Rising Window Pattern: Ek Ahem Price Action Pattern

Rising window pattern ek price action pattern hai jo forex market mein dekha jata hai. Yeh pattern typically ek bullish continuation pattern hai jo market mein uptrend ke doran dekha jata hai. Is pattern mein ek sudden gap ya window dekha jata hai jahan price ek session se agle session mein higher level par open hoti hai, aur yeh gap previous session ke closing price se upar hota hai. Chuki aapne Roman Urdu mein Rising Window Pattern ke baare mein maloomat talash ki hai, to chaliye isey gehri tafseel se samajhte hain:

Rising Window Pattern Kya Hai?

Rising window pattern ko doosre naam se "gapping up" bhi jana jata hai. Yeh pattern typically ek bullish continuation pattern hai jo uptrend ke doran dekha jata hai. Is pattern mein price ek sudden gap ya window banati hai jahan price ek session se agle session mein higher level par open hoti hai, aur yeh gap previous session ke closing price se upar hota hai.

Rising Window Pattern Ki Pehchan Kaise Karein:

- Sudden Gap ya Window: Rising window pattern ki pehchan ek sudden gap ya window se hoti hai. Yeh gap typically previous session ke closing price se upar hota hai aur ek higher level par open hota hai.

- Volume Increase: Rising window pattern ke saath usually ek volume increase bhi dekha jata hai. Agar volume increase nahi hota hai, to pattern ki reliability kam ho sakti hai.

- Continuation of Uptrend: Rising window pattern typically uptrend ke doran dekha jata hai aur iska matlab hai ke price ke uptrend mein continuation hone ka chance hai.

Rising Window Pattern Ke Arkaan:

- Sudden Gap: Rising window pattern ka pehla arkan ek sudden gap ya window hota hai jahan price ek higher level par open hoti hai.

- Volume Increase: Is pattern ke saath usually volume ka increase dekha jata hai jo uski reliability ko aur bhi zyada banata hai.

- Continuation of Uptrend: Rising window pattern typically uptrend ke doran dekha jata hai aur iska matlab hai ke price ke uptrend mein continuation hone ka chance hai.

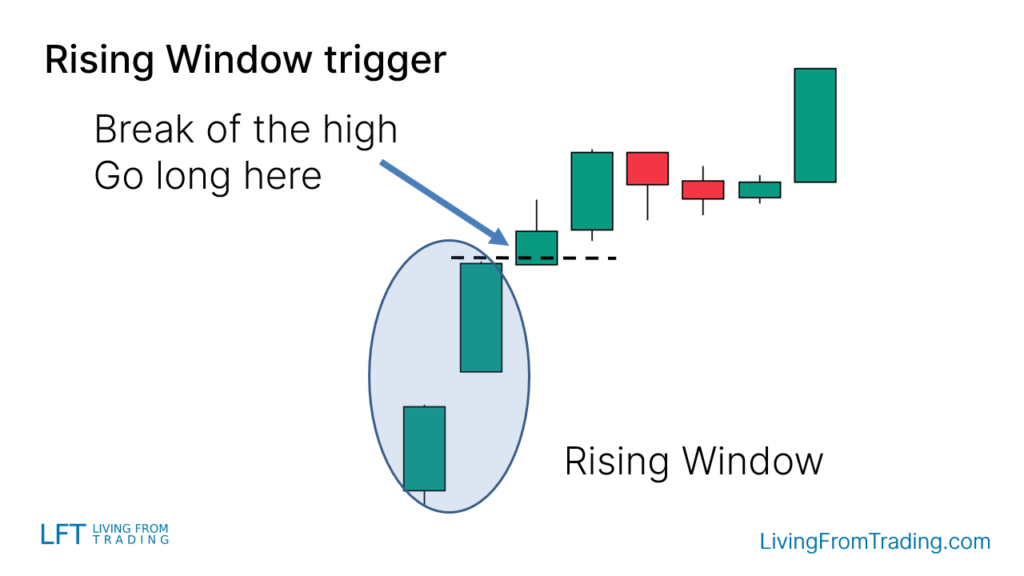

Rising Window Pattern Ka Trade Setup:

- Entry Point: Rising window pattern ke baad traders long positions lete hain. Entry point usually window ke just above rakha jata hai.

- Stop Loss: Stop loss ko typically window ke just below rakha jata hai takay traders ko false breakout se bachaya ja sake.

- Take Profit: Take profit level ko traders previous swing high ya resistance level ke near rakhte hain.

Rising Window Pattern Ke Fayde:

- Bullish Continuation Signal: Rising window pattern bullish continuation ko indicate karta hai, jisse traders ko uptrend mein further movement ka indication milta hai.

- Clear Entry Aur Exit Points: Is pattern mein traders ko clear entry aur exit points milte hain, jisse unhe trading decisions lene mein madad milti hai.

- Reliable Signal: Agar rising window pattern sahi tareeke se confirm hota hai, to yeh ek reliable trading signal provide karta hai.

- Volume Confirmation: Rising window pattern ke saath usually ek volume increase bhi dekha jata hai jo pattern ki reliability ko aur bhi zyada banata hai.

Rising window pattern ek ahem price action pattern hai jo traders ko bullish continuation ke liye ek potential signal provide karta hai. Lekin, yaad rahe ke har ek pattern ki tarah, is pattern ka bhi sahi tareeke se confirm hona zaroori hai. Isi tarah, traders ko market analysis aur risk management ke saath sahi tareeke se rising window pattern ko samajhna aur uske saath practice karna chahiye takay wo market mein kamyaabi haasil kar sakein.

تبصرہ

Расширенный режим Обычный режим