Margin Trading Plan

Introduction

Dear Fellows,

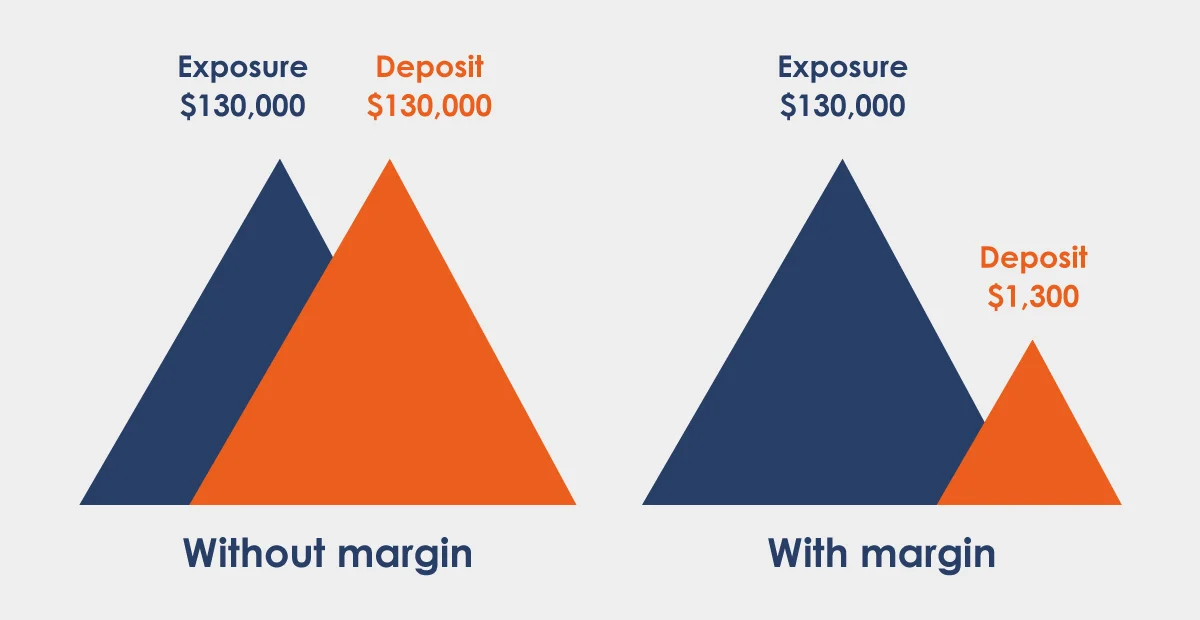

Forex market main hamari investment se position open karny key liay ham payment karty hain. Awar pir hum kabi be etni payment nahi kar sakty hey, es ley ham broker se loan le kar hee position/order open kar sakty hain. Awar agar hamri position/order 100$ ki ho to forex market me 100$ ki payment ki koi ehmeyat nahi hoti jab tak ham broker se apni position key ley loan ko use na karen, 10,000$ ki position open karny key ley 100$ account balance bahot kam hota hay es key ley hamy broker se loan ki zarorat hoti hay esi broker loan ko Margin wo ha jo kay aap ke trades ko open karny main istemaal hota hain. Like agar aap kay pass 400 margin hay to aap 2.0 ke lot sy order laga sakty hain. Aap chahy choti lot lagain ya aik he bari. Total aap aik pair par buy ya sirf sell 2.0 ke lot laga sakty hain. Pir ye k Margin ka directly ta'aluk leverage sy hota hain. Jitne leverage zayda hoti hay itna margin trades ko open karny ma kam use hota hay. So leverage ye kay aapko kitna loan mil sakta hay aur margin ye hota hay kay aap kitne lot aur laga sakty hain. Awar Instaforex bonus account main 1:50 leverage milte hay aapko aur phir margin us k baad Trading account me margin ka advantage broker ki taraf se dia jata hay ham apni asani key ley es ko loan be keh sakty hey, es margin (loan) ko ham trading me use kar sakty hey aur es margin key help se hamy ye advantage mil jata hay key little amount se be trading karna hamary ley easy ho jata hain. But agar trading me margin broker na dety to kia hota? trading me agar margin na hota to forex me hamesha rich traders hi big investment se trading karty aur profit earn karny ki koshish karty, margin ki waja se forex business ko har koi join kar sakta hay aur 1$ se be trading start kar skata hain.

Implementation

Fellows,

Essko kaisay implement kry to forex mai hamy margin rahk ky kam karna chahiay. Awar forex aik online business hain hum is mai part time be kam kar sakty hain hum is mai full time be kam kar sakty hain hum is mai kam kar k ache earning hasial kar sakty hain forex aik world wide business hain hum is mai bager pasiao ky account bana kar be kam kar sakty hain forex aik international business hain hum is mai agar bager learning ky kam kary gy to hamy loss ho jy ga forex mai hum bager pasiao ky account bana krar be kam kar sakty hain. acha bonus earn kar k Forex trading main trader ko trading kay liye leverage ka tool dia jata hay jo kay trader ko kam investment say ziada earning ki facility deta hay. ager trader ka balance kam ho to wo market main kabi bhi trading nahi ker sakta jab tak kay wo us trade kay liye utna margin ya balance nahi deposit kerta. to is kay liye broker hamen margin trading allow kerta hay. is main ager 10000 dollar ki trade ho gi to hamen apni leverage ki percentage kay mutabiq thori amount margin kay liye deni hoti hay jo kay trade close honay chahiay.

Conclusion

Fellows,

Ess k sath sath forex aik out off class business hain hum is mai margin trading be kar sakty hain hum is mai part time be trading kar sakty hain hum is mai full time be trading kar sakty hain hum is mai kam kar ky ache earning hasial kar sakty hain or apne zarorto ko pura kar sakty hain forex aik asa business hain jo hamy learning ky sat earning be deta hain hum is mai apne marze sy time table bana kar kam kar sakty hain hum is mai part time be trading kar sakty hain hum is mai full time be trading kar saky hain forex trading students or house main margin trading main ap apny account ko save rakh kar trdaing karty hain jis main ap ki trading main apka ccount secure rahta hai chahye wo small he q na ho or margin main apko jitni maount milti hai wo broker ki traf se apko milti hai k ap os had tak invest kar skty hain q k wqo apki apni invest nahi hoti hai broker ny apko help kiya hota hai es liye aghr ap apni trading karen tu ap ko margion k hisab se invest krna chahye ta k loss ki bad apko loss cover karny ka option bhi ho or ap os main acha profit bhi eran kar skaen or ye tab hota hain jab ap fully ready ho.

Thanks

Introduction

Dear Fellows,

Forex market main hamari investment se position open karny key liay ham payment karty hain. Awar pir hum kabi be etni payment nahi kar sakty hey, es ley ham broker se loan le kar hee position/order open kar sakty hain. Awar agar hamri position/order 100$ ki ho to forex market me 100$ ki payment ki koi ehmeyat nahi hoti jab tak ham broker se apni position key ley loan ko use na karen, 10,000$ ki position open karny key ley 100$ account balance bahot kam hota hay es key ley hamy broker se loan ki zarorat hoti hay esi broker loan ko Margin wo ha jo kay aap ke trades ko open karny main istemaal hota hain. Like agar aap kay pass 400 margin hay to aap 2.0 ke lot sy order laga sakty hain. Aap chahy choti lot lagain ya aik he bari. Total aap aik pair par buy ya sirf sell 2.0 ke lot laga sakty hain. Pir ye k Margin ka directly ta'aluk leverage sy hota hain. Jitne leverage zayda hoti hay itna margin trades ko open karny ma kam use hota hay. So leverage ye kay aapko kitna loan mil sakta hay aur margin ye hota hay kay aap kitne lot aur laga sakty hain. Awar Instaforex bonus account main 1:50 leverage milte hay aapko aur phir margin us k baad Trading account me margin ka advantage broker ki taraf se dia jata hay ham apni asani key ley es ko loan be keh sakty hey, es margin (loan) ko ham trading me use kar sakty hey aur es margin key help se hamy ye advantage mil jata hay key little amount se be trading karna hamary ley easy ho jata hain. But agar trading me margin broker na dety to kia hota? trading me agar margin na hota to forex me hamesha rich traders hi big investment se trading karty aur profit earn karny ki koshish karty, margin ki waja se forex business ko har koi join kar sakta hay aur 1$ se be trading start kar skata hain.

Implementation

Fellows,

Essko kaisay implement kry to forex mai hamy margin rahk ky kam karna chahiay. Awar forex aik online business hain hum is mai part time be kam kar sakty hain hum is mai full time be kam kar sakty hain hum is mai kam kar k ache earning hasial kar sakty hain forex aik world wide business hain hum is mai bager pasiao ky account bana kar be kam kar sakty hain forex aik international business hain hum is mai agar bager learning ky kam kary gy to hamy loss ho jy ga forex mai hum bager pasiao ky account bana krar be kam kar sakty hain. acha bonus earn kar k Forex trading main trader ko trading kay liye leverage ka tool dia jata hay jo kay trader ko kam investment say ziada earning ki facility deta hay. ager trader ka balance kam ho to wo market main kabi bhi trading nahi ker sakta jab tak kay wo us trade kay liye utna margin ya balance nahi deposit kerta. to is kay liye broker hamen margin trading allow kerta hay. is main ager 10000 dollar ki trade ho gi to hamen apni leverage ki percentage kay mutabiq thori amount margin kay liye deni hoti hay jo kay trade close honay chahiay.

Conclusion

Fellows,

Ess k sath sath forex aik out off class business hain hum is mai margin trading be kar sakty hain hum is mai part time be trading kar sakty hain hum is mai full time be trading kar sakty hain hum is mai kam kar ky ache earning hasial kar sakty hain or apne zarorto ko pura kar sakty hain forex aik asa business hain jo hamy learning ky sat earning be deta hain hum is mai apne marze sy time table bana kar kam kar sakty hain hum is mai part time be trading kar sakty hain hum is mai full time be trading kar saky hain forex trading students or house main margin trading main ap apny account ko save rakh kar trdaing karty hain jis main ap ki trading main apka ccount secure rahta hai chahye wo small he q na ho or margin main apko jitni maount milti hai wo broker ki traf se apko milti hai k ap os had tak invest kar skty hain q k wqo apki apni invest nahi hoti hai broker ny apko help kiya hota hai es liye aghr ap apni trading karen tu ap ko margion k hisab se invest krna chahye ta k loss ki bad apko loss cover karny ka option bhi ho or ap os main acha profit bhi eran kar skaen or ye tab hota hain jab ap fully ready ho.

Thanks

تبصرہ

Расширенный режим Обычный режим