Introduction.

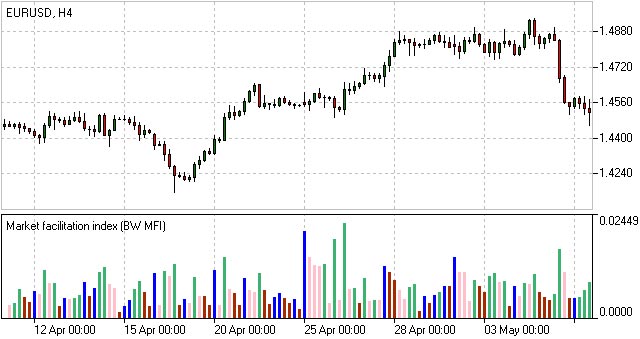

Market Facilitation Index (MFI) ek technical indicator hai jo market ki liquidity aur volatility ko measure karta hai. Yeh indicator Bill Williams ke dwara develop kiya gaya tha aur iska use market trends aur price action ke analysis ke liye kiya jata hai.

Market Facilitation Index (MFI) working.

Market Facilitation Index (MFI) ko calculate karne ke liye, yeh chaar components use karta hai:

1. Price

2. Volume

3. Tick Volume

4. Spread

Yeh components market ki liquidity aur volatility ko measure karte hai. MFI ki value zero se 100 tak hoti hai. Zero ki value low liquidity aur volatility ko indicate karta hai jabki 100 ki value high liquidity aur volatility ko indicate karta hai.

Market Facilitation Index (MFI) Anylesis.

MFI ka use market trends aur price action ke analysis ke liye kiya jata hai. Jab MFI ki value high hoti hai, yeh bullish trend ko indicate karta hai. Jab MFI ki value low hoti hai, yeh bearish trend ko indicate karta hai.

MFI ka use market ki reversal points ko identify karne ke liye bhi kiya jata hai. Agar MFI ki value high hai aur market bearish trend se bullish trend mein shift kar raha hai, toh yeh market ki reversal point ko indicate karta hai.

Key points.

MFI ka use market ki breakouts ko identify karne ke liye bhi kiya jata hai. Agar MFI ki value high hai aur market ko breakout hone wala hai, toh yeh market ki breakout point ko indicate karta hai.Market Facilitation Index (MFI) market ki liquidity aur volatility ko measure karne ke liye ek powerful technical indicator hai. Iska use market trends aur price action ke analysis ke liye kiya jata hai. MFI ki value high hone par bullish trend aur low hone par bearish trend ko indicate karta hai. Iske alawa, MFI ki value se market ki reversal points aur breakouts ko bhi identify kiya ja sakta hai.

Market Facilitation Index (MFI) ek technical indicator hai jo market ki liquidity aur volatility ko measure karta hai. Yeh indicator Bill Williams ke dwara develop kiya gaya tha aur iska use market trends aur price action ke analysis ke liye kiya jata hai.

Market Facilitation Index (MFI) working.

Market Facilitation Index (MFI) ko calculate karne ke liye, yeh chaar components use karta hai:

1. Price

2. Volume

3. Tick Volume

4. Spread

Yeh components market ki liquidity aur volatility ko measure karte hai. MFI ki value zero se 100 tak hoti hai. Zero ki value low liquidity aur volatility ko indicate karta hai jabki 100 ki value high liquidity aur volatility ko indicate karta hai.

Market Facilitation Index (MFI) Anylesis.

MFI ka use market trends aur price action ke analysis ke liye kiya jata hai. Jab MFI ki value high hoti hai, yeh bullish trend ko indicate karta hai. Jab MFI ki value low hoti hai, yeh bearish trend ko indicate karta hai.

MFI ka use market ki reversal points ko identify karne ke liye bhi kiya jata hai. Agar MFI ki value high hai aur market bearish trend se bullish trend mein shift kar raha hai, toh yeh market ki reversal point ko indicate karta hai.

Key points.

MFI ka use market ki breakouts ko identify karne ke liye bhi kiya jata hai. Agar MFI ki value high hai aur market ko breakout hone wala hai, toh yeh market ki breakout point ko indicate karta hai.Market Facilitation Index (MFI) market ki liquidity aur volatility ko measure karne ke liye ek powerful technical indicator hai. Iska use market trends aur price action ke analysis ke liye kiya jata hai. MFI ki value high hone par bullish trend aur low hone par bearish trend ko indicate karta hai. Iske alawa, MFI ki value se market ki reversal points aur breakouts ko bhi identify kiya ja sakta hai.

تبصرہ

Расширенный режим Обычный режим