Best Timing for Trading

Introduction

Dear Fellows,

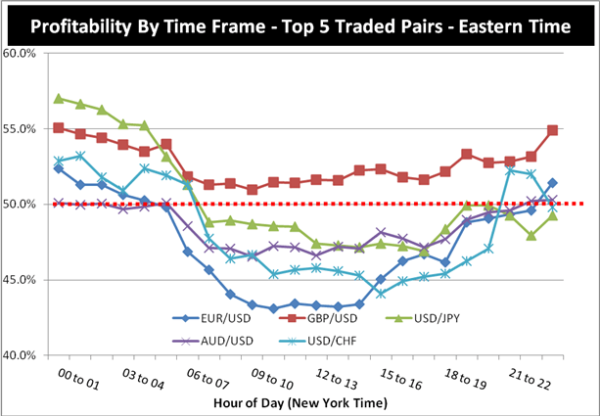

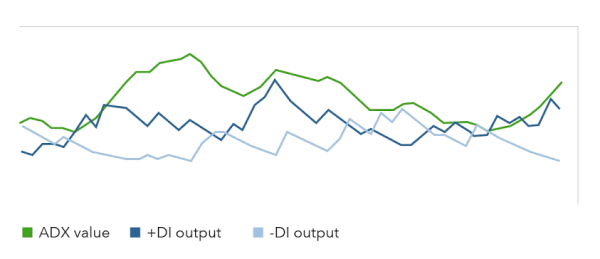

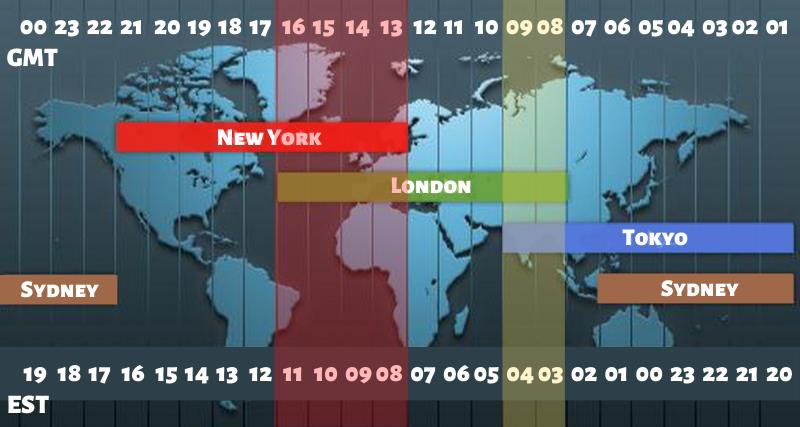

Trading main forex aik bahot hi zyada acha online buisness hain. Awar Jiss k through hum currency ko buy and sale kar k un sa earning matllab k proffit hasil karty hain. Like Main apko aik choti c example dyta hoon jaisy k hum koi cheez 10$ ki buy karty hain awar us ko kuch days ya kuch time apny pass rakhty hain and phir ham us cheez ko 15$ or 12$ main sale kar dyty hain to hamain faida hi to hota hy. And ya bhi ho skta hy k ham wo cheez 8$ ya phir 9$ main sale kar dain.pir ye k Jis sa hamain loss hota hy so isi trha ya forex bhi hy. And ap k sawaal k mutaabik jahan tak.mera khiyal hy to main apko btata hoon k hamain tuesday ko tradding karni chaheye. Wesy jaisa k ap na kaha hy m friday and monday ko tradding mushkil hoti hainto mera khiyal ya hy k ager koi best tradder and expert tradder friday ko ya phir monday ko tradde open kry to wo success ho skta hy. Q k us k pass is k baary main Ap trading tab kary jab ap k pas time ho trading 24 hours open hoti hai lekin trading har waqt open hai to is ka matlab ye nahi k ap ko har waqt profit hoga agar ap profit lena chahty hai to apko market k analysis karny pary gy us k liye apko dekhna hoga k market ki movement kis tarf hai pehly kis tarf thi or next kis tarf ho sakti hai or ap ko dekhna hoga kis time market ki movement slow hogi or kis time fast ye sab dekh kar hi apko pata lagy ga k kis time trading karni hai awar kis time apko ap ki trade mily gi or jab ap trading kary to take profit or stop loss zaroor use kary is sy ap ki trade or account safe rahy gy or time to apko tab hi pata chaly ga jab ap analysis kary gy bgair analysis k apko andaza nahi k forex mai hum live trading karty hain hamy apny free time mai trading karne chahey agar hum job less hain to hum full time ky liye trading kar sakty hain or agar hum koi job karty hain to hum part time ky liye trading kar sakty hain forex mai kam kar ky hum ache earning hasial kar sakty hain forex aik aam business ke nisbat bohat acha business hain hum is mai agar lalchi ban ky kam kary gy to hamy loss ho jy ga.mazeed ye k forex aik bohat bara business hain yai pury pakistan mai legal ban cuka hain hum isy apna life time career be depend krta hain.

Ehmiat

Fellows,

Esski bahot ehmait hain. forex trading main trading ka best time ap ko kisi bhi time mil skta hai jub k market hmain pora 5 din open milti hai monday till friady night es liye en times main hmain kisi bhi time market acha trend show kar skti hai jo k hmari apni favoyr main hota hai es liye hmain apni trading ability ko itna strong rakna chahye k hum market ko os time par follow kar skaen jub hmain acha perofit mil skay ess k ila apni trading expiernce ko madh e nazar rakhty howe market ko follow akrna chahye q k market main kbhi apo sort e hall critical milti hai jis ko smjhna ap ki trading ko khtry main dal skta hai es liye trading os time par awar Forex trading business Ek bahut jyada risky trading business hai isiliye koshish karen ki Forex trading business Mein trading tab Karen Jab aapke pass Achcha experience Achcha knowledge aur Achcha information aur acchi news Ho without any analysis kabhi bhi trade na lagaen Kyunki Jab Ham without any knowledge experience or analysis trailer Gate Hain To Hamen Hamesha loss ka Samna karna padta hai Logon se bachne ke liye koshish Karni chahie ki Ham Apne experience ko increase Karen aur demo account per ziadda Se ziada practis Karen aur news ka analysis Karen aur Market ko follow kry.

Conclusion

Fellows,

Last main ye k trading to main ap ko bata don kay ap wesy to har waqat trading kar sakty hain laikin kuch khayal karna chahiay special us waqat jab market kisi aik point pa na stay karen ya phir jab currency ki qeemat iup aur down ho rahi ho aur apko month kay ends pa khayal karna chahiay trading karty waqat overall movements daikhni chahiay apko wesy to 24 hours market open hi hoti hay laikin ap ko soch samajh kay karni chahiay record check karna chahiay aur daikhna chahiay kay kis waqt ya kis kis din ya days main market up down ho rahi hay aur kin dinu main stay hain ya aik sequence ma ja rahi hay is liay apko ye sab kuch note kar kay tab apko trading karni chahiay is say ap ko loss kay chances bahut kam ho jaty hain aur ap profit ki tarf jatay hain is liay overview daikh kay karni chahiay trading ko dekhna b chahiay.

Thanks

Introduction

Dear Fellows,

Trading main forex aik bahot hi zyada acha online buisness hain. Awar Jiss k through hum currency ko buy and sale kar k un sa earning matllab k proffit hasil karty hain. Like Main apko aik choti c example dyta hoon jaisy k hum koi cheez 10$ ki buy karty hain awar us ko kuch days ya kuch time apny pass rakhty hain and phir ham us cheez ko 15$ or 12$ main sale kar dyty hain to hamain faida hi to hota hy. And ya bhi ho skta hy k ham wo cheez 8$ ya phir 9$ main sale kar dain.pir ye k Jis sa hamain loss hota hy so isi trha ya forex bhi hy. And ap k sawaal k mutaabik jahan tak.mera khiyal hy to main apko btata hoon k hamain tuesday ko tradding karni chaheye. Wesy jaisa k ap na kaha hy m friday and monday ko tradding mushkil hoti hainto mera khiyal ya hy k ager koi best tradder and expert tradder friday ko ya phir monday ko tradde open kry to wo success ho skta hy. Q k us k pass is k baary main Ap trading tab kary jab ap k pas time ho trading 24 hours open hoti hai lekin trading har waqt open hai to is ka matlab ye nahi k ap ko har waqt profit hoga agar ap profit lena chahty hai to apko market k analysis karny pary gy us k liye apko dekhna hoga k market ki movement kis tarf hai pehly kis tarf thi or next kis tarf ho sakti hai or ap ko dekhna hoga kis time market ki movement slow hogi or kis time fast ye sab dekh kar hi apko pata lagy ga k kis time trading karni hai awar kis time apko ap ki trade mily gi or jab ap trading kary to take profit or stop loss zaroor use kary is sy ap ki trade or account safe rahy gy or time to apko tab hi pata chaly ga jab ap analysis kary gy bgair analysis k apko andaza nahi k forex mai hum live trading karty hain hamy apny free time mai trading karne chahey agar hum job less hain to hum full time ky liye trading kar sakty hain or agar hum koi job karty hain to hum part time ky liye trading kar sakty hain forex mai kam kar ky hum ache earning hasial kar sakty hain forex aik aam business ke nisbat bohat acha business hain hum is mai agar lalchi ban ky kam kary gy to hamy loss ho jy ga.mazeed ye k forex aik bohat bara business hain yai pury pakistan mai legal ban cuka hain hum isy apna life time career be depend krta hain.

Ehmiat

Fellows,

Esski bahot ehmait hain. forex trading main trading ka best time ap ko kisi bhi time mil skta hai jub k market hmain pora 5 din open milti hai monday till friady night es liye en times main hmain kisi bhi time market acha trend show kar skti hai jo k hmari apni favoyr main hota hai es liye hmain apni trading ability ko itna strong rakna chahye k hum market ko os time par follow kar skaen jub hmain acha perofit mil skay ess k ila apni trading expiernce ko madh e nazar rakhty howe market ko follow akrna chahye q k market main kbhi apo sort e hall critical milti hai jis ko smjhna ap ki trading ko khtry main dal skta hai es liye trading os time par awar Forex trading business Ek bahut jyada risky trading business hai isiliye koshish karen ki Forex trading business Mein trading tab Karen Jab aapke pass Achcha experience Achcha knowledge aur Achcha information aur acchi news Ho without any analysis kabhi bhi trade na lagaen Kyunki Jab Ham without any knowledge experience or analysis trailer Gate Hain To Hamen Hamesha loss ka Samna karna padta hai Logon se bachne ke liye koshish Karni chahie ki Ham Apne experience ko increase Karen aur demo account per ziadda Se ziada practis Karen aur news ka analysis Karen aur Market ko follow kry.

Conclusion

Fellows,

Last main ye k trading to main ap ko bata don kay ap wesy to har waqat trading kar sakty hain laikin kuch khayal karna chahiay special us waqat jab market kisi aik point pa na stay karen ya phir jab currency ki qeemat iup aur down ho rahi ho aur apko month kay ends pa khayal karna chahiay trading karty waqat overall movements daikhni chahiay apko wesy to 24 hours market open hi hoti hay laikin ap ko soch samajh kay karni chahiay record check karna chahiay aur daikhna chahiay kay kis waqt ya kis kis din ya days main market up down ho rahi hay aur kin dinu main stay hain ya aik sequence ma ja rahi hay is liay apko ye sab kuch note kar kay tab apko trading karni chahiay is say ap ko loss kay chances bahut kam ho jaty hain aur ap profit ki tarf jatay hain is liay overview daikh kay karni chahiay trading ko dekhna b chahiay.

Thanks

تبصرہ

Расширенный режим Обычный режим