Forex trading ek shauq hai jo bahut se logon ko apne apne financial goals tak pohanchne mein madad deta hai. Lekin, yeh bhi ek challenging kaam hai jismein traders ko market ke trends ko samajhna aur analyse karna hota hai. Ek tareeqa jo traders istemal karte hain market ki movement ko predict karne ke liye, woh hai candlestick patterns ka istemal karna. Aaj hum baat karenge "Tower Top" candlestick pattern ke bare mein aur iske istemal ke tareeqon ke bare mein.

1. Tower Top Candlestick Pattern Ki Tareef

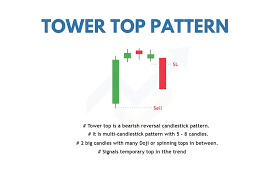

Tower Top candlestick pattern ek technical analysis tool hai jo traders ko market mein hone wale reversals ko detect karne mein madad deta hai. Yeh pattern typically bullish trend ke ant mein paya jata hai aur future mein bearish trend ki possibility ko signal karta hai.

Tower Top pattern ka pehla candle bullish hota hai, jo market mein strong buying activity ko indicate karta hai. Dusra candle, jo ki chhoti body aur lambi upper shadow ke saath hota hai, price mein ek sudden decline ko dikhata hai.

2. Tower Top Candlestick Pattern Ka Hissay

Tower Top pattern mein do important candlesticks shamil hote hain: pehla candle bullish hota hai, jo market mein strong buying activity ko indicate karta hai. Dusra candle, jo ki chhoti body aur lambi upper shadow ke saath hota hai, price mein ek sudden decline ko dikhata hai.

3. Tower Top Candlestick Pattern Ki Pehchan

Tower Top pattern ki pehchan ke liye traders ko khaas tor par do cheezon par dhyan dena hota hai: pehli, pehle candle ka size lamba hona chahiye aur bullish trend ko reflect karna chahiye. Dusra, doosre candle ka size chhota hona chahiye aur uski upper shadow lambi honi chahiye.Tower Top pattern ki pehchan ke liye traders ko khaas tor par do cheezon par dhyan dena hota hai: pehli, pehle candle ka size lamba hona chahiye aur bullish trend ko reflect karna chahiye. Dusra, doosre candle ka size chhota hona chahiye aur uski upper shadow lambi honi chahiye.

4. Tower Top Candlestick Pattern Ka Matlab

Tower Top pattern ka matlab hota hai ke market mein bullish momentum khatam ho raha hai aur bearish trend ki shuruaat hone wali hai. Yeh ek potential reversal signal hai jise traders istemal karke apne trading strategies ko adjust kar sakte hain.Tower Top pattern ka matlab hota hai ke market mein bullish momentum khatam ho raha hai aur bearish trend ki shuruaat hone wali hai. Yeh ek potential reversal signal hai jise traders istemal karke apne trading strategies ko adjust kar sakte hain.

5. Tower Top Candlestick Pattern Ka Istemal

Tower Top pattern ka istemal karne ke liye traders ko cautious rehna chahiye aur is pattern ki confirmation ke liye doosre technical indicators ka istemal karna chahiye. Iske alawa, risk management ka dhyan rakhna bhi zaroori hai taake nuksan se bacha ja sake.

Tower Top pattern ka istemal karne ke liye traders ko cautious rehna chahiye aur is pattern ki confirmation ke liye doosre technical indicators ka istemal karna chahiye. Iske alawa, risk management ka dhyan rakhna bhi zaroori hai taake nuksan se bacha ja sake.

6. Tower Top Candlestick Pattern Ki Mehdoodiyyat

Tower Top pattern ki mehdoodiyyat yeh hai ke yeh har samay 100% accurate nahin hota. Market mein kai factors hote hain jo price movement ko influence karte hain, isliye ek hi pattern par depend karna wise decision nahin hota.Tower Top pattern ki mehdoodiyyat yeh hai ke yeh har samay 100% accurate nahin hota. Market mein kai factors hote hain jo price movement ko influence karte hain, isliye ek hi pattern par depend karna wise decision nahin hota.

7. Tower Top Candlestick Pattern Ka Istemal Karna Seekhein

Tower Top candlestick pattern ka istemal karna seekhna traders ke liye zaroori hai taake woh market ke trends ko samajh sake aur apne trading strategies ko improve kar sakein. Practice aur research ke zariye traders is pattern ko sahi tareeqe se samajh sakte hain.

Tower Top candlestick pattern ka istemal karna seekhna traders ke liye zaroori hai taake woh market ke trends ko samajh sake aur apne trading strategies ko improve kar sakein. Practice aur research ke zariye traders is pattern ko sahi tareeqe se samajh sakte hain.

8. Tower Top Candlestick Pattern Aur Trading Psychology

Tower Top pattern ke istemal se traders ko market ke psychological aspects ko samajhne mein madad milti hai. Yeh pattern unko market sentiment ko samajhne mein madad karta hai aur unhe sahi time par trade karne mein madad deta hai.Tower Top pattern ke istemal se traders ko market ke psychological aspects ko samajhne mein madad milti hai. Yeh pattern unko market sentiment ko samajhne mein madad karta hai aur unhe sahi time par trade karne mein madad deta hai.

9. Conclusion

Tower Top candlestick pattern forex trading mein ek ahem tool hai jo traders ko market ke reversals ko detect karne mein madad deta hai. Lekin, is pattern ka istemal karne se pehle traders ko market ki overall conditions ko samajhna zaroori hai aur doosre technical indicators ka istemal karna chahiye. Iske alawa, risk management ko bhi prioritize karna zaroori hai taake nuksan se bacha ja sake. Overall, Tower Top pattern ka istemal karke traders apni trading strategies ko refine kar sakte hain aur market ke movements ko sahi tareeqe se samajh sakte hain.

1. Tower Top Candlestick Pattern Ki Tareef

Tower Top candlestick pattern ek technical analysis tool hai jo traders ko market mein hone wale reversals ko detect karne mein madad deta hai. Yeh pattern typically bullish trend ke ant mein paya jata hai aur future mein bearish trend ki possibility ko signal karta hai.

Tower Top pattern ka pehla candle bullish hota hai, jo market mein strong buying activity ko indicate karta hai. Dusra candle, jo ki chhoti body aur lambi upper shadow ke saath hota hai, price mein ek sudden decline ko dikhata hai.

2. Tower Top Candlestick Pattern Ka Hissay

Tower Top pattern mein do important candlesticks shamil hote hain: pehla candle bullish hota hai, jo market mein strong buying activity ko indicate karta hai. Dusra candle, jo ki chhoti body aur lambi upper shadow ke saath hota hai, price mein ek sudden decline ko dikhata hai.

3. Tower Top Candlestick Pattern Ki Pehchan

Tower Top pattern ki pehchan ke liye traders ko khaas tor par do cheezon par dhyan dena hota hai: pehli, pehle candle ka size lamba hona chahiye aur bullish trend ko reflect karna chahiye. Dusra, doosre candle ka size chhota hona chahiye aur uski upper shadow lambi honi chahiye.Tower Top pattern ki pehchan ke liye traders ko khaas tor par do cheezon par dhyan dena hota hai: pehli, pehle candle ka size lamba hona chahiye aur bullish trend ko reflect karna chahiye. Dusra, doosre candle ka size chhota hona chahiye aur uski upper shadow lambi honi chahiye.

4. Tower Top Candlestick Pattern Ka Matlab

Tower Top pattern ka matlab hota hai ke market mein bullish momentum khatam ho raha hai aur bearish trend ki shuruaat hone wali hai. Yeh ek potential reversal signal hai jise traders istemal karke apne trading strategies ko adjust kar sakte hain.Tower Top pattern ka matlab hota hai ke market mein bullish momentum khatam ho raha hai aur bearish trend ki shuruaat hone wali hai. Yeh ek potential reversal signal hai jise traders istemal karke apne trading strategies ko adjust kar sakte hain.

5. Tower Top Candlestick Pattern Ka Istemal

Tower Top pattern ka istemal karne ke liye traders ko cautious rehna chahiye aur is pattern ki confirmation ke liye doosre technical indicators ka istemal karna chahiye. Iske alawa, risk management ka dhyan rakhna bhi zaroori hai taake nuksan se bacha ja sake.

Tower Top pattern ka istemal karne ke liye traders ko cautious rehna chahiye aur is pattern ki confirmation ke liye doosre technical indicators ka istemal karna chahiye. Iske alawa, risk management ka dhyan rakhna bhi zaroori hai taake nuksan se bacha ja sake.

6. Tower Top Candlestick Pattern Ki Mehdoodiyyat

Tower Top pattern ki mehdoodiyyat yeh hai ke yeh har samay 100% accurate nahin hota. Market mein kai factors hote hain jo price movement ko influence karte hain, isliye ek hi pattern par depend karna wise decision nahin hota.Tower Top pattern ki mehdoodiyyat yeh hai ke yeh har samay 100% accurate nahin hota. Market mein kai factors hote hain jo price movement ko influence karte hain, isliye ek hi pattern par depend karna wise decision nahin hota.

7. Tower Top Candlestick Pattern Ka Istemal Karna Seekhein

Tower Top candlestick pattern ka istemal karna seekhna traders ke liye zaroori hai taake woh market ke trends ko samajh sake aur apne trading strategies ko improve kar sakein. Practice aur research ke zariye traders is pattern ko sahi tareeqe se samajh sakte hain.

Tower Top candlestick pattern ka istemal karna seekhna traders ke liye zaroori hai taake woh market ke trends ko samajh sake aur apne trading strategies ko improve kar sakein. Practice aur research ke zariye traders is pattern ko sahi tareeqe se samajh sakte hain.

8. Tower Top Candlestick Pattern Aur Trading Psychology

Tower Top pattern ke istemal se traders ko market ke psychological aspects ko samajhne mein madad milti hai. Yeh pattern unko market sentiment ko samajhne mein madad karta hai aur unhe sahi time par trade karne mein madad deta hai.Tower Top pattern ke istemal se traders ko market ke psychological aspects ko samajhne mein madad milti hai. Yeh pattern unko market sentiment ko samajhne mein madad karta hai aur unhe sahi time par trade karne mein madad deta hai.

9. Conclusion

Tower Top candlestick pattern forex trading mein ek ahem tool hai jo traders ko market ke reversals ko detect karne mein madad deta hai. Lekin, is pattern ka istemal karne se pehle traders ko market ki overall conditions ko samajhna zaroori hai aur doosre technical indicators ka istemal karna chahiye. Iske alawa, risk management ko bhi prioritize karna zaroori hai taake nuksan se bacha ja sake. Overall, Tower Top pattern ka istemal karke traders apni trading strategies ko refine kar sakte hain aur market ke movements ko sahi tareeqe se samajh sakte hain.

تبصرہ

Расширенный режим Обычный режим