Advanced Concept Wyckoff Methodology:

First kitab mein jo puri theory hai woh Wyckoff methodology ko samajhne aur market ki movement ko samajhne ke liye zaroori hai. Lekin Wyckoff methodology, ya meri samajhne ki tarika, isse bahut aage jaata hai. Yeh sirf chart par labeling karne ki baat nahi hai.

Har Event Ke Peeche:

Humne har event ke peeche ki cheezein seekhi hai; kaise banti hai, chart par kaise represent hoti hai, uske peeche ki psychology, aur aise hi bahut kuch. Lekin jaisa main kehta hoon, yeh method bahut zyada rich hai. Market ki apni prakriti ke karan, do bilkul barabar structures hona practically impossible hai.

Book Diagrams:

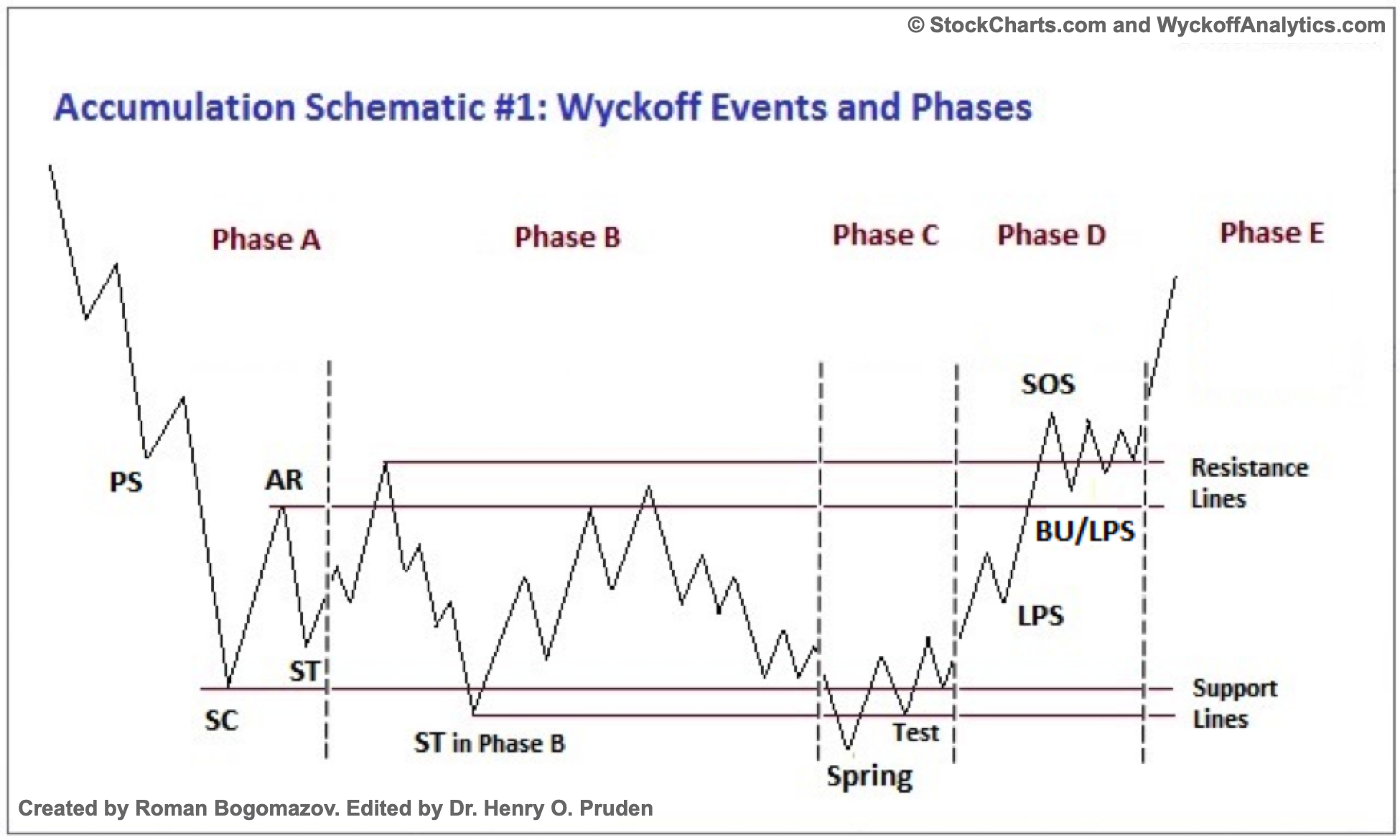

Har roz hum "book" diagrams dekhte hain, jo classic examples ke liye bahut sahi tarike se adapt kiye gaye hote hain, lekin zyadatar cases mein market less conventional structures develop karegi, jahan aise events ki pehchan karna mushkil ho jayegi. Isliye zaroori hai ki hum events ki exact search par focus na karein (especially Phase A ke stop events), aur fact par dhyan de ki sach mein important hai action as a whole.

Trend Movement:

Matlab, hum bahut saare charts mein dekhenge ki ek trend movement rukti hai aur ek lateralization process shuru hoti hai, lekin hum sahi tarah se woh pehle 4 stop events identify nahi kar paate. Shayad is wajah se hum asset ko discard kar dete hain aur hum future operational opportunity miss kar dete hain. Yeh ek galti hai.

Events Identify Karna:

Jaisa main kehta hoon, zaroori nahi hai ki hum woh 4 stop events identify kar paaye, lekin zaroori hai ki market ne objectively trend movement ko roka hai. Shayad Climax, Reaction aur Test ko hum asli tareeke se identify na kar sakein, lekin objective yeh hai ki market ruki hai aur character change shuru kar diya hai (trend se lateral state ki taraf migration). Jaisa hum examples mein dekhte hain, yeh structures bilkul perfect nahi hoti hain.

First kitab mein jo puri theory hai woh Wyckoff methodology ko samajhne aur market ki movement ko samajhne ke liye zaroori hai. Lekin Wyckoff methodology, ya meri samajhne ki tarika, isse bahut aage jaata hai. Yeh sirf chart par labeling karne ki baat nahi hai.

Har Event Ke Peeche:

Humne har event ke peeche ki cheezein seekhi hai; kaise banti hai, chart par kaise represent hoti hai, uske peeche ki psychology, aur aise hi bahut kuch. Lekin jaisa main kehta hoon, yeh method bahut zyada rich hai. Market ki apni prakriti ke karan, do bilkul barabar structures hona practically impossible hai.

Book Diagrams:

Har roz hum "book" diagrams dekhte hain, jo classic examples ke liye bahut sahi tarike se adapt kiye gaye hote hain, lekin zyadatar cases mein market less conventional structures develop karegi, jahan aise events ki pehchan karna mushkil ho jayegi. Isliye zaroori hai ki hum events ki exact search par focus na karein (especially Phase A ke stop events), aur fact par dhyan de ki sach mein important hai action as a whole.

Trend Movement:

Matlab, hum bahut saare charts mein dekhenge ki ek trend movement rukti hai aur ek lateralization process shuru hoti hai, lekin hum sahi tarah se woh pehle 4 stop events identify nahi kar paate. Shayad is wajah se hum asset ko discard kar dete hain aur hum future operational opportunity miss kar dete hain. Yeh ek galti hai.

Events Identify Karna:

Jaisa main kehta hoon, zaroori nahi hai ki hum woh 4 stop events identify kar paaye, lekin zaroori hai ki market ne objectively trend movement ko roka hai. Shayad Climax, Reaction aur Test ko hum asli tareeke se identify na kar sakein, lekin objective yeh hai ki market ruki hai aur character change shuru kar diya hai (trend se lateral state ki taraf migration). Jaisa hum examples mein dekhte hain, yeh structures bilkul perfect nahi hoti hain.

تبصرہ

Расширенный режим Обычный режим