Forex Trading Mein Horizontal Channel: Ek Tafseeli Jaiza

Forex trading, jaise ke aap jante hain, ek dynamic aur challenging duniya hai jahan traders currencies ke values ko analyze karte hain aur un par trades execute karte hain. Har trader ki koshish hoti hai ke woh market ke mizaj ko samajh sake aur sahi waqt par sahi faislay kar sake. Ek ahem concept jo forex trading mein use hota hai woh hai "Horizontal Channel". Is article mein, hum horizontal channel ke mutaliq tafseelat ko explore karenge, iske mukhtalif aspects aur traders ke liye iska maqam ko samjhein ge.

Horizontal Channel Kya Hai?

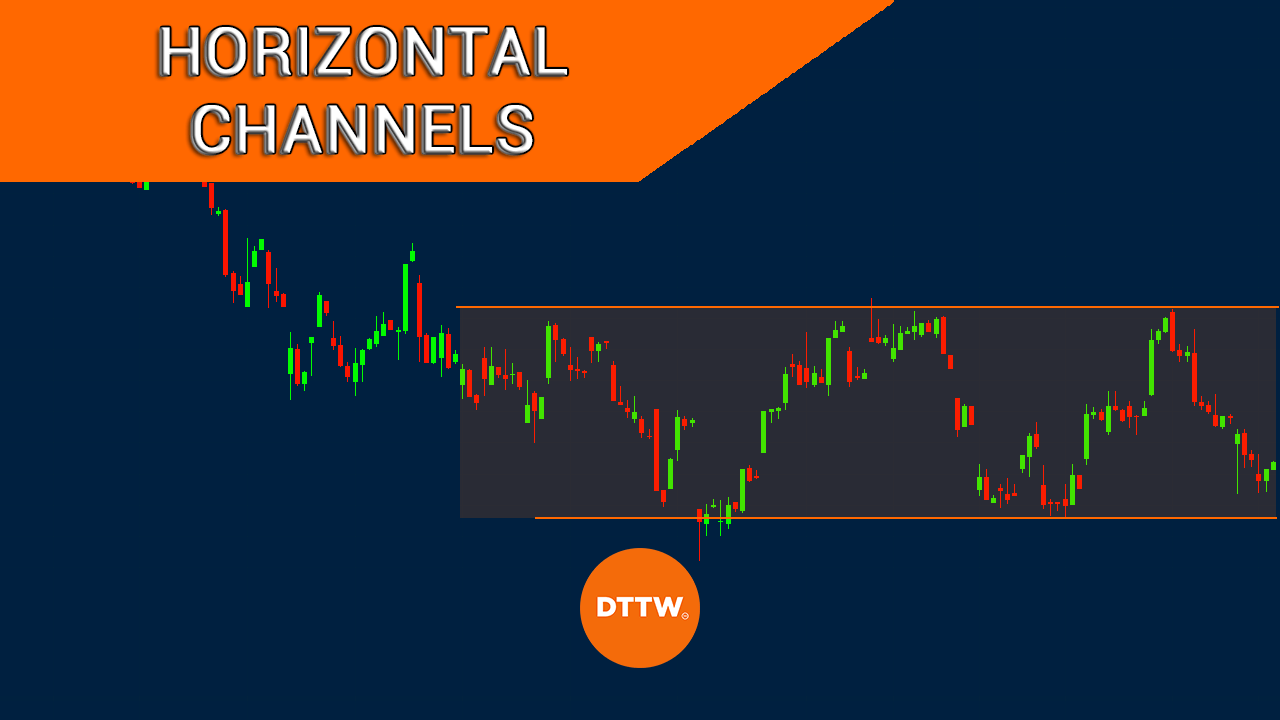

Horizontal channel ek price action concept hai jo traders ko market ke price movements aur trends ko samajhne mein madad karta hai. Ye pattern do horizontal lines ke darmiyan draw kiya jata hai jo ke price ke peaks aur troughs ko represent karte hain. Yeh channel market mein trading range ko darust karta hai jahan price ek mukhtalif range ke andar fluctuate karti hai magar overall trend undefined hota hai.

Horizontal Channel Ki Tashreeh

Horizontal channel ki pehchan karne ke liye kuch zaroori points hain jo traders ko dekhne chahiye:

- Horizontal Lines: Horizontal channel ko define karne ke liye do horizontal lines draw kiye jate hain. Ek line price ke highs ko connect karti hai aur doosri line price ke lows ko connect karti hai. In lines ke darmiyan ek channel create hota hai jahan price fluctuates.

- Price Fluctuations: Horizontal channel mein price ke fluctuations hoti hain jahan price ek definite range ke andar move karti hai. Yeh fluctuations do lines ke darmiyan hoti hain aur traders ko in fluctuations ko analyze karke trading decisions leni chahiye.

- Volume Analysis: Volume bhi ek important factor hai horizontal channel ki tashreeh mein. Agar price horizontal channel ke andar fluctuate karta hai aur volume bhi consistent hai, to ye indicate karta hai ke market mein strong support aur resistance levels hain.

- Duration: Ek aur aspect horizontal channel ka duration hai. Traders ko dekhna chahiye ke horizontal channel kitne arse tak maintain hota hai. Agar channel zyada arse tak maintain hota hai, to ye indicate karta hai ke market mein consolidation phase hai aur trend ki clarity nahi hai.

Horizontal Channel Aur Trading Strategies

Horizontal channel ko trading strategies mein istemal karne ke liye kuch approaches hain:

- Range Trading: Horizontal channel ko range trading ke liye istemal kiya jata hai. Jab price ek channel ke andar fluctuate karta hai, to traders long positions enter karte hain jab price support level ke qareeb hoti hai aur short positions enter karte hain jab price resistance level ke qareeb hoti hai.

- Breakout Trading: Horizontal channel ke breakout ka istemal bhi kiya jata hai. Agar price ek channel ke bahar nikalti hai, to ye indicate karta hai ke market mein trend change hone wala hai. Traders is breakout ko capture karke directional trades execute karte hain.

- Support aur Resistance: Horizontal channel ko support aur resistance levels ke taur par bhi dekha jata hai. Traders in levels ko identify karke price ka behavior samajhte hain aur trading decisions lete hain.

- Pattern Recognition: Horizontal channel ko pattern recognition ke liye bhi istemal kiya jata hai. Traders dekhte hain ke kis tarah se price channel ke andar fluctuate kar rahi hai aur kya koi specific patterns form ho rahe hain jo unhe trading opportunities provide kar sakte hain.

Sawaalat aur Jawabaat

- Kya Horizontal Channel Har Market Condition Mein Effective Hota Hai? Horizontal channel har market condition mein effective nahi hota hai. Iski effectiveness market volatility, liquidity aur overall trend par depend karta hai.

- Horizontal Channel Ka Istemal Kis Timeframe Par Kiya Jata Hai? Horizontal channel ko kisi bhi timeframe par istemal kiya ja sakta hai, lekin zyadatar traders ise short to medium term timeframes par prefer karte hain.

- Horizontal Channel Ko Draw Karne Ka Sahi Tarika Kya Hai? Horizontal channel ko draw karne ke liye traders ko price ke highs aur lows ko identify karna hota hai aur phir unhe connect karke channel banate hain.

تبصرہ

Расширенный режим Обычный режим