!!!!!Forex Trading Mein Multi-Timeframe Analysis!!!!

Forex trading mein multi-timeframe analysis ka matlab hota hai ke traders market ke mukhya trends ko samajhne ke liye different timeframes ka istemal karte hain. Is technique mein, traders ek specific timeframe par nazar rakhte hain aur us samay ke charts ko analyze karte hain, lekin wo dusre timeframes jaise chhote ya bade timeframes bhi dekhte hain taaki unhe ek adhik comprehensive aur accurate picture mil sake.

!!!!!Forex Trading Mein Multi-Timeframe Analysis Ki Techniques!!!!

multi-timeframe analysis ka mukhya aim hota hai ke traders ko market ke multiple perspectives aur trends ko samajhne mein madad mile aur unhe better trading decisions lene mein sahayata pradan kare. Yeh technique traders ko nimn points par madad karti hai:

Overall, multi-timeframe analysis ek powerful tool hai jo traders ko market ke various aspects ko samajhne mein madad karta hai aur unhe ek holistic trading approach provide karta hai. Isse traders apne trading strategies ko refine karke aur better results achieve karne mein safal ho sakte hain.

Forex trading mein multi-timeframe analysis ka matlab hota hai ke traders market ke mukhya trends ko samajhne ke liye different timeframes ka istemal karte hain. Is technique mein, traders ek specific timeframe par nazar rakhte hain aur us samay ke charts ko analyze karte hain, lekin wo dusre timeframes jaise chhote ya bade timeframes bhi dekhte hain taaki unhe ek adhik comprehensive aur accurate picture mil sake.

!!!!!Forex Trading Mein Multi-Timeframe Analysis Ki Techniques!!!!

multi-timeframe analysis ka mukhya aim hota hai ke traders ko market ke multiple perspectives aur trends ko samajhne mein madad mile aur unhe better trading decisions lene mein sahayata pradan kare. Yeh technique traders ko nimn points par madad karti hai:

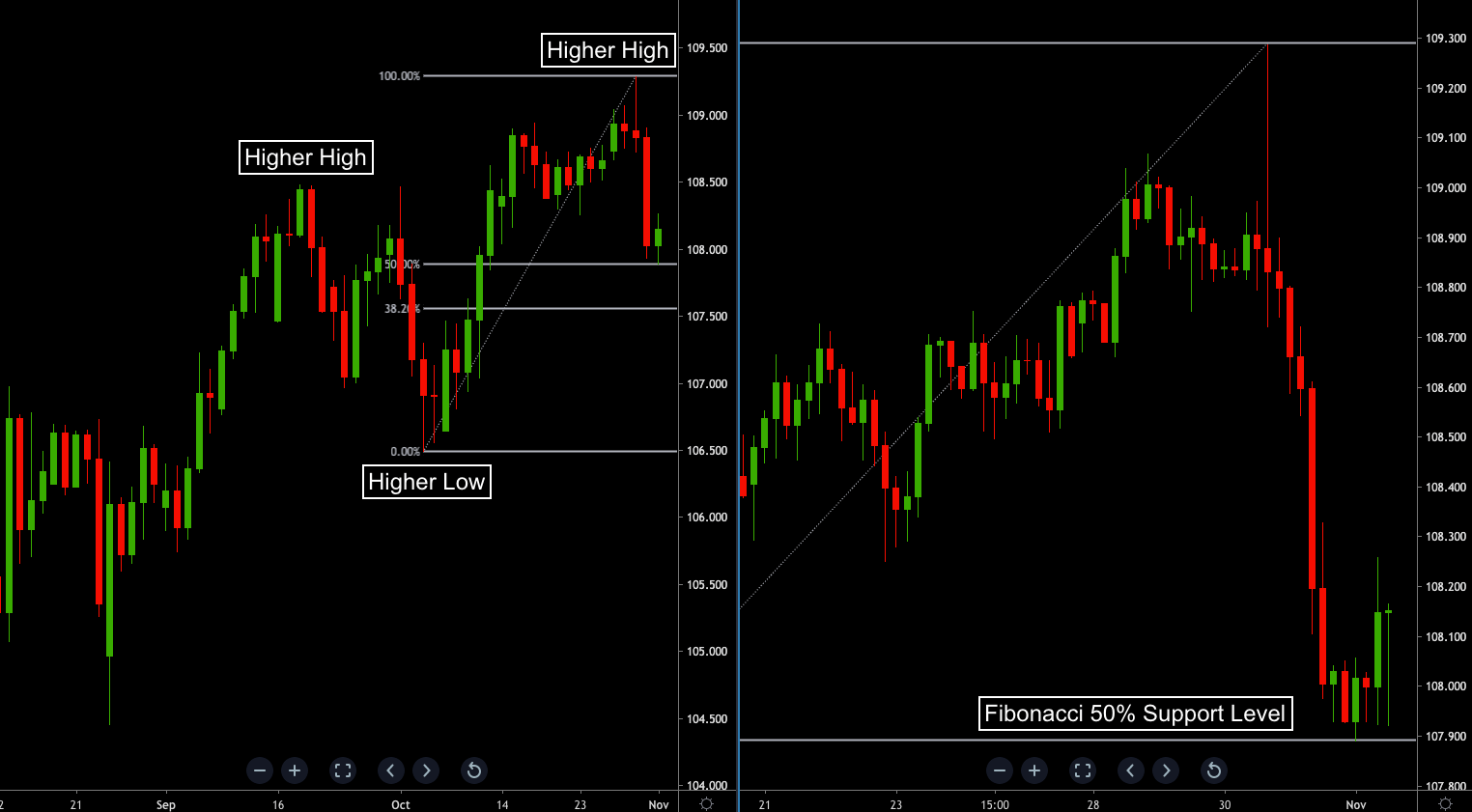

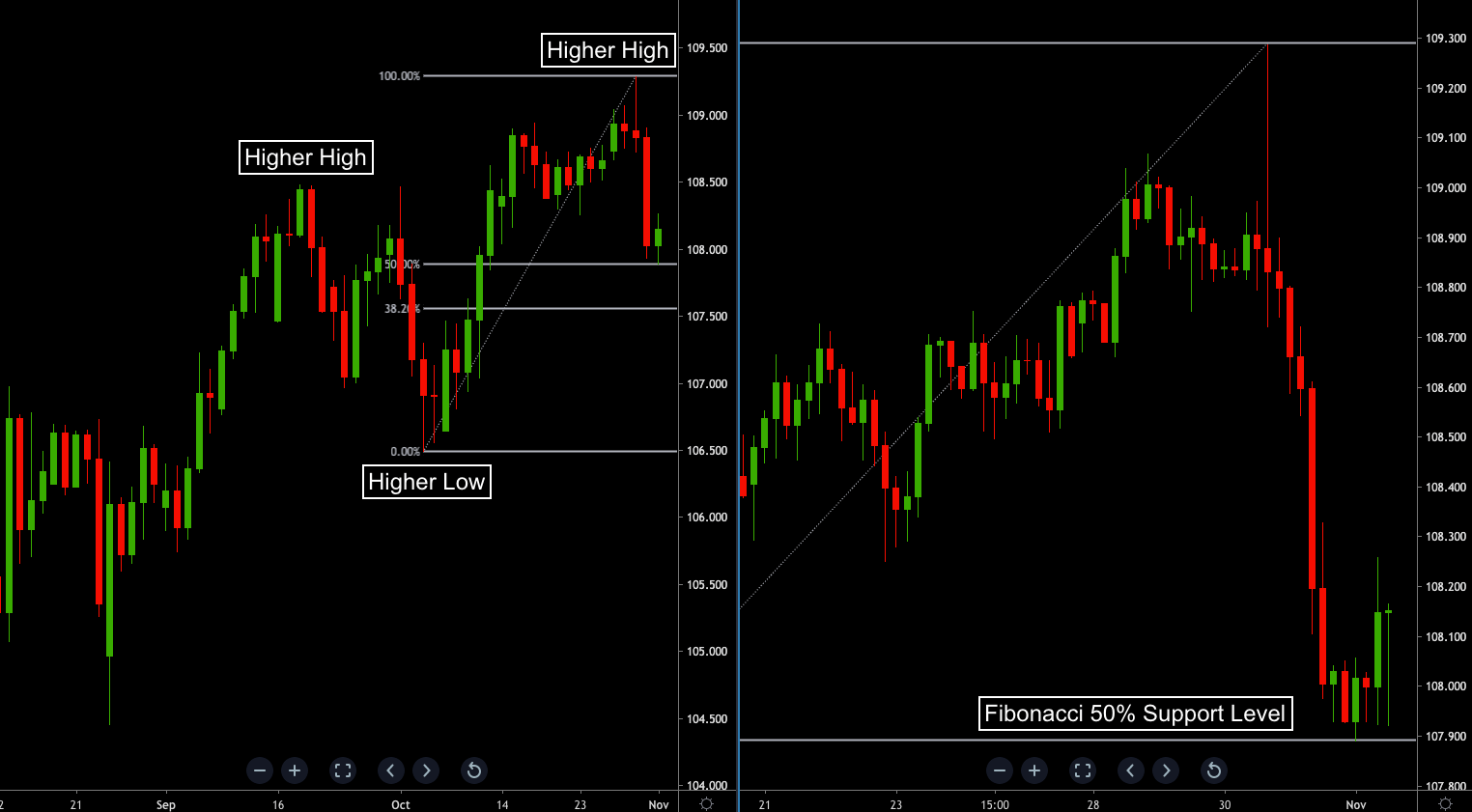

- Long-Term Trends: Bade timeframes jaise daily, weekly, ya monthly charts dekhkar traders ko long-term trends ka pata chalta hai. Isse unhe market ka overall direction samajhne mein madad milti hai.

- Short-Term Opportunities: Chhote timeframes jaise hourly ya 15-minute charts dekhkar traders ko short-term opportunities aur entry/exit points ka pata chalta hai. Isse unhe short-term trades mein bhi fayda milta hai.

- Entry aur Exit Points: Multi-timeframe analysis se traders ko sahi entry aur exit points ka pata lagta hai. Jab ek timeframe mein trend confirm ho jata hai, tab traders doosre timeframe ko bhi check karke apne decisions ko validate karte hain.

- Risk Management: Alag-alag timeframes ko analyze karke, traders apne risk management strategies ko optimize kar sakte hain. Isse unhe apne trades ko better control aur manage karne mein madad milti hai.

- Confirmation: Multi-timeframe analysis se traders ko confirming signals milte hain. Jab ek timeframe mein signal milta hai, tab doosre timeframes ko dekhkar confirmation hasil kiya ja sakta hai, jo trading accuracy ko badhata hai.

- Market Sentiment: Different timeframes ko dekhkar traders ko market ka overall sentiment aur strength ka pata chalta hai. Isse unhe market ki behavior ko samajhne mein madad milti hai.

Overall, multi-timeframe analysis ek powerful tool hai jo traders ko market ke various aspects ko samajhne mein madad karta hai aur unhe ek holistic trading approach provide karta hai. Isse traders apne trading strategies ko refine karke aur better results achieve karne mein safal ho sakte hain.

تبصرہ

Расширенный режим Обычный режим