Scalping Introduction

Scalping ek trading strategy hai jisme traders chhoti muddat ke dauran bohot si chhoti trades karte hain, jinhein munafa kamane ke liye tezi se bandh diya jata hai. Yeh strategy market ki chhoti tezi aur girebanon ke andar ka profit uthane par mabni hoti hai.

Mazboot Technical Analysis

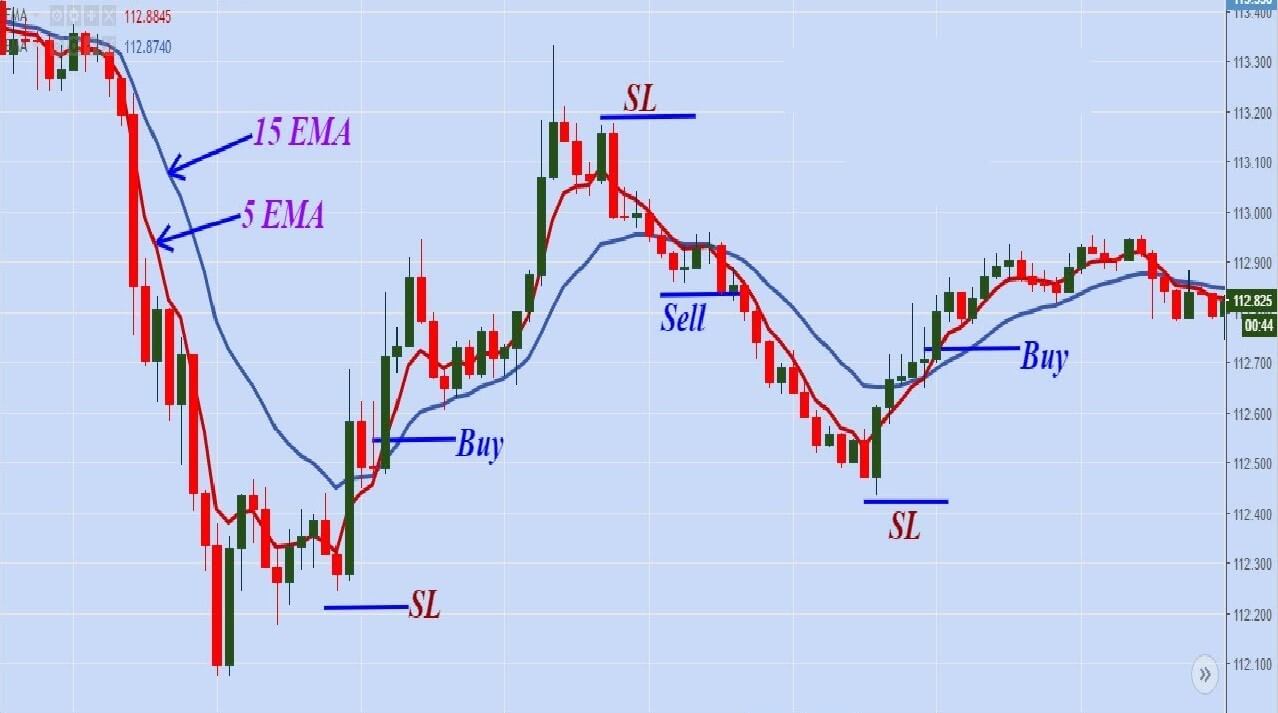

Scalping ke liye sabse zaroori cheez mazboot technical analysis hai. Aapko price action, support aur resistance levels, aur indicators jaise ki moving averages aur RSI ka istemal karna hoga. In sab cheezon se aap market ke mizaj ko samajh sakte hain aur munafa kamane ke liye behtareen mouke pehchan sakte hain.

Tight Spreads aur Fast Execution

Scalping mein spreads aur execution ka waqt bohot ahem hota hai. Spread woh farq hai jo broker buy aur sell price ke darmiyan hota hai. Scalping ke liye, aapko kam spreads wale brokers chunna chahiye taake aap har trade par zyada se zyada munafa kamana saken.

Small Time Frames ka Istemal

Scalping mein, traders chhoti time frames jaise ki 1-minute aur 5-minute charts ka istemal karte hain. In time frames par, market ki tezi aur girebanon ko asani se dekha ja sakta hai, aur munafa kamane ke liye tezi se trades ki ja sakti hai.

Entry aur Exit Points ki Wazahat

Scalping mein entry aur exit points ka tareeqa wazahat se tay kiya jana chahiye. Entry point ko samajhna zaroori hai taake aap munafa dar trades kar saken, aur exit point ko bhi munafa ko mehfooz rakhne ke liye theek waqt par samajhna zaroori hai.

Risk Management

Har trading strategy mein risk management ka bohot ahem kirdar hota hai, aur scalping bhi iske bina mumkin nahi hai. Aapko har trade mein kitna risk lena hai aur kitna munafa lena hai yeh tay karna zaroori hai. Zyada risk lena aapko nuqsaan mein daal sakta hai, is liye hamesha apne risk ko control mein rakhein.

News aur Market Events ka Dhyan Rakhein

Scalping mein, market ke hawale se har samachar aur ghatnaon ka dhyan rakhna zaroori hai. Koi bhi bari ghatna ya unexpected news aapki trades ko prabhavit kar sakti hai, is liye market ke samay par updates rakhna zaroori hai.

Emotions ko Control Karein

Scalping ki strategy ko follow karte waqt, emotions ko control karna zaroori hai. Ghabrahat ya hawas mein aakar trading karne se bachein. Plan ke mutabiq trading karein aur apne decisions ko logic aur analysis ke sath lein.

Practice aur Patience

Scalping ek mushkil strategy hai jo practice aur patience ko mangti hai. Shuruwat mein, demo account par practice karein aur apne skills ko improve karein. Sabr se kaam lein aur apne mistakes se seekhein.

Realistic Expectations

Scalping mein munafa kamana aasan nahi hai. Is liye, realistic expectations rakhein aur apne skills ko gradually improve karte rahein. Chhoti chhoti munafa kamane ki jagah, consistent aur stable trading pe focus karein.

Performance ki Analysis

Apni scalping strategy ki performance ko regularly analyze karein. Apne trades ko track karein aur mistakes ko samjhein. Jo cheezen kaam kar rahi hain unhein barqarar rakhein aur jo nahi un par kaam karein.

Scalping ek trading strategy hai jisme traders chhoti muddat ke dauran bohot si chhoti trades karte hain, jinhein munafa kamane ke liye tezi se bandh diya jata hai. Yeh strategy market ki chhoti tezi aur girebanon ke andar ka profit uthane par mabni hoti hai.

Mazboot Technical Analysis

Scalping ke liye sabse zaroori cheez mazboot technical analysis hai. Aapko price action, support aur resistance levels, aur indicators jaise ki moving averages aur RSI ka istemal karna hoga. In sab cheezon se aap market ke mizaj ko samajh sakte hain aur munafa kamane ke liye behtareen mouke pehchan sakte hain.

Tight Spreads aur Fast Execution

Scalping mein spreads aur execution ka waqt bohot ahem hota hai. Spread woh farq hai jo broker buy aur sell price ke darmiyan hota hai. Scalping ke liye, aapko kam spreads wale brokers chunna chahiye taake aap har trade par zyada se zyada munafa kamana saken.

Small Time Frames ka Istemal

Scalping mein, traders chhoti time frames jaise ki 1-minute aur 5-minute charts ka istemal karte hain. In time frames par, market ki tezi aur girebanon ko asani se dekha ja sakta hai, aur munafa kamane ke liye tezi se trades ki ja sakti hai.

Entry aur Exit Points ki Wazahat

Scalping mein entry aur exit points ka tareeqa wazahat se tay kiya jana chahiye. Entry point ko samajhna zaroori hai taake aap munafa dar trades kar saken, aur exit point ko bhi munafa ko mehfooz rakhne ke liye theek waqt par samajhna zaroori hai.

Risk Management

Har trading strategy mein risk management ka bohot ahem kirdar hota hai, aur scalping bhi iske bina mumkin nahi hai. Aapko har trade mein kitna risk lena hai aur kitna munafa lena hai yeh tay karna zaroori hai. Zyada risk lena aapko nuqsaan mein daal sakta hai, is liye hamesha apne risk ko control mein rakhein.

News aur Market Events ka Dhyan Rakhein

Scalping mein, market ke hawale se har samachar aur ghatnaon ka dhyan rakhna zaroori hai. Koi bhi bari ghatna ya unexpected news aapki trades ko prabhavit kar sakti hai, is liye market ke samay par updates rakhna zaroori hai.

Emotions ko Control Karein

Scalping ki strategy ko follow karte waqt, emotions ko control karna zaroori hai. Ghabrahat ya hawas mein aakar trading karne se bachein. Plan ke mutabiq trading karein aur apne decisions ko logic aur analysis ke sath lein.

Practice aur Patience

Scalping ek mushkil strategy hai jo practice aur patience ko mangti hai. Shuruwat mein, demo account par practice karein aur apne skills ko improve karein. Sabr se kaam lein aur apne mistakes se seekhein.

Realistic Expectations

Scalping mein munafa kamana aasan nahi hai. Is liye, realistic expectations rakhein aur apne skills ko gradually improve karte rahein. Chhoti chhoti munafa kamane ki jagah, consistent aur stable trading pe focus karein.

Performance ki Analysis

Apni scalping strategy ki performance ko regularly analyze karein. Apne trades ko track karein aur mistakes ko samjhein. Jo cheezen kaam kar rahi hain unhein barqarar rakhein aur jo nahi un par kaam karein.

تبصرہ

Расширенный режим Обычный режим