Divergence Trading

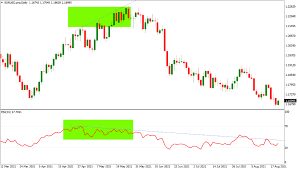

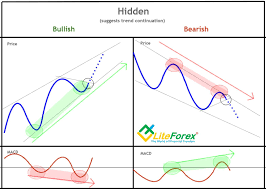

Divergence buying and selling ek famous buying and selling method hai jo technical analysis par adharit hai. Ye approach fee a buying and selling divergence ek vital aur beneficial tareeqa hai market ke trend adjustments ko samajhne ka. Is method ko sahi tareeqe se samajh kar istemal karne se traders apni buying and selling performance ko behtar bana sakte hain. Magar yeh zaroori hai ke traders proper danger management aur technical analysis par makhsoos tawajjo dein taake unhein sahi buying and selling choices ka intikhab karne mein madad milti rahe.Ction aur momentum indicators ke divergences ko pick out karke buying and selling choices lene par cognizance karta hai.Divergence trading mein investors divergence patterns ko spot karte hain, jo charge motion aur momentum indicators ke beech mein contradiction indicate karte hain. Divergence usually tab hoti hai jab price movement aur indicator movement opposite path mein ja rahe hote hain. Ye divergence bullish ya bearish reversal signals ke roop mein interpret ki ja sakti hai, depending at the context aur marketplace conditions.

Treading Strategy

Divergence trading mein investors ko pric divergence trading ek effective tool hai jo traders ko trend reversals aur trend modifications ke alerts provide karta hai. Is strategy ka istemal karke investors apne trading overall performance ko improve kar sakte hain aur steady profits earn kar sakte hain. Divergence buying and selling ko samajhna aur istemal karna, technical analysis ka ek ahem hissa hai jo traders ki achievement mein madadgare movement ke saath saath signs ka bhi dhyan rakhna hota hai. Confirmation ke liye, doosre technical signs aur price action analysis kation ke saath saath signs ka bhi dhyan rakhna hota hai. Confirmation ke liye, doosre technical indicators aur fee motion evaluation ka bhi istemal kiya jata hai. False signals ko keep away from karne ke liye, traders ko right hazard control ke principles ko observe karna chahiye.Overall, divergence trading ek powerful strategy hai jo traders ko market trends aur reversals ko bhi istemal kiya jata hai. False signals ko keep away from karne ke liye, investors ko proper risk management ke concepts ko comply with karna chahiye.Overall, divergence buying and selling ek effective method hai jo investors ko marketplace trends aur reversals ko become aware of karne mein madad karta hai, lekin ismein experience aur proper evaluation ka zaroori hai.

Divergence buying and selling ek famous buying and selling method hai jo technical analysis par adharit hai. Ye approach fee a buying and selling divergence ek vital aur beneficial tareeqa hai market ke trend adjustments ko samajhne ka. Is method ko sahi tareeqe se samajh kar istemal karne se traders apni buying and selling performance ko behtar bana sakte hain. Magar yeh zaroori hai ke traders proper danger management aur technical analysis par makhsoos tawajjo dein taake unhein sahi buying and selling choices ka intikhab karne mein madad milti rahe.Ction aur momentum indicators ke divergences ko pick out karke buying and selling choices lene par cognizance karta hai.Divergence trading mein investors divergence patterns ko spot karte hain, jo charge motion aur momentum indicators ke beech mein contradiction indicate karte hain. Divergence usually tab hoti hai jab price movement aur indicator movement opposite path mein ja rahe hote hain. Ye divergence bullish ya bearish reversal signals ke roop mein interpret ki ja sakti hai, depending at the context aur marketplace conditions.

Treading Strategy

Divergence trading mein investors ko pric divergence trading ek effective tool hai jo traders ko trend reversals aur trend modifications ke alerts provide karta hai. Is strategy ka istemal karke investors apne trading overall performance ko improve kar sakte hain aur steady profits earn kar sakte hain. Divergence buying and selling ko samajhna aur istemal karna, technical analysis ka ek ahem hissa hai jo traders ki achievement mein madadgare movement ke saath saath signs ka bhi dhyan rakhna hota hai. Confirmation ke liye, doosre technical signs aur price action analysis kation ke saath saath signs ka bhi dhyan rakhna hota hai. Confirmation ke liye, doosre technical indicators aur fee motion evaluation ka bhi istemal kiya jata hai. False signals ko keep away from karne ke liye, traders ko right hazard control ke principles ko observe karna chahiye.Overall, divergence trading ek powerful strategy hai jo traders ko market trends aur reversals ko bhi istemal kiya jata hai. False signals ko keep away from karne ke liye, investors ko proper risk management ke concepts ko comply with karna chahiye.Overall, divergence buying and selling ek effective method hai jo investors ko marketplace trends aur reversals ko become aware of karne mein madad karta hai, lekin ismein experience aur proper evaluation ka zaroori hai.

تبصرہ

Расширенный режим Обычный режим