Keltner Channel Indicator introduction.

Keltner Channel Indicator ek technical analysis tool hai jo traders ko market volatility aur price trends ka analysis karne mein madad karta hai. Yeh indicator price ke around ek upper band, lower band, aur ek middle line ko display karta hai.Keltner Channel ek powerful tool hai jo traders ko market trends aur volatility ka analysis karne mein madad karta hai. Lekin, sahi taur par iska istemal karne ke liye, traders ko apni strategy ko test karna aur sahi risk management ka dhyan rakhna zaroori hai.

Keltner Channel Components.

Keltner Channel main teen ahem components hote hain.

Upper Band.Yeh price ke around ek volatility-based resistance level hai.

Lower Band.Yeh price ke around ek volatility-based support level hai.

Middle Line. Yeh typically simple moving average (SMA) hoti hai jo price ka trend indicate karti hai.

Strategy for Trading on Keltner Channel.

Keltner Channel par trading karne ke liye, kuch mukhtasir steps hain jo traders istemal karte hain

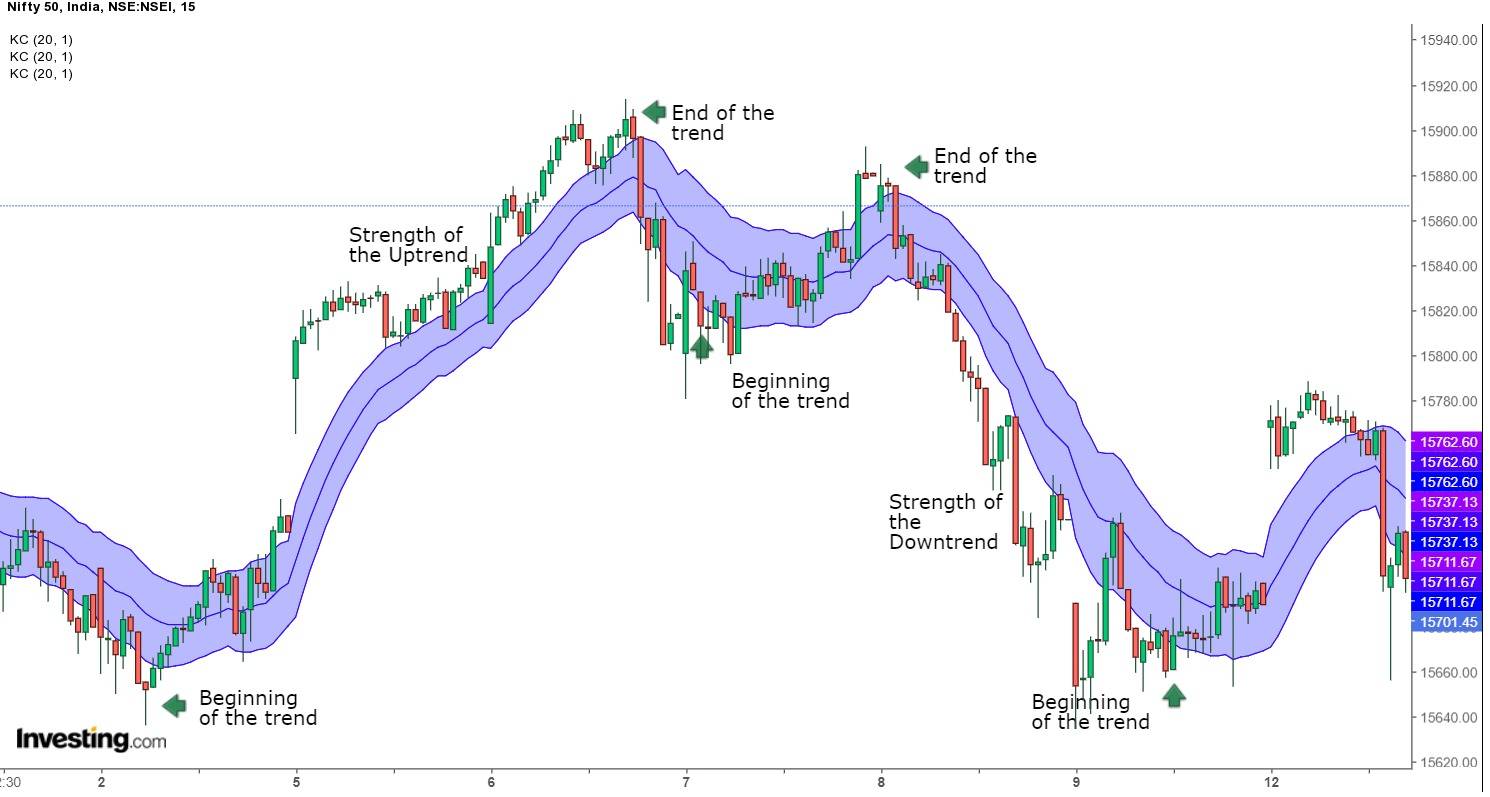

Keltner Channel ke istemal se traders trends ko identify karte hain. Agar price upper band se upar hai, to trend bullish ho sakti hai, aur agar price lower band se neeche hai, to trend bearish ho sakti hai.

Entry points ko determine karne ke liye, traders price ke middle line se ya fir bands ke cross par focus karte hain. Agar price middle line ko cross kar rahi hai aur trend bullish hai, to yeh entry point ho sakta hai.

Har trading strategy mein stop loss aur take profit levels ka tay karna ahem hota hai. Traders Keltner Channel ke upper aur lower bands ko stop loss aur take profit levels ke taur par istemal karte hain.

Keltner Channel ke signals ko confirm karne ke liye, traders doosri technical indicators jaise RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence) ka istemal bhi karte hain.

Bullish Scenario.

Agar price upper band ke upar hai aur middle line ko cross kar rahi hai, to yeh ek bullish scenario ho sakti hai. Traders yahan par long positions le sakte hain aur upper band ko target set kar sakte hain.

Bearish Scenario.

Agar price lower band ke neeche hai aur middle line ko neeche se cross kar rahi hai, to yeh ek bearish scenario ho sakti hai. Traders yahan par short positions le sakte hain aur lower band ko target set kar sakte hain.

Sideways Market.

Jab price Keltner Channel ke bands ke darmiyan trade kar rahi ho aur middle line ko frequently touch kar rahi ho, to yeh ek sideways market indicate karta hai. Traders is situation mein range-bound trading strategies istemal karte hain.Har trading strategy ke saath sahi risk management ka hona zaroori hai. Keltner Channel par trading karte waqt, stop loss aur take profit levels ko dhyan mein rakhna ahem hai taki nuksan se bacha ja sake.Trading mein zehniyat ka bhi bara kirdar hota hai. Keltner Channel indicator ke signals par pura bharosa rakhna aur un par amal karna, discipline aur patience ko require karta hai.

Keltner Channel Indicator ek technical analysis tool hai jo traders ko market volatility aur price trends ka analysis karne mein madad karta hai. Yeh indicator price ke around ek upper band, lower band, aur ek middle line ko display karta hai.Keltner Channel ek powerful tool hai jo traders ko market trends aur volatility ka analysis karne mein madad karta hai. Lekin, sahi taur par iska istemal karne ke liye, traders ko apni strategy ko test karna aur sahi risk management ka dhyan rakhna zaroori hai.

Keltner Channel Components.

Keltner Channel main teen ahem components hote hain.

Upper Band.Yeh price ke around ek volatility-based resistance level hai.

Lower Band.Yeh price ke around ek volatility-based support level hai.

Middle Line. Yeh typically simple moving average (SMA) hoti hai jo price ka trend indicate karti hai.

Strategy for Trading on Keltner Channel.

Keltner Channel par trading karne ke liye, kuch mukhtasir steps hain jo traders istemal karte hain

Keltner Channel ke istemal se traders trends ko identify karte hain. Agar price upper band se upar hai, to trend bullish ho sakti hai, aur agar price lower band se neeche hai, to trend bearish ho sakti hai.

Entry points ko determine karne ke liye, traders price ke middle line se ya fir bands ke cross par focus karte hain. Agar price middle line ko cross kar rahi hai aur trend bullish hai, to yeh entry point ho sakta hai.

Har trading strategy mein stop loss aur take profit levels ka tay karna ahem hota hai. Traders Keltner Channel ke upper aur lower bands ko stop loss aur take profit levels ke taur par istemal karte hain.

Keltner Channel ke signals ko confirm karne ke liye, traders doosri technical indicators jaise RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence) ka istemal bhi karte hain.

Bullish Scenario.

Agar price upper band ke upar hai aur middle line ko cross kar rahi hai, to yeh ek bullish scenario ho sakti hai. Traders yahan par long positions le sakte hain aur upper band ko target set kar sakte hain.

Bearish Scenario.

Agar price lower band ke neeche hai aur middle line ko neeche se cross kar rahi hai, to yeh ek bearish scenario ho sakti hai. Traders yahan par short positions le sakte hain aur lower band ko target set kar sakte hain.

Sideways Market.

Jab price Keltner Channel ke bands ke darmiyan trade kar rahi ho aur middle line ko frequently touch kar rahi ho, to yeh ek sideways market indicate karta hai. Traders is situation mein range-bound trading strategies istemal karte hain.Har trading strategy ke saath sahi risk management ka hona zaroori hai. Keltner Channel par trading karte waqt, stop loss aur take profit levels ko dhyan mein rakhna ahem hai taki nuksan se bacha ja sake.Trading mein zehniyat ka bhi bara kirdar hota hai. Keltner Channel indicator ke signals par pura bharosa rakhna aur un par amal karna, discipline aur patience ko require karta hai.

:max_bytes(150000):strip_icc()/figure-2.-keltner-channel-trending-strategy-57559b745f9b5892e8a4b1ac.jpg)

تبصرہ

Расширенный режим Обычный режим