[[[[Forex Trading Mein Chart Mill Value Indicator]]]]

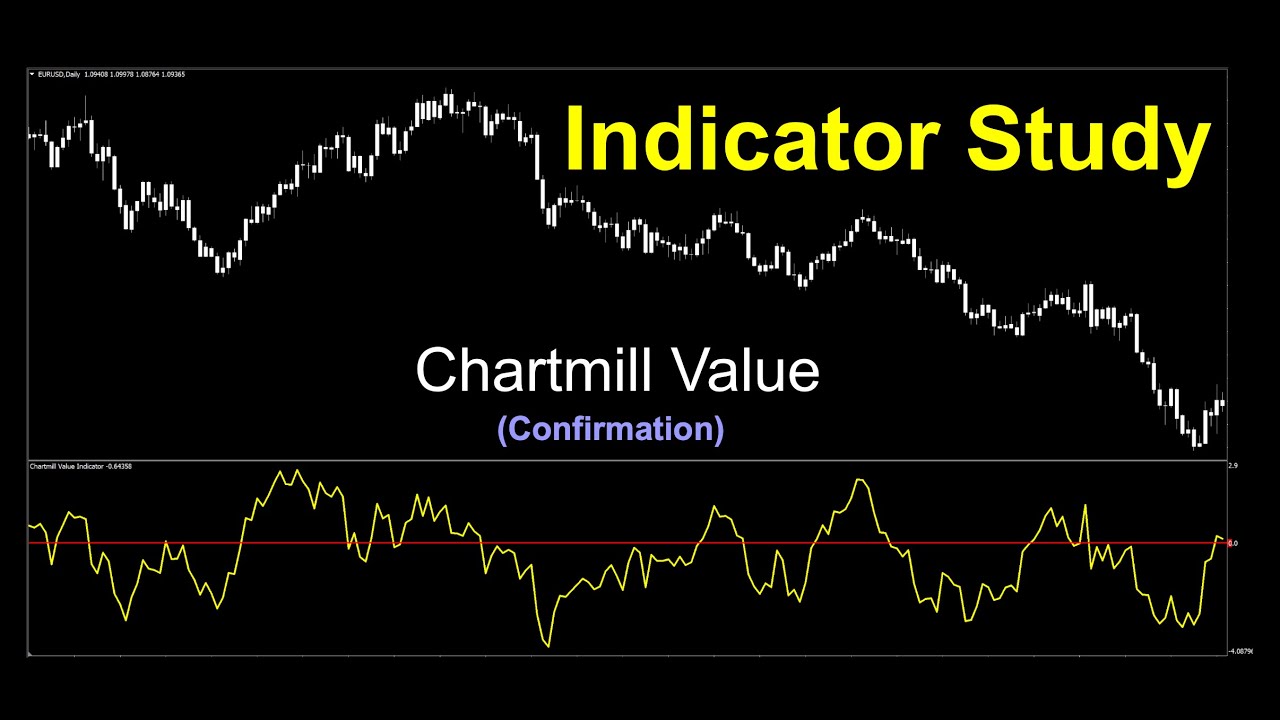

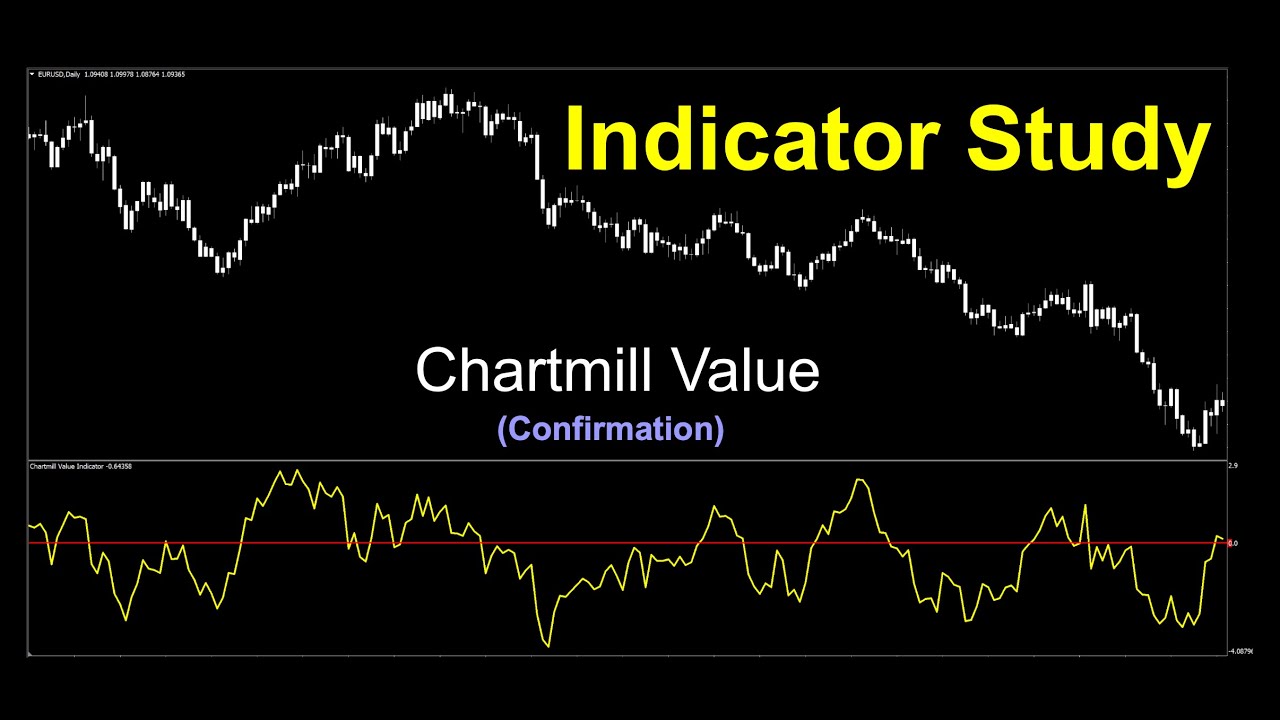

Forex trading mein "Chart Mill Value (CMV)" indicator ek technical analysis tool hai jo traders ko market trends aur potential trading opportunities identify karne mein madad karta hai. CMV indicator, market volatility aur trend strength ko measure karta hai, jisse traders ko market ke current health aur future direction ke baare mein insights milte hain.

CMV indicator ka calculation market ke price action aur volume data par based hota hai. Iska primary aim market trends ko capture karna hai, jisse traders ko entry aur exit points identify karne mein help milti hai. CMV indicator ka use karke traders market momentum ko samajh sakte hain aur potential reversals ya trend changes ko anticipate kar sakte hain.

Overall, Chart Mill Value (CMV) indicator ek powerful tool ho sakta hai forex trading mein, lekin iska proper use aur interpretation ke liye traders ko adequate knowledge aur experience honi chahiye.

[[[[Forex Trading Mein Chart Mill Value Indicator Ke Key Points]]]]

Chart Mill Value (CMV) indicator ka use karke traders market analysis aur trading decisions mein kuch key points ko dhyan mein rakh sakte hain:

Forex trading mein "Chart Mill Value (CMV)" indicator ek technical analysis tool hai jo traders ko market trends aur potential trading opportunities identify karne mein madad karta hai. CMV indicator, market volatility aur trend strength ko measure karta hai, jisse traders ko market ke current health aur future direction ke baare mein insights milte hain.

CMV indicator ka calculation market ke price action aur volume data par based hota hai. Iska primary aim market trends ko capture karna hai, jisse traders ko entry aur exit points identify karne mein help milti hai. CMV indicator ka use karke traders market momentum ko samajh sakte hain aur potential reversals ya trend changes ko anticipate kar sakte hain.

Overall, Chart Mill Value (CMV) indicator ek powerful tool ho sakta hai forex trading mein, lekin iska proper use aur interpretation ke liye traders ko adequate knowledge aur experience honi chahiye.

[[[[Forex Trading Mein Chart Mill Value Indicator Ke Key Points]]]]

Chart Mill Value (CMV) indicator ka use karke traders market analysis aur trading decisions mein kuch key points ko dhyan mein rakh sakte hain:

- Market Trends: CMV indicator market trends ko analyze karta hai, jaise uptrends, downtrends, aur sideways trends. Traders ko ye information provide karta hai ki market ka overall direction kya hai aur kis tarah ka trading strategy adopt karna chahiye.

- Volatility Analysis: CMV indicator market volatility ko bhi measure karta hai. High volatility situations mein traders ko risk management strategies ko adjust karna hota hai, jabki low volatility situations mein trading approach different hota hai.

- Trend Strength: Indicator trend strength ko bhi evaluate karta hai, jisse traders ko ye pata chalta hai ki trend kitna strong hai aur kya usme potential hai. Strong trends mein traders trend-following strategies ka use karte hain, jabki weak trends mein contrarian strategies ka use kiya jata hai.

- Entry and Exit Points: CMV indicator traders ko potential entry aur exit points provide karta hai. Ye points market ke momentum aur trend ke basis par calculate hote hain, jisse traders apne trades ko time kar sakte hain aur profitable opportunities ka benefit utha sakte hain.

- Confirmation with Other Indicators: CMV indicator ko dusre technical analysis tools aur indicators ke sath combine karke bhi use kiya ja sakta hai. Isse traders ko aur bhi strong signals milte hain aur trading decisions ko confirm karne mein help milti hai.

تبصرہ

Расширенный режим Обычный режим