka indicator hai jo traders aur investors ke liye istemal kiya jata hai. Iska istemal stock market me trend aur momentum ke zareye buy ya sell karne ke liye kiya jata hai. RSI indicator J. Welles Wilder ka develop kiya gaya tha. Iska istemal stock market, forex market, commodities, aur futures market me kiya jata hai.

Working

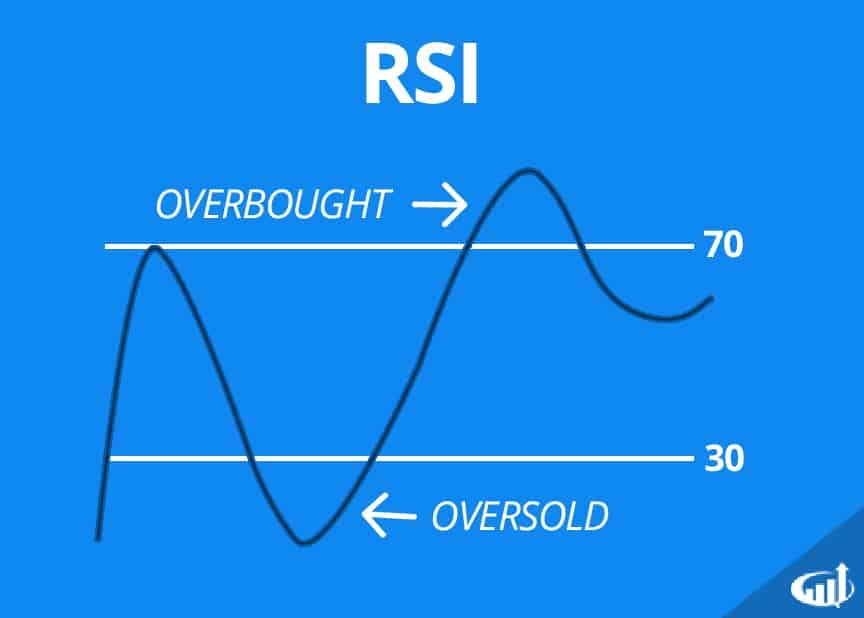

RSI indicator price ki movement ko analyze karta hai aur overbought aur oversold levels identify karta hai. Iske liye, RSI 0 se 100 tak ka range use karta hai. Agar RSI 70 se upar jata hai toh yeh overbought zone mein hota hai aur agar 30 se kam ho jata hai toh oversold zone mein chala jata hai.

Interpretation

Agar RSI overbought zone mein hai toh yeh indicate karta hai ki market mein bahut zyada buyers hain aur price ki correction ki possibility hai. Jabki agar RSI oversold zone mein hai toh yeh indicate karta hai ki market mein bahut zyada sellers hain aur price ki reversal ki possibility hai. RSI indicator forex mein price ki direction aur trend ko identify karne ke liye use hota hai. Isse traders ko buy aur sell ke signals milte hain. Iske alawa, RSI divergence ko bhi detect karta hai aur price ki reversal ki possibility ko indicate karta hai.

Conclusion

RSI indicator forex mein ek important tool hai jo traders ko price ki movement ko analyze karne mein help karta hai. Iske alawa, isse buy aur sell ke signals milte hain aur traders apni trading decisions ko improve kar sakte hain.

تبصرہ

Расширенный режим Обычный режим