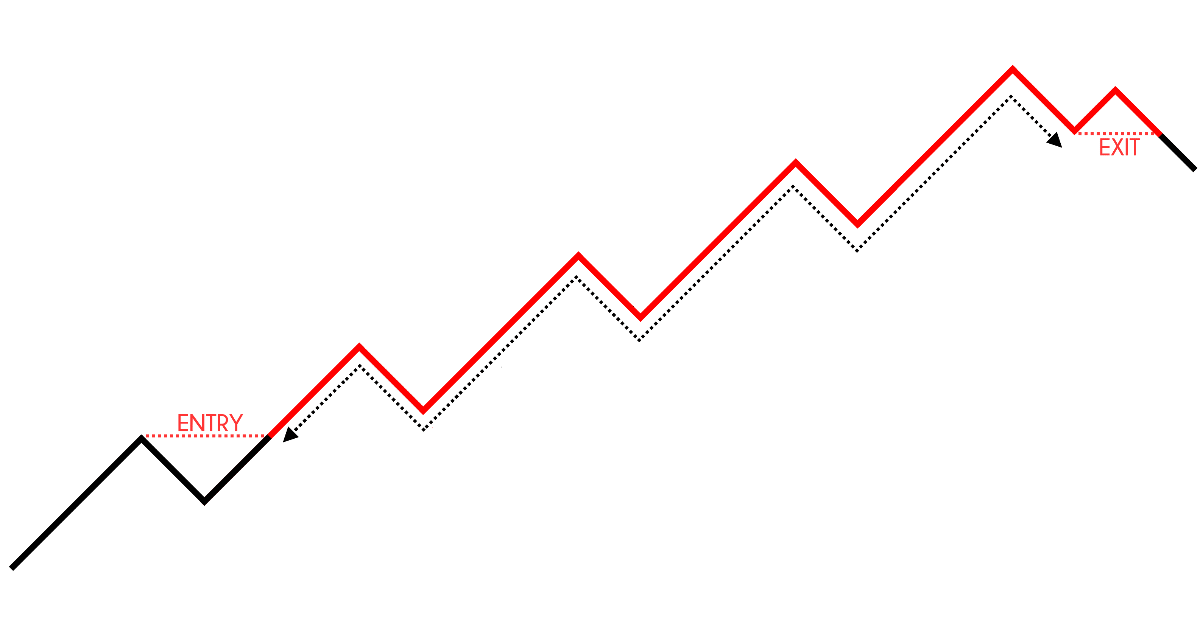

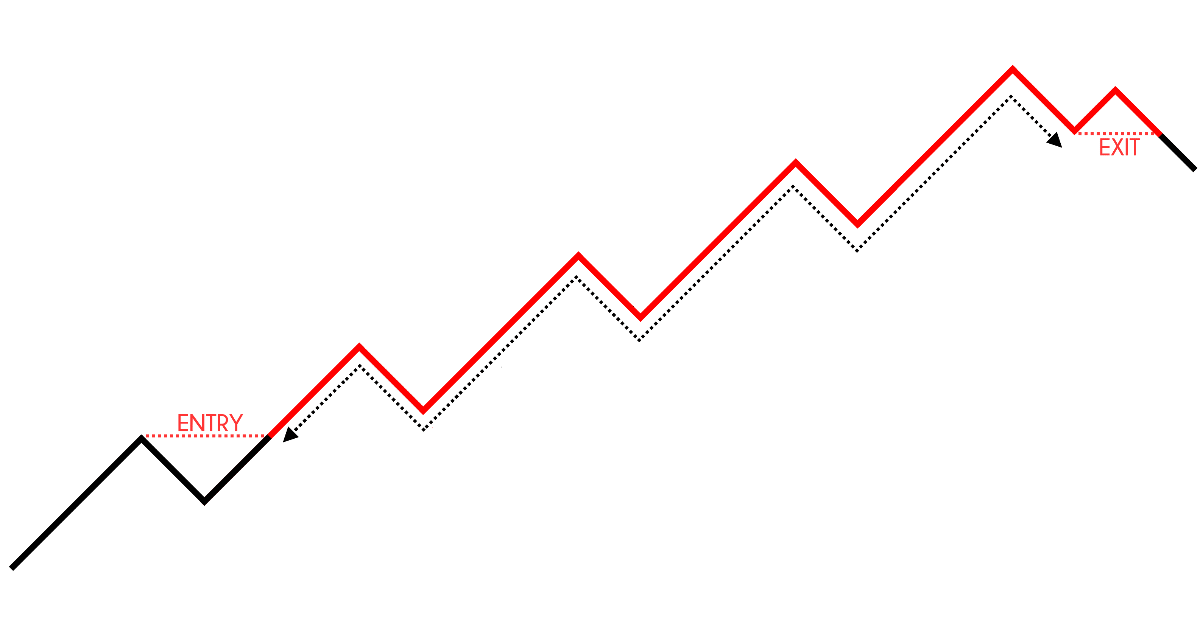

Position trading ek strategic approach hai jis mein traders maqami trends ko capture karke positions ko lambi muddat tak hold karte hain, aam tor par kuch hafton se lekar mahinon ya saalon tak. Ye strategy chhote muddat ke trading styles jaise day trading ya swing trading se mukhtalif hai jo mukhtalif muddat tak ke price movements se faida uthane par mabni hoti hai. Position traders market ko zyada se zyada dekhte hain, unko major trends ko dhundhne ka faida hota hai jo waqt guzarne par intehai faide ka baa'is banti hain.

Core Principles of Position Trading

Position trading ka aik bunyadi usool sabr hai. Is strategy ko istemaal karne wale traders ko lambi muddat ki nazar rakni chahiye aur maqami market fluctuations ko bardasht karne ki salahiyat honi chahiye bina pareshani ya overall strategy se chhat gaye. Is mein izzat karna, mukhtalif zariye se baareek tor par market ko samajhne ki zaroorat hoti hai aur bari tasveer par tawajjo rakhni hoti hai.

Advantages of Position Trading

Position trading ka pehla faida us ke faide ka imkaan hai. Major price movements ko capture karke, position traders ko baray faide ka imkaan hota hai. Ye khaas tor par tab sach hai jab market mein strong aur sath saath ke trends hote hain, jahan lambi muddat tak invest karne se intehai faide hasil ho sakte hain.

Dusra faida position trading ka kam transaction cost hai. Position traders apne positions ko lambi muddat tak hold karte hain, is se active traders ki nisbat kam trades hoti hain. Is se commission expenses aur trading ke dusre fees kam ho jati hain jo ke zyada net returns ke liye contribute karte hain.

Position trading ziada time consuming bhi nahi hoti muqablay ke dusre active trading styles se. Traders ko market ko baray zarrae se nahi dekhna hota aur na hi jaldi fesla karna hota hai, jo unhe doosre hisson mein apni zindagi ya investment strategies par tawajjo dene ki ijazat deta hai. Is wajah se ye position trading masroor logon ke liye bhi munasib hai jo zindagi mein mashgool hain ya jo trading mein relaxed approach ko pasand karte hain.

Long-Term Perspective

Is ke ilawa, position trading lambi muddat ki nazar ko encourage karti hai, jo ke behtar invest karna aur faide hasil karne mein madadgar ho sakti hai. Fundamentals aur major trends par tawajjo di jaati hai jis se traders ko short-term market fluctuations par jaldi react karne se bachaya ja sakta hai. Ye disciplined approach aksar zyada mustaqil aur mustaqim faide hasil karwata hai.

Challenges of Position Trading

Lekin position trading ke sath sath kuch challenges bhi hote hain. Ek badi challenge market volatility hai. Traders ko chhote muddat ke price swings aur market corrections ko bardasht karna hota hai bina lambi muddat ki strategy ko chhod diya jaye. Is ke liye strong emotional discipline ki zaroorat hoti hai aur unhe mukhtalif trends par focus rakhna hota hai.

Is ke ilawa positions ko lambi muddat tak hold karna capital ko tie up karta hai. Traders ko apne capital allocation ko mazbooti se manage karna chahiye taake wo apne funds ko doosre opportunities mein laga sake ya phir positions ke potential drawdowns ko bardasht kar sakein. Is ke liye effective risk management aur capital preservation strategies ki zaroorat hoti hai.

In challenges ke bawajood, bohot saare traders ko position trading mein kheenchav hota hai us ke zyada faide hasil karne aur active trading styles ke muqablay kam time ka izhar karna. Position trading mein kamyabi ke liye, traders ko mukhtalif research aur analysis par mabni saaf strategy develop karni chahiye. Unhe discipline aur sabr bhi maintain karna chahiye aur market conditions ko nazarandaz na karte hue apne positions ko accordingly adjust karna chahiye.

Position Trading as a Strategic Approach

Position trading ek aham strategic approach hai jo traders ke liye bohot se faide lati hai jo sabr, discipline aur lambi muddat ki nazar rakhte hain. Is ke challenges jaise market volatility aur capital management ke bawajood, is ka potential bohot bada hai major trends ko capture karke financial markets mein faide hasil karne ka.

Core Principles of Position Trading

Position trading ka aik bunyadi usool sabr hai. Is strategy ko istemaal karne wale traders ko lambi muddat ki nazar rakni chahiye aur maqami market fluctuations ko bardasht karne ki salahiyat honi chahiye bina pareshani ya overall strategy se chhat gaye. Is mein izzat karna, mukhtalif zariye se baareek tor par market ko samajhne ki zaroorat hoti hai aur bari tasveer par tawajjo rakhni hoti hai.

Advantages of Position Trading

Position trading ka pehla faida us ke faide ka imkaan hai. Major price movements ko capture karke, position traders ko baray faide ka imkaan hota hai. Ye khaas tor par tab sach hai jab market mein strong aur sath saath ke trends hote hain, jahan lambi muddat tak invest karne se intehai faide hasil ho sakte hain.

Dusra faida position trading ka kam transaction cost hai. Position traders apne positions ko lambi muddat tak hold karte hain, is se active traders ki nisbat kam trades hoti hain. Is se commission expenses aur trading ke dusre fees kam ho jati hain jo ke zyada net returns ke liye contribute karte hain.

Position trading ziada time consuming bhi nahi hoti muqablay ke dusre active trading styles se. Traders ko market ko baray zarrae se nahi dekhna hota aur na hi jaldi fesla karna hota hai, jo unhe doosre hisson mein apni zindagi ya investment strategies par tawajjo dene ki ijazat deta hai. Is wajah se ye position trading masroor logon ke liye bhi munasib hai jo zindagi mein mashgool hain ya jo trading mein relaxed approach ko pasand karte hain.

Long-Term Perspective

Is ke ilawa, position trading lambi muddat ki nazar ko encourage karti hai, jo ke behtar invest karna aur faide hasil karne mein madadgar ho sakti hai. Fundamentals aur major trends par tawajjo di jaati hai jis se traders ko short-term market fluctuations par jaldi react karne se bachaya ja sakta hai. Ye disciplined approach aksar zyada mustaqil aur mustaqim faide hasil karwata hai.

Challenges of Position Trading

Lekin position trading ke sath sath kuch challenges bhi hote hain. Ek badi challenge market volatility hai. Traders ko chhote muddat ke price swings aur market corrections ko bardasht karna hota hai bina lambi muddat ki strategy ko chhod diya jaye. Is ke liye strong emotional discipline ki zaroorat hoti hai aur unhe mukhtalif trends par focus rakhna hota hai.

Is ke ilawa positions ko lambi muddat tak hold karna capital ko tie up karta hai. Traders ko apne capital allocation ko mazbooti se manage karna chahiye taake wo apne funds ko doosre opportunities mein laga sake ya phir positions ke potential drawdowns ko bardasht kar sakein. Is ke liye effective risk management aur capital preservation strategies ki zaroorat hoti hai.

In challenges ke bawajood, bohot saare traders ko position trading mein kheenchav hota hai us ke zyada faide hasil karne aur active trading styles ke muqablay kam time ka izhar karna. Position trading mein kamyabi ke liye, traders ko mukhtalif research aur analysis par mabni saaf strategy develop karni chahiye. Unhe discipline aur sabr bhi maintain karna chahiye aur market conditions ko nazarandaz na karte hue apne positions ko accordingly adjust karna chahiye.

Position Trading as a Strategic Approach

Position trading ek aham strategic approach hai jo traders ke liye bohot se faide lati hai jo sabr, discipline aur lambi muddat ki nazar rakhte hain. Is ke challenges jaise market volatility aur capital management ke bawajood, is ka potential bohot bada hai major trends ko capture karke financial markets mein faide hasil karne ka.

تبصرہ

Расширенный режим Обычный режим