1. Introduction:

Forex trading, ya foreign exchange trading, ek global aur dynamic market hai jahan currencies ke exchange par transactions kiye jate hain. Is market mein traders currencies ke pairs ko khareedte hain aur bechte hain, umooman profit kamane ke liye. Technical analysis, jise chart analysis bhi kaha jata hai, ek aham hissa hai forex trading ka. Is mein traders past price movements ko study karte hain taake future ke movements ka andaza lagaya ja sake.

2. Triangle Chart Patterns:

Triangle chart patterns, jaise ke naam se zahir hai, graf mein triangles ki shakal mein dikhayi dete hain. Ye patterns market mein consolidation ka dor dikhate hain jab prices ek darwaze mein band hote hain aur phir ek disha mein tawajjo jama hoti hai. Triangle patterns mein typically price ki highs aur lows ek line mein connect ki jati hain, jise trend lines kaha jata hai. In patterns ka sahi tajziya kar ke, traders market ke future movements ka andaza lagate hain.

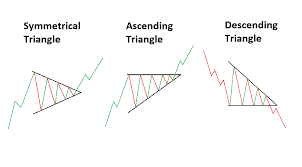

3. Types of Triangle Chart Patterns:

Triangle chart patterns do mukhtalif qisam ke hote hain: symmetrical triangles aur asymmetrical (ascending aur descending) triangles. Symmetrical triangles mein, trend lines ek dosre ke qareeb hoti hain aur graph mein price ko chadhne aur ghirne ki tarah mehsoos hota hai. Ascending triangles mein, ek trend line horizontal hoti hai jabke doosri trend line uptrend mein hoti hai. Descending triangles mein, ek trend line horizontal hoti hai aur doosri downtrend mein hoti hai. Har qisam ke triangle pattern ke saath trading karne ke liye alag strategies hote hain.

4. Identifying Triangle Chart Patterns:

Triangle chart patterns ko pehchanna mahatva hai taake traders unka faida utha sakein. Inko pehchanne ka aasan tareeqa hai price ki highs aur lows ko connect karke triangles banane ka. Agar price trend lines ke darmiyan ghoom rahi hai aur volume decrease ho raha hai, to ye ek triangle pattern ki alamat hai. Is tareeqe se, traders ko market ke movements ko samajhne mein madad milti hai aur woh behtar trading decisions le sakte hain.

5. Trading Strategies with Triangle Chart Patterns:

Triangle chart patterns ke saath trading karne ke liye kuch mukhtalif strategies hain. Ek strategy ye hai ke traders breakout ke baad entry karte hain, jab price trend lines ko todati hai aur ek disha mein jaati hai. Breakout ke baad entry karke, traders ko market ki direction ka andaza lagane mein madad milti hai aur woh potential profits kamane ke liye tayari kar sakte hain. Doosri strategy ye hai ke traders support aur resistance levels par entry aur exit points tay karte hain, taake unko jald hi profits mil sakein.

6. Risks and Challenges:

Triangle chart patterns ke istemal ke bawajood, trading mein khatraat aur challenges hote hain. Kabhi kabhi false breakouts ya fakeouts ho sakte hain, jisme traders ko nuqsan ho sakta hai. False breakouts mein, price briefly trend lines ko todati hai lekin phir wapas reverse ho jati hai, jisse traders nuqsan uthate hain. Isi tarah, market volatility aur unexpected events bhi trading ko asaan nahi bana sakte. Is liye, traders ko hamesha cautious rehna chahiye aur apne risk management ko strong banaye rakhna chahiye.

7. Importance of Risk Management:

Risk management trading mein bohot ahem hai, khaaskar jab triangle chart patterns ke sath trading ki ja rahi ho. Traders ko apne positions ko monitor karna chahiye aur stop-loss orders ka istemal karna chahiye taake nuqsanat ko minimize kiya ja sake. Stop-loss orders lagane se, traders apne nuqsanat ko control mein rakh sakte hain aur emotional trading se bach sakte hain. Isi tarah, position sizes ko bhi control mein rakhna ahem hai taake excessive losses se bacha ja sake.

8. Conclusion:

Triangle chart patterns forex trading mein ahem tajziya ki ek zaroori hissa hain. Inko pehchanne aur samajhne se traders market ke mukhtalif movements ko samajh sakte hain aur munafa kamane ke liye behtar faislay kar sakte hain. Lekin, sahi tajziya aur risk management ke baghair, ye patterns trading mein nuqsanat bhi laa sakte hain. Is liye, traders ko in patterns ko samajh kar, sahi strategies ka istemal kar ke, mehsoos ki gayi sari maloomat ka istemal karke, cautious aur informed trading karna chahiye. Triangle chart patterns ke saath trading karne se pehle, traders ko apne risk tolerance aur trading goals ko samajhna chahiye taake woh behtar trading decisions le sakein.

Forex trading, ya foreign exchange trading, ek global aur dynamic market hai jahan currencies ke exchange par transactions kiye jate hain. Is market mein traders currencies ke pairs ko khareedte hain aur bechte hain, umooman profit kamane ke liye. Technical analysis, jise chart analysis bhi kaha jata hai, ek aham hissa hai forex trading ka. Is mein traders past price movements ko study karte hain taake future ke movements ka andaza lagaya ja sake.

2. Triangle Chart Patterns:

Triangle chart patterns, jaise ke naam se zahir hai, graf mein triangles ki shakal mein dikhayi dete hain. Ye patterns market mein consolidation ka dor dikhate hain jab prices ek darwaze mein band hote hain aur phir ek disha mein tawajjo jama hoti hai. Triangle patterns mein typically price ki highs aur lows ek line mein connect ki jati hain, jise trend lines kaha jata hai. In patterns ka sahi tajziya kar ke, traders market ke future movements ka andaza lagate hain.

3. Types of Triangle Chart Patterns:

Triangle chart patterns do mukhtalif qisam ke hote hain: symmetrical triangles aur asymmetrical (ascending aur descending) triangles. Symmetrical triangles mein, trend lines ek dosre ke qareeb hoti hain aur graph mein price ko chadhne aur ghirne ki tarah mehsoos hota hai. Ascending triangles mein, ek trend line horizontal hoti hai jabke doosri trend line uptrend mein hoti hai. Descending triangles mein, ek trend line horizontal hoti hai aur doosri downtrend mein hoti hai. Har qisam ke triangle pattern ke saath trading karne ke liye alag strategies hote hain.

4. Identifying Triangle Chart Patterns:

Triangle chart patterns ko pehchanna mahatva hai taake traders unka faida utha sakein. Inko pehchanne ka aasan tareeqa hai price ki highs aur lows ko connect karke triangles banane ka. Agar price trend lines ke darmiyan ghoom rahi hai aur volume decrease ho raha hai, to ye ek triangle pattern ki alamat hai. Is tareeqe se, traders ko market ke movements ko samajhne mein madad milti hai aur woh behtar trading decisions le sakte hain.

5. Trading Strategies with Triangle Chart Patterns:

Triangle chart patterns ke saath trading karne ke liye kuch mukhtalif strategies hain. Ek strategy ye hai ke traders breakout ke baad entry karte hain, jab price trend lines ko todati hai aur ek disha mein jaati hai. Breakout ke baad entry karke, traders ko market ki direction ka andaza lagane mein madad milti hai aur woh potential profits kamane ke liye tayari kar sakte hain. Doosri strategy ye hai ke traders support aur resistance levels par entry aur exit points tay karte hain, taake unko jald hi profits mil sakein.

6. Risks and Challenges:

Triangle chart patterns ke istemal ke bawajood, trading mein khatraat aur challenges hote hain. Kabhi kabhi false breakouts ya fakeouts ho sakte hain, jisme traders ko nuqsan ho sakta hai. False breakouts mein, price briefly trend lines ko todati hai lekin phir wapas reverse ho jati hai, jisse traders nuqsan uthate hain. Isi tarah, market volatility aur unexpected events bhi trading ko asaan nahi bana sakte. Is liye, traders ko hamesha cautious rehna chahiye aur apne risk management ko strong banaye rakhna chahiye.

7. Importance of Risk Management:

Risk management trading mein bohot ahem hai, khaaskar jab triangle chart patterns ke sath trading ki ja rahi ho. Traders ko apne positions ko monitor karna chahiye aur stop-loss orders ka istemal karna chahiye taake nuqsanat ko minimize kiya ja sake. Stop-loss orders lagane se, traders apne nuqsanat ko control mein rakh sakte hain aur emotional trading se bach sakte hain. Isi tarah, position sizes ko bhi control mein rakhna ahem hai taake excessive losses se bacha ja sake.

8. Conclusion:

Triangle chart patterns forex trading mein ahem tajziya ki ek zaroori hissa hain. Inko pehchanne aur samajhne se traders market ke mukhtalif movements ko samajh sakte hain aur munafa kamane ke liye behtar faislay kar sakte hain. Lekin, sahi tajziya aur risk management ke baghair, ye patterns trading mein nuqsanat bhi laa sakte hain. Is liye, traders ko in patterns ko samajh kar, sahi strategies ka istemal kar ke, mehsoos ki gayi sari maloomat ka istemal karke, cautious aur informed trading karna chahiye. Triangle chart patterns ke saath trading karne se pehle, traders ko apne risk tolerance aur trading goals ko samajhna chahiye taake woh behtar trading decisions le sakein.

تبصرہ

Расширенный режим Обычный режим