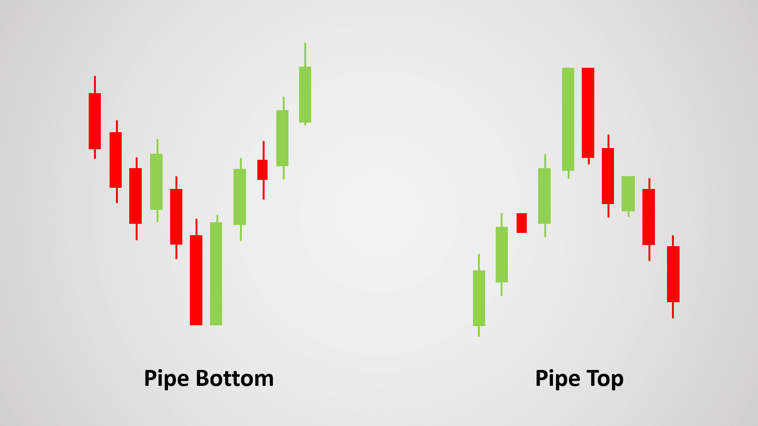

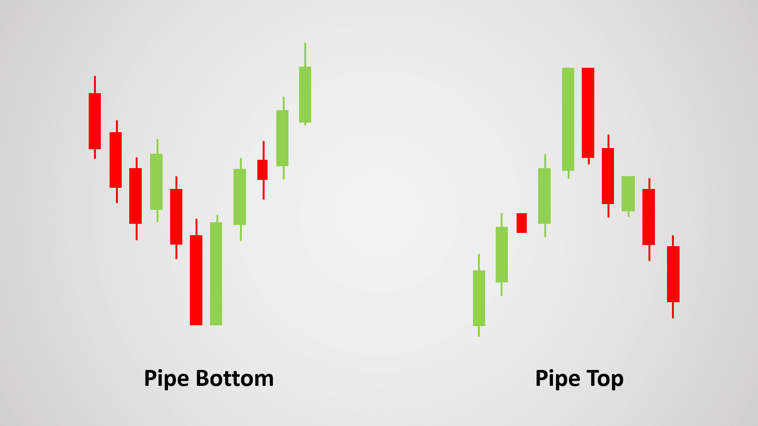

Pipe Top ya Pipe Bottom pattern ek technical analysis pattern hai jo traders istemal karte hain taake market mein possible reversal points ko identify kar sakein. Ye pattern apne shape ke mutabiq pipe jaisi hoti hai aur ye aam tor par price charts mein dekhi jati hai mukhtalif financial markets mein, jaise ke stocks, forex, aur commodities. Pipe Top ya Pipe Bottom pattern ke characteristics, formation, aur implications ko samajhna traders ko unke trading strategies ke bare mein suchit faislay karne mein madad karta hai.

Characteristics of Pipe Top or Pipe Bottom Pattern

Pipe Top pattern aam tor par ek uptrend ke akhir mein hota hai, jo ke potential reversal ko downtrend ki taraf point karta hai. Isay ek series mein higher highs aur higher lows ka khaaka milta hai, jo ke aakhir mein aik final high ko create karta hai jo ke peechle highs se zyada nahi hota. Isay horizontal ya thora sa downward-sloping resistance level banata hai, jo ke pipe ki shape banata hai.

Mukabil, Pipe Bottom pattern ek downtrend ke akhir mein hota hai, jo ke potential reversal ko uptrend ki taraf point karta hai. Isay lower lows aur lower highs ki series se pehchana jata hai, jo ke aik final low ko create karta hai jo ke peechle lows se zyada nahi hota. Isay horizontal ya thora sa upward-sloping support level banata hai, jo ke pipe ki shape banata hai.

Formation of Pipe Top or Pipe Bottom Pattern

Characteristics of Pipe Top or Pipe Bottom Pattern

Pipe Top pattern aam tor par ek uptrend ke akhir mein hota hai, jo ke potential reversal ko downtrend ki taraf point karta hai. Isay ek series mein higher highs aur higher lows ka khaaka milta hai, jo ke aakhir mein aik final high ko create karta hai jo ke peechle highs se zyada nahi hota. Isay horizontal ya thora sa downward-sloping resistance level banata hai, jo ke pipe ki shape banata hai.

Mukabil, Pipe Bottom pattern ek downtrend ke akhir mein hota hai, jo ke potential reversal ko uptrend ki taraf point karta hai. Isay lower lows aur lower highs ki series se pehchana jata hai, jo ke aik final low ko create karta hai jo ke peechle lows se zyada nahi hota. Isay horizontal ya thora sa upward-sloping support level banata hai, jo ke pipe ki shape banata hai.

Formation of Pipe Top or Pipe Bottom Pattern

- Uptrend Pipe Top: Ek uptrend mein, prices nihayat consistent tor par higher highs aur higher lows banate hain. Traders is pattern ko observe karte hain jab tak aik final high tak nahi pohanchte jo ke peechle highs ko zyada nahi karta. Isay resistance level banata hai, jo ke Pipe Top pattern ko create karta hai.

- Downtrend Pipe Bottom: Ek downtrend mein, prices nihayat consistent tor par lower lows aur lower highs banate hain. Traders is pattern ko observe karte hain jab tak aik final low tak nahi pohanchte jo ke peechle lows ko zyada nahi karta. Isay support level banata hai, jo ke Pipe Bottom pattern ko create karta hai.

- Reversal Signal: Pipe Top ya Pipe Bottom pattern ek possible reversal signal ke tor par istemal hota hai. Traders is patterns ko interpret karte hain ke current trend exhausted hone ki nishani hai, jo ke opposite direction mein reversal ko indicate karta hai.

- Confirmation: Pipe Top ya Pipe Bottom pattern ki validity ko confirm karne ke liye, traders aksar additional technical indicators ya price action signals ko dekhte hain. Ye divergences in momentum oscillators, candlestick patterns, ya volume analysis shamil ho sakti hain.

- Entry aur Exit Points: Traders Pipe Top ya Pipe Bottom pattern ko apne trades ke liye entry aur exit points establish karne ke liye istemal kar sakte hain. Misal ke tor par, aik trader jo Pipe Top pattern ko observe kar raha hai woh resistance level ke qareeb aik short position enter kar sakta hai, ek downtrend ko expect karte hue. Mukabil, aik trader jo Pipe Bottom pattern ko observe kar raha hai woh support level ke qareeb aik long position enter kar sakta hai, ek uptrend ko expect karte hue.

- Risk Management: Jaise ke kisi bhi trading strategy mein, risk management Pipe Top ya Pipe Bottom pattern par trading karte waqt nihayat zaroori hai. Traders ko stop-loss orders set karna chahiye takay potential losses ko limit kiya ja sake aur proper position sizing ka dhyaan rakhna chahiye takay risk ko effectively manage kiya ja sake.

- Fawaid:

- Clear reversal signal market mein possible turning points ko identify karne ke liye.

- Di gai technical analysis tools ke saath combine kiya ja sakta hai confirmation ke liye.

- Defined entry aur exit points ko trading strategies ke liye provide karta hai.

- Nuqsanat:

- False signals aksar aate hain, agar sahi tarah se confirm nahi kiya gaya.

- Isay identify aur interpret karne ke liye skill aur experience zaroori hai.

- Market conditions aur volatility pattern ki reliability par asar dal sakti hain.

تبصرہ

Расширенный режим Обычный режим