Forex trading mein oversold levels ka tasavur bohot ahem hai. Oversold levels wo halat hain jahan koi maal ya currency pair ka qeemat tezi se gir chuki hoti hai aur ise zyada sasta samjha jata hai, jo ke ek kharidne ka mauqa darust kar sakta hai.

Oversold Levels

Forex trading mein oversold levels wo haalat hoti hain jahan koi maal ya currency pair ki keemat neeche gir chuki hoti hai aur ise zyada sasta samjha jata hai. Ye tab hota hai jab ek tezi se giravat aur lambe samay tak ka downtrend hota hai, jo ke ek lamba bechne wala dabaav ka samay utpann karta hai. Is natije mein, maal ya currency pair ki keemat ek had tak gir chuki hoti hai jo ke uski asli qeemat ya fair market price se kam hoti hai.

Identifying Oversold Levels

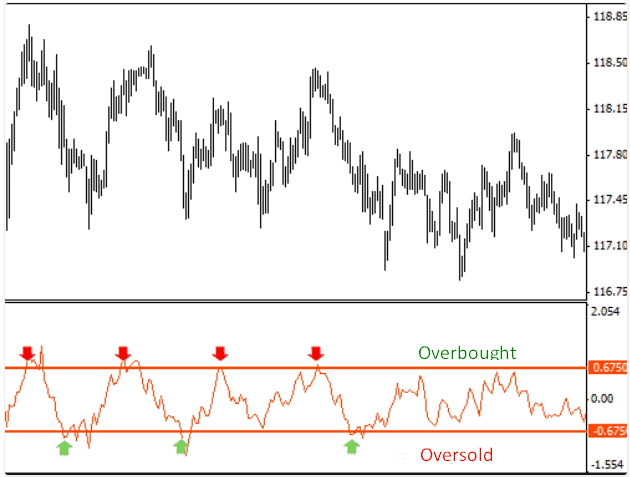

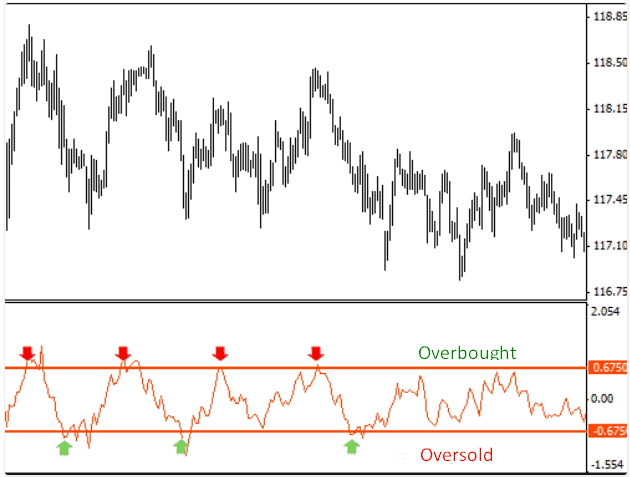

Traders oversold levels ko pehchanne ke liye mukhtalif technical indicators ka istemal karte hain. Is maksad ke liye ek aam indicator Relative Strength Index (RSI) hai. RSI ek momentum oscillator hai jo ke keemat ke tezi aur tabdeel hone ka fasla napta hai. Iska range 0 se 100 tak hota hai aur aam tor par price chart ke neeche ek line graph ke roop mein darust kiya jata hai.

Jab RSI kisi khaas threshold, aam tor par 30 ke aas paas, neeche gir jata hai to ye samjha jata hai ke maal ya currency pair oversold ho sakta hai. Traders ise ek kharidne ka mauqa samajhte hain, kyunke keemat neeche zyada gir chuki hai aur jald hi ek ulta chaal ya bounce back ka samay aane wala hai.

Significance of Oversold Levels

Oversold levels traders ke liye ahmiyat rakhte hain kyunke ye market mein mukammal palatne ke potential nuqtae nazar darust kar sakte hain. Jab koi maal oversold ho jata hai to iska matlab hai ke ek badi tadad mein market ke shiraa'k zayada maal bech chuke hain, jis se keemat par neeche ki taraf dabaav padta hai. Magar, ye bechne ka dabao had tak jari nahi reh sakta, aur kuch waqt baad kharidar samne aane ki umeed ki ja sakti hai jo ke usay zyada keemat samajh kar is ka fayeda uthane ke liye majboor karta hai.

Traders oversold levels ko dhundte hain kyunke ye potential palatne ya ek temporary downtrend ki rok ke indicators samjhe jate hain. Ye trading opportunities present karte hain un traders ke liye jo kam keemat par kharidna chahte hain aur umeed rakhte hain ke keemat jald hi palatne ya direction badalne wali hai.

Using Oversold Levels in Trading Strategies

Traders oversold levels ko apni trading strategies mein mukhtalif tareeqon se istemal karte hain. Ek aam approach ye hai ke ek kharidne ka mauqa dekha jata hai jab oversold conditions ka confirmation mil jata hai. Ye confirmation bullish candlestick pattern, trendline breakout, ya moving averages ke crossover ke roop mein aa sakta hai.

Misal ke taur par, ek trader dekhta hai ke ek currency pair RSI indicator ke base par oversold levels tak pohanch chuka hai. Seedha kharidna ki bajaye, usay ek bullish reversal candlestick pattern ka intezaar hota hai, jaise ke hammer ya bullish engulfing pattern, jo ke price chart par ban jata hai. Ye confirmation ek potential shift ko signal karta hai bearish se bullish momentum mein, jo ke trade ke liye ek ziada mazboot entry point faraham karta hai.

Advantages of Using Oversold Levels

Oversold Levels

Forex trading mein oversold levels wo haalat hoti hain jahan koi maal ya currency pair ki keemat neeche gir chuki hoti hai aur ise zyada sasta samjha jata hai. Ye tab hota hai jab ek tezi se giravat aur lambe samay tak ka downtrend hota hai, jo ke ek lamba bechne wala dabaav ka samay utpann karta hai. Is natije mein, maal ya currency pair ki keemat ek had tak gir chuki hoti hai jo ke uski asli qeemat ya fair market price se kam hoti hai.

Identifying Oversold Levels

Traders oversold levels ko pehchanne ke liye mukhtalif technical indicators ka istemal karte hain. Is maksad ke liye ek aam indicator Relative Strength Index (RSI) hai. RSI ek momentum oscillator hai jo ke keemat ke tezi aur tabdeel hone ka fasla napta hai. Iska range 0 se 100 tak hota hai aur aam tor par price chart ke neeche ek line graph ke roop mein darust kiya jata hai.

Jab RSI kisi khaas threshold, aam tor par 30 ke aas paas, neeche gir jata hai to ye samjha jata hai ke maal ya currency pair oversold ho sakta hai. Traders ise ek kharidne ka mauqa samajhte hain, kyunke keemat neeche zyada gir chuki hai aur jald hi ek ulta chaal ya bounce back ka samay aane wala hai.

Significance of Oversold Levels

Oversold levels traders ke liye ahmiyat rakhte hain kyunke ye market mein mukammal palatne ke potential nuqtae nazar darust kar sakte hain. Jab koi maal oversold ho jata hai to iska matlab hai ke ek badi tadad mein market ke shiraa'k zayada maal bech chuke hain, jis se keemat par neeche ki taraf dabaav padta hai. Magar, ye bechne ka dabao had tak jari nahi reh sakta, aur kuch waqt baad kharidar samne aane ki umeed ki ja sakti hai jo ke usay zyada keemat samajh kar is ka fayeda uthane ke liye majboor karta hai.

Traders oversold levels ko dhundte hain kyunke ye potential palatne ya ek temporary downtrend ki rok ke indicators samjhe jate hain. Ye trading opportunities present karte hain un traders ke liye jo kam keemat par kharidna chahte hain aur umeed rakhte hain ke keemat jald hi palatne ya direction badalne wali hai.

Using Oversold Levels in Trading Strategies

Traders oversold levels ko apni trading strategies mein mukhtalif tareeqon se istemal karte hain. Ek aam approach ye hai ke ek kharidne ka mauqa dekha jata hai jab oversold conditions ka confirmation mil jata hai. Ye confirmation bullish candlestick pattern, trendline breakout, ya moving averages ke crossover ke roop mein aa sakta hai.

Misal ke taur par, ek trader dekhta hai ke ek currency pair RSI indicator ke base par oversold levels tak pohanch chuka hai. Seedha kharidna ki bajaye, usay ek bullish reversal candlestick pattern ka intezaar hota hai, jaise ke hammer ya bullish engulfing pattern, jo ke price chart par ban jata hai. Ye confirmation ek potential shift ko signal karta hai bearish se bullish momentum mein, jo ke trade ke liye ek ziada mazboot entry point faraham karta hai.

Advantages of Using Oversold Levels

- Identification of Buying Opportunities: Oversold levels traders ko potential buying opportunities ka pata lagane mein madad karte hain, khaaskar jab ye dusre technical indicators ya price patterns ke saath combine kiya jaye.

- Risk Management: Oversold conditions ke base par trade ke pehle confirmation ka intezar karke, traders apna risk behtar taur par manage kar sakte hain. Confirmation ke bina trade mein dakhil hone ki sambhavna ko kam karke, traders neeche aur nuksan ka samna karne ki kam sambhavna rakhte hain.

- Profit Potential: Oversold levels par kharidna profitable trades ka samna karta hai agar keemat oversold condition se palatne ya bounce back karne ki umeed rakhti hai. Traders is tarah ke price movements ka faida uthane ke liye aim karte hain.

- Contrarian Trading: Oversold levels par trading karne mein aksar ek contrarian approach ka istemal hota hai, jahan traders prevailing trend ke khilaf jate hain. Ye tabadla faydemand ho sakta hai jab market sentiment zyada bearish hoti hai, jo ke potential price reversals ko indicate karta hai.

- False Signals: Oversold levels kabhi kabhi false signals ko hasil kar sakte hain, jahan keemat oversold territory tak pohanchne ke baad bhi girne ka silsila jaari rehta hai. Traders ko ehtiyaat se kaam lena chahiye aur additional confirmation ka istemal karna chahiye oversold conditions par trade mein dakhil hone se pehle.

- Market Volatility: Zayada volatility ke dino mein, oversold levels zyada ahmiyat nahi rakhte, kyunke price movements erratic aur unpredictable ho sakte hain. Traders ko oversold indicators ka istemal karte waqt market conditions aur volatility levels ka bhi tawajjo deni chahiye.

- Timing Issues: Oversold levels ka pehchan karna ek cheez hai, lekin trade ke dakhil aur nikalne ka sahi waqt tay karna mushkil ho sakta hai. Traders ko oversold signals ko doosre technical aur fundamental analysis ke saath combine karke timing ko behtar banana chahiye.

- Divergence: Traders price aur RSI indicator ke darmiyan divergence dhundte hain, jahan price neeche ki taraf jaari rehti hai lekin RSI higher lows banata hai. Ye divergence oversold condition mein ek potential reversal ko signal kar sakta hai.

- Support and Resistance Levels: Traders oversold levels ko price chart par key support levels ke saath combine karte hain. Confluence zones mein kharidna, jahan oversold conditions aur mazboot support levels aam tor par overlap karte hain, trade ke successful hone ke chances ko zyada karta hai.

- Multiple Time Frame Analysis: Traders oversold levels ko mukhtalif time frames par analyze karte hain taake confirmation ki strength ko darust kiya ja sake. Misal ke taur par, agar ek currency pair daily chart par oversold hai aur 4-hour chart par bullish divergence dikhata hai, to ye ek potential reversal ke liye case ko mazboot karta hai.

- Volume Analysis: Traders oversold levels ke saath trading volume ko bhi dekhte hain taake buying interest ki strength ko ja sakte hain. Oversold conditions ke doran zyada volume ka hona zyada buying pressure aur reversal ke chances ko zyada karta hai.

تبصرہ

Расширенный режим Обычный режим