Assalamu Alaikum Dosto!

Market Manipulation

Market manipulation ek aisi maharat hai jahan market ke price action ko bewakoof banaane ke liye ghair-kanuni ya anethical tareeqon se tehqiqi taur par ghatein ki gayin hain. Iska maqsad market ke jhooti bewakoof movements ko apni shakhsiyat ke liye faida uthane mein hai.

Market Manipulation Zone

Tanqeed se, ek manipulayshun zone sirf aik esa area hai jahan market ko manipulate kiya gaya hai aur kuch traders ko bahir nikal liya gaya hai.

Market Ko Kyun aur Kaise Manipulate Kiya Gaya Hai?

Sab se pehle, individual retail traders price ke movements par bohat kam asar daalte hain. Yeh woh log hain jinke paas bade paise hain jo price action ko hilate hain aur manipulate karte hain. Bade paise walay jaise ke banks aur doosre bade investors, prices ko manipulate karte hain. Market ko manipulate karne ki wajah bari rakam ko market mein bharwana hai. Maslan, agar aik bank ko stock ki 300 million dollars ki qeemat ke shares kharidne hain, toh unke order ko foran fill karwana mushkil hota hai aur aksar woh kuch nuksan uthate hain agar woh apne order ko har retail trader ki tarah execute kar lete hain. Aam taur par woh yeh karte hain ke woh market mein kuch bearish pressure uttate hain apne investment fund ke kuch quota ko istemal kar ke, maslan 20 million dollars. Is tarah market mein bearish sentiment paida karte hain, jis se traders short positions lete hain. Taa ke woh kam rate par invest kar saken. Jab price unke maqsad ke hadaf tak pohnch jata hai, toh phir woh apne bachay huay 280 million dollars ko apne maqsad ke shares kharidne ke liye rakh dete hain. Is se sell stops ko dur kar diya jata hai aur market mein bullish momentum paida hota hai.

Market Manipulation Types

Market Manipulation ka amal sirf aik tarah se nahi hota bulkeh ye amal mukhtalif type mein hota hai. Aam tawar par market manipulation k 6 bari types hen jo traders ya investors ko loss deti hai;

- Market Rumors aur Fake News

Market manipulation ke aik bohat mashhoor tareeqe mein se aik hai market rumors banane ka. Insiders jhooti maloomat phailate hain jin se aam logon ko aik trading faisla lene par majboor kiya jata hai, jab ke unhe pata hota hai ke yeh maloomat jhooti hain. Yeh woh karte hain ke kuch traders ya investors jhooti maloomat bana kar stock ke price ko upar ya niche le jane ke liye jhooti maloomat phailate hain. Maslan, companies ko behtareen dikhane ke liye rumors istemal ki jati hain taa ke price upar jaye. Aam taur par behtareen companies ko jurmana dikhane ke liye mushkil hota hai taa ke price kam ho, lekin yeh kehne ka matlab nahi hai ke yeh puri tarah se na-mumkin hai. Aksar rumors ya fake news price par asar dalte hain aur chote arse ke traders ke liye bari nuksan ki wajah ban sakti hain.

Fakes Market Rumors Ke Jaal Se Bachne Ka Tareeqa:- Source Ko Tasdeeq Karein: Yeh dekhne ke liye ziada research karen ke phaili hui maloomat asal aur sahi source se aa rahi hai.

- Initial Move Ko Weak Kar Dein. Iska matlab hai ke shakhsiyat ki khabar sun kar shakhsiyat ke khilaf trading karen.

- Pump aur Dump

Market Rumors ya Fake News ki tarah, market ko manipulate karne ke liye doosra aik tareeqa hai jise Pump aur Dump kehte hain. Pump aur Dump spam emails ya messages, groups aur seminars ke zariye kiya jata hai. "Pump" tab hota hai jab retail masses ya investors stock mein invest karne lagte hain. Is se stock ki qeemat aur volume tezi se barh jati hai. Jaise hi retail investors stock mein shamil ho jate hain, advocates apne shares bech dete hain ("the dump"), jis se price gir jati hai. Aksar manipulators ko stocks ko jo kam volume ya volatile hote hain, manipulate karne mein asani hoti hai. Di gai maloomat se aap samajh sakte hain ke yeh aqalmandana faisla nahi hai ke kam volume ya volatility wale stocks mein invest kiya jaye. Is tarah ke manipulation se bachne ka behtareen tareeqa yeh hai ke aap new stocks se bachain jo achanak tezi se upar jate hain. - Spoofing

Spoofing aik aur manipulative tareeqa hai jo maharat se trading karne wale short-term traders istemal karte hain market ko manipulate karne ke liye. Yahan aksar yeh hota hai:

Yeh maharat se traders aik khaas level par bade orders place karte hain jinka maqsad unhe execute karne ka koi irada nahi hota. Unka systematic tareeqa (algorithm ya bots ke zariye) unhe bari miqdar mein trades banane ka mauqa deta hai. Is tarah jab doosre investors bade orders ko dekhte hain, toh unhe lagta hai ke kuch bade sharks aik khaas level par buy ya sell karna chahte hain, is wajah se woh bhi wahan trade karna chahte hain aur apne trades usi level par place karte hain. Kabhi kabhi, market unke price par trade hone se minutes ya seconds pehle, algorithm orders ko cancel kar deta hai. Yeh tezi se karne wale logon ko market par short term control milta hai. Jab spoofer ya manipulator order ko cancel kar deta hai, toh market upar ya niche jata hai, is se nuksan hota hai un logon ko jo behisab bewakoof banane mein fas jate hain. Is se sath chaliye, duniya mein hone wale bohat saari maloomat se shabab ghar hone wale logon par jo market mein nuksan pohunchte hain. - Bear Raiding

Bear Raiding ek aisi strategy hai jo bade investors istemal karte hain taake kisi share ki keemat ko neeche le jayein, bade bech ke order daal kar. Uske baad, jhooti maloomat market mein phelate hain. Jab log bechte hain, to keemat girne se manipulator nuksan mein se faida uthata hai. Bear Raiding dinon, hafton ya mahinon tak ho sakti hai. Iska zyada asar lambi muddat ke traders par hota hai. - Wash Trading

Wash Trading tab hoti hai jab traders ek-dusre ke khilaaf khareed o farokht ke order daalte hain. Wash Trading se manipulators ko faida nahi hota, aur na hi unhein nuksan hota hai. Yeh strategy sirf trading volume ko zyada dikhane ke liye istemal hoti hai taki share ya koi bhi maali asbaab normal se zyada active nazar aaye. Traders, jo keemat volume ko dekhte hain, unko trading mein shamil hone mein mashhoor kar diya jata hai kyunki trading activity badh jati hai. Wash Trading short-term investors jaise scalpers aur day traders par asar daalti hai, lekin aksar long-term investors ya traders par asar nahi hoti kyunki yeh lambe arsay tak nahi chalti. Kyunki wash trading ka lamba asar nahi hota hai, is liye lambi muddat mein invest karna behtar hota hai. - Market ko Control Karna

Market ko control karna ka matlab hota hai jab koi shakhs ya kisi group ki koshish hoti hai ke zyadatar maali asbaab ya share ko apne control mein lein taake share ya asbaab ki keemat par apni rehnumaai kar sakein. Is manipulation ko karne mein waqt lagta hai, is liye lambi muddat ke investors par bura asar hota hai. Is se bachne ke liye, aapko jo bhi maali asbaab mein invest karne ka irada karte hain, us par mukhlis research karna hoga.

Doosri Types ki Manipulation

Trading k dowran tab hoti hai jab kisi shakhs ko kisi company ke maali harkat ke bare mein kuch ahem maloomat hai jo awaam se pehle disclose ki jati hai, aur woh ummeed rakhta hai ke jab khabar disclose hogi to usse faida hoga. Churning tab hoti hai jab fund managers ya brokers jo bade sums ki zimmedari sambhalte hain, woh apni commissions barhane ke liye zyada trades karte hain. Is se unke investors ko zyada paisa kamane mein madad nahi milti. Is tarah ki manipulation aam taur par market ke amm investors ko nuksan nahi pohnchati, lekin isse vyakti vyakti investor ko nuksan pohnch sakta hai. Jab market ko manipulate kiya jata hai, to yeh investors ke liye na-insaafi environment banata hai aur agar yeh sakht ho jata hai, to yeh retailers ko nuksan pohnchata hai jo market ke potential khatron ko pehchan nahi sakte.

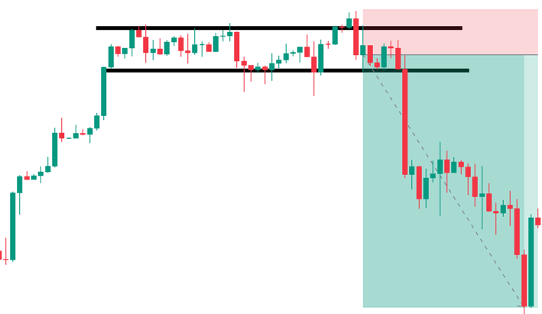

Stop Hunting

Market manipulation ke tarah, stop hunting woh hota hai jab bade market manipulators kisi level ke qareeb stop loss orders ko target karte hain taa ke apni liquidity needs puri kar saken. Market manipulation tactics jo maine upar explain ki hain woh fundamental analysis mein bari bhumika ada kar sakti hain, stop hunt technical analysis mein aham bhumika ada karti hai.

Stop Hunting Se Bachne Ka Tareeqa:

Chaliye seedhe to baat karte hain - aap yeh kehne mein kuch nuksan nahi utha sakte ke aap poori tarah se stop hunting se bach sakte hain... lekin aap apne trading system mein iske mumkin hone ke imkaan ko kam karne ke liye kuch tareeqon ka istemal kar sakte hain. Aur sab se bada tareeqa apne stop loss ko ek aqalmandi se set karna hai. Apna stop loss sirf ek bade resistance ke upar ya ek bade support ke niche set na karen. Kyun ke liquidity resistance ke upar aur support ke niche hoti hai, is wajah se price ek liquidity point se doosre liquidity point tak jati hai, aur wahan kai traders apna stop loss place karte hain.

Note: stop loss = Liquidity

Is baat ko jante huye, aapko apna stop loss sirf bade resistance ya bade support ke ek munasib fasle par rakhna behtar hai. Aap apne stop loss ko naapne mein Fibonacci Retracement tool ka istemal kar sakte hain. Ek aur ahem point yeh hai ke aapko apna stop loss us level par set karna chahiye jahan aapka trade mehrban nahi hota. Aam taur par traders ke entries pullbacks, breakouts aur chart patterns par mabni hoti hain. Pullback par trade karte waqt aam taur par apna stop loss pichli unchi ya pichli kam par set karna hota hai. Usi tarah, breakouts par trade karte waqt aam taur par apna stop loss consolidation ke neeche ya ooper set karna hota hai. Agar aap apne entries chart patterns par base karte hain, toh stop loss woh level par set karna chahiye jahan chart pattern mehrban nahi hota.

تبصرہ

Расширенный режим Обычный режим