Stick Sandwich Pattern in forex

Forex trading mein patterns ka ahem kirdar hota hai jo traders ko potential trading opportunities ka pata lagane mein madad karte hain. Ek aham pattern jiska istemal traders karte hain, wo hai Stick Sandwich pattern. Is article mein hum Stick Sandwich pattern ke tafseelat aur uska istemal forex trading mein roman Urdu mein tafseel se bayan karenge.

Stick Sandwich Pattern Ki Bunyadi Tafseel

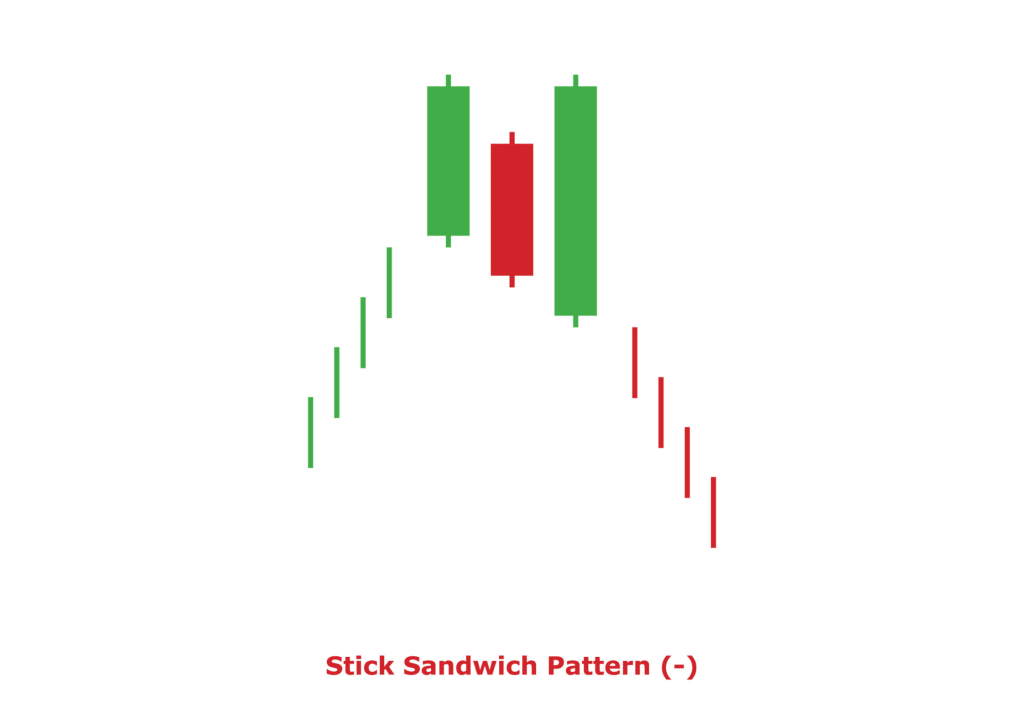

**1. **Stick Sandwich pattern ek reversal pattern hai jo trend ke change hone ka pata lagane mein madad deta hai.

**2. **Is pattern mein teen candlesticks hote hain: pehla aur teesra candlestick ek taraf trend ko confirm karte hain jabke doosra candlestick opposite direction mein hota hai aur pehle do candlesticks ke darmiyan close hota hai.

**3. **Pehla aur teesra candlestick zyada zor ka hota hai aur doosra candlestick unke darmiyan choti body ke sath hota hai, isliye is pattern ko "stick sandwich" kehte hain.

**4. **Stick Sandwich pattern ko confirm karne ke liye, traders ko volume aur price action ko bhi madahna chahiye taake unhein sahi entry aur exit points ka pata lag sake.

Stick Sandwich Pattern Ke Istemal Ke Tareeqay

**1. **Traders Stick Sandwich pattern ko trend reversal ke signals ke liye istemal karte hain. Agar trend downtrend mein hai aur Stick Sandwich pattern uptrend ke indication deta hai, to ye potential trend reversal ka pata lagata hai.

**2. **Is pattern ko confirm karne ke liye, traders ko doosre indicators aur tools ka istemal karna chahiye. Misal ke tor par, agar Stick Sandwich pattern ke sath RSI ya MACD jaise indicators bhi confirmations dete hain, to ye traders ke liye zyada reliable hota hai.

**3. **Traders ko Stick Sandwich pattern ke pehle aur teesre candlesticks ke zor ko dekhna chahiye. Agar ye candlesticks zyada lambay hain aur volume bhi zyada hai, to ye pattern ko aur bhi strong banata hai.

**4. **Entry aur exit points ka faisla karne se pehle, traders ko price action aur market ke overall conditions ka bhi tafseeli jaaizah karna chahiye. Agar market mein kisi aur indication hai jo Stick Sandwich pattern ke against hai, to traders ko cautious rehna chahiye.

Stick Sandwich Pattern Ke Faide

**1. **Stick Sandwich pattern traders ko trend reversal ke signals ka pata lagane mein madad deta hai. Agar ye pattern sahi tarah se identify kiya jaye, to traders ko potential profitable trades mil sakte hain.

**2. **Is pattern ka istemal karke traders apne risk ko kam kar sakte hain aur apni trading strategies ko improve kar sakte hain.

**3. **Stick Sandwich pattern ko confirm karne ke liye traders ko doosre indicators aur tools ka bhi istemal karna hota hai, jo unke liye trading decisions ko aur bhi reliable banata hai.

**4. **Ye pattern zyada tar timeframes par kaam karta hai, isliye traders ko alag-alag timeframes par iska istemal karke confirmations mil sakte hain.

Ikhtitami Alfaz

Stick Sandwich pattern ek ahem reversal pattern hai jo traders ko trend reversal ke signals ka pata lagane mein madad deta hai. Magar, is pattern ko sahi taur par samajhna aur identify karna traders ke liye zaroori hai. Practice aur experience ke sath, traders Stick Sandwich pattern ka istemal karke apni trading performance ko behtar bana sakte hain.

تبصرہ

Расширенный режим Обычный режим