Ascending Triangle Pattern ek popular technical analysis tool hai jo traders ko market ke potential bullish reversals ya continuations ko identify karne mein madad karta hai. Yeh pattern jab market mein dekha jata hai, toh traders ko ek upward price movement ki sambhavna hoti hai. Neeche Ascending Triangle Pattern ke baare mein tafseelat roman Urdu mein di gayi hai:

Ascending Triangle Pattern Kya Hai?

Ascending Triangle Pattern ek continuation pattern hai jo uptrend ke doran dekha jata hai.

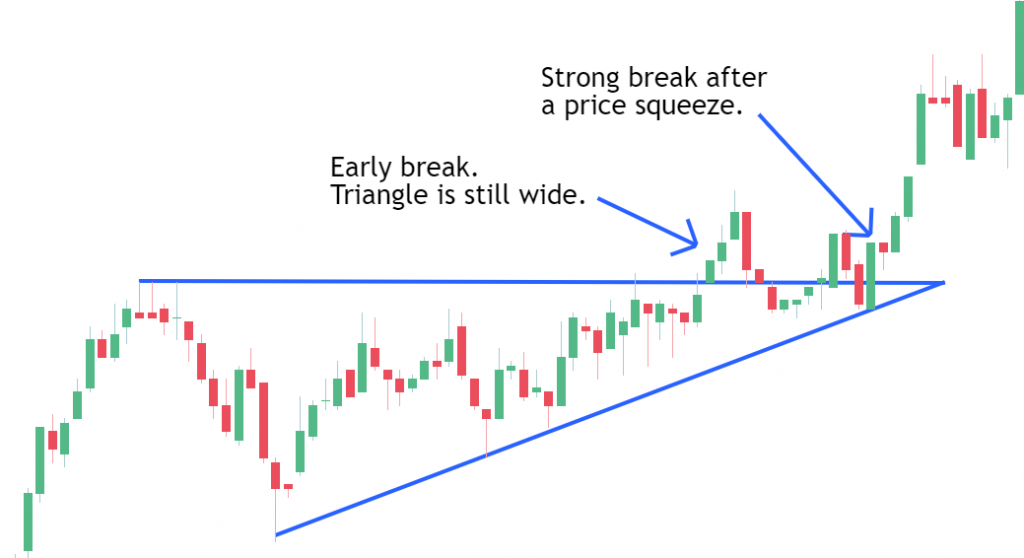

Is pattern mein ek horizontal resistance line aur ek rising trend line hoti hai jo higher lows ko connect karti hai.

Resistance line horizontal hoti hai, jabki support line upward sloping hoti hai.

Ascending Triangle Pattern Ki Tafseel:

Jab market mein ascending triangle pattern dekha jata hai, toh yeh ek bullish continuation ya reversal ka indication hota hai.

Is pattern mein price resistance line se baar-baar takra kar wapas jaata hai, lekin higher lows banata hai.

Is pattern mein volume dheere dheere kam ho jata hai, jo ek breakout ki sambhavna ko darust karta hai.

Ascending Triangle Pattern Ka Istemal:

Ascending Triangle Pattern ka istemal traders price breakout ki expectation mein karte hain.

Breakout ka wait karte waqt, traders ko volume ki bhi nigaah rakhni chahiye. Agar volume breakout ke samay badh jata hai, toh yeh breakout ko confirm karta hai.

Ascending Triangle Pattern Ke Faide:

Ascending Triangle Pattern ko samajhne se traders ko market ke potential bullish movements ka pata lagta hai.

Is pattern ka istemal karke traders sahi waqt par entry aur exit points tay kar sakte hain aur profit earn kar sakte hain.

Yeh pattern traders ko market ka sentiment samajhne mein madad karta hai aur unhein trading decisions lene mein guide karta hai.

Udaharan:

Agar ek stock ka price ek horizontal resistance line ke upar repeatedly takra raha hai aur ek rising trend line ke saath higher lows banata ja raha hai, toh yeh ek ascending triangle pattern ko indicate karta hai.

Jab price resistance line ko break karke upar chadta hai, toh yeh breakout ka signal hota hai aur traders entry karte hain.

Ascending Triangle Pattern ek powerful tool hai jo traders ko market ke potential bullish movements ko identify karne mein madad karta hai. Is pattern ko samajh kar traders sahi waqt par entry aur exit points tay kar sakte hain aur profit earn kar sakte hain.

Ascending Triangle Pattern Kya Hai?

Ascending Triangle Pattern ek continuation pattern hai jo uptrend ke doran dekha jata hai.

Is pattern mein ek horizontal resistance line aur ek rising trend line hoti hai jo higher lows ko connect karti hai.

Resistance line horizontal hoti hai, jabki support line upward sloping hoti hai.

Ascending Triangle Pattern Ki Tafseel:

Jab market mein ascending triangle pattern dekha jata hai, toh yeh ek bullish continuation ya reversal ka indication hota hai.

Is pattern mein price resistance line se baar-baar takra kar wapas jaata hai, lekin higher lows banata hai.

Is pattern mein volume dheere dheere kam ho jata hai, jo ek breakout ki sambhavna ko darust karta hai.

Ascending Triangle Pattern Ka Istemal:

Ascending Triangle Pattern ka istemal traders price breakout ki expectation mein karte hain.

Breakout ka wait karte waqt, traders ko volume ki bhi nigaah rakhni chahiye. Agar volume breakout ke samay badh jata hai, toh yeh breakout ko confirm karta hai.

Ascending Triangle Pattern Ke Faide:

Ascending Triangle Pattern ko samajhne se traders ko market ke potential bullish movements ka pata lagta hai.

Is pattern ka istemal karke traders sahi waqt par entry aur exit points tay kar sakte hain aur profit earn kar sakte hain.

Yeh pattern traders ko market ka sentiment samajhne mein madad karta hai aur unhein trading decisions lene mein guide karta hai.

Udaharan:

Agar ek stock ka price ek horizontal resistance line ke upar repeatedly takra raha hai aur ek rising trend line ke saath higher lows banata ja raha hai, toh yeh ek ascending triangle pattern ko indicate karta hai.

Jab price resistance line ko break karke upar chadta hai, toh yeh breakout ka signal hota hai aur traders entry karte hain.

Ascending Triangle Pattern ek powerful tool hai jo traders ko market ke potential bullish movements ko identify karne mein madad karta hai. Is pattern ko samajh kar traders sahi waqt par entry aur exit points tay kar sakte hain aur profit earn kar sakte hain.

تبصرہ

Расширенный режим Обычный режим