&&&&Forex Trading Mein Flat Correction&&&&

Forex trading mein "Flat Correction" ek technical analysis concept hai, jo Elliott Wave Theory ke antargat aata hai. Elliott Wave Theory, stock market aur financial markets mein price movements ko predict karne ke liye use ki jati hai.

Flat Correction, market mein ek specific pattern ko describe karta hai, jisme price ek specific range mein sideways movement karta hai, uske baad ek sudden reversal hota hai. Ye pattern mostly corrective phase mein dekha jata hai, jab market mein overall trend mein temporary interruption hoti hai.

&&&&Forex Trading Mein Flat Correction Ki Characteristics&&&&

Flat Correction ke kuch key features hote hain:

Lekin dhyan rahe, ki market movements unpredictable bhi ho sakte hain aur kisi bhi pattern ya indicator ko blindly follow nahi kiya jaana chahiye. Always risk management ka dhyan rakhe aur proper research aur analysis ke saath trading decisions le.

Forex trading mein "Flat Correction" ek technical analysis concept hai, jo Elliott Wave Theory ke antargat aata hai. Elliott Wave Theory, stock market aur financial markets mein price movements ko predict karne ke liye use ki jati hai.

Flat Correction, market mein ek specific pattern ko describe karta hai, jisme price ek specific range mein sideways movement karta hai, uske baad ek sudden reversal hota hai. Ye pattern mostly corrective phase mein dekha jata hai, jab market mein overall trend mein temporary interruption hoti hai.

&&&&Forex Trading Mein Flat Correction Ki Characteristics&&&&

Flat Correction ke kuch key features hote hain:

- Sideways Movement: Is pattern mein price ek specific range mein sideways movement karta hai, jise corrective phase ke doran dekha jata hai.

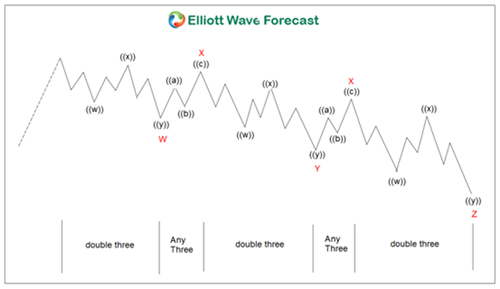

- Three-Wave Structure: Flat Correction mein typically three waves hote hain, jo ki a-b-c structure ko follow karte hain. Yeh waves ek dusre ke against move karte hain.

- Shallow Retracements: Is pattern mein retracements normal se kam hoti hain, matlab price pehle ki trend ke against move karta hai lekin zyada extent tak nahi jaata.

- Sudden Reversal: Flat Correction ke baad ek sudden reversal hota hai, jisme price previous trend direction mein move karta hai.

Lekin dhyan rahe, ki market movements unpredictable bhi ho sakte hain aur kisi bhi pattern ya indicator ko blindly follow nahi kiya jaana chahiye. Always risk management ka dhyan rakhe aur proper research aur analysis ke saath trading decisions le.

تبصرہ

Расширенный режим Обычный режим