;;;;;Forex Trading Mein Corrective Waves;;;;

Forex trading mein, "Corrective Waves" Elliott Wave Theory ka ek important concept hai. Elliott Wave Theory ek technical analysis method hai jo financial markets, including forex markets, mein use hota hai. Is theory ke according, markets mein price movements ko patterns mein analyze kiya jata hai jo human psychology, investor sentiment, aur market dynamics ko reflect karte hain.

Corrective Waves, Elliott Wave Theory ke doosre type ke waves hote hain, pehle type ke waves ko "Impulse Waves" kehte hain. Corrective Waves ko Impulse Waves ke opposite movements consider kiya jata hai, yaani ke jab Impulse Waves market mein upar ki taraf move karte hain, tab Corrective Waves market mein neeche ki taraf move karte hain, aur vice versa.

;;;;;Forex Trading Mein Corrective Waves Ki Types;;;;

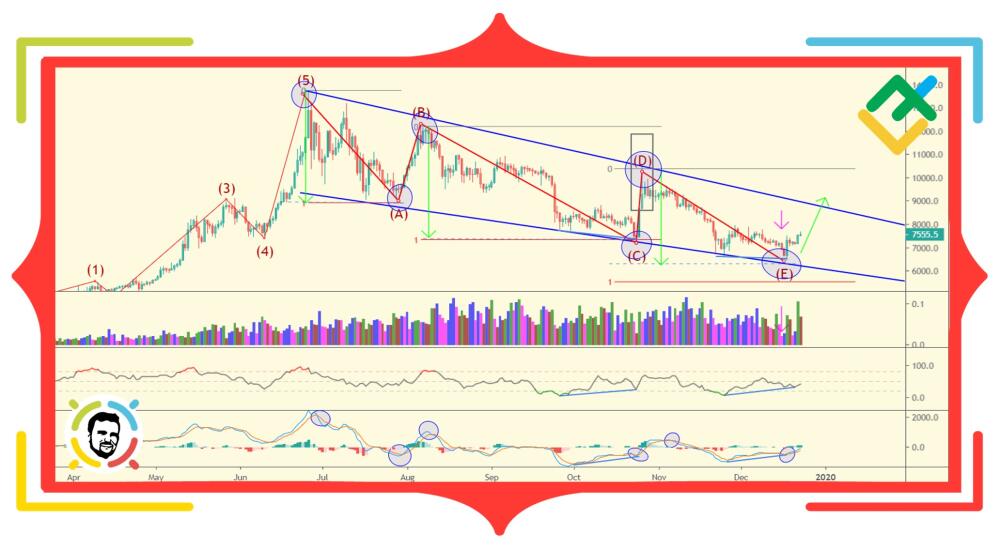

Corrective Waves ko mainly market mein consolidation periods ya price retracements ke doran dekha jata hai. Ye waves impulsive moves ke baad aate hain aur overall trend ko correct karte hain ya temporarily reverse karte hain. Corrective Waves ko three main types mein divide kiya jata hai:

Forex trading mein, "Corrective Waves" Elliott Wave Theory ka ek important concept hai. Elliott Wave Theory ek technical analysis method hai jo financial markets, including forex markets, mein use hota hai. Is theory ke according, markets mein price movements ko patterns mein analyze kiya jata hai jo human psychology, investor sentiment, aur market dynamics ko reflect karte hain.

Corrective Waves, Elliott Wave Theory ke doosre type ke waves hote hain, pehle type ke waves ko "Impulse Waves" kehte hain. Corrective Waves ko Impulse Waves ke opposite movements consider kiya jata hai, yaani ke jab Impulse Waves market mein upar ki taraf move karte hain, tab Corrective Waves market mein neeche ki taraf move karte hain, aur vice versa.

;;;;;Forex Trading Mein Corrective Waves Ki Types;;;;

Corrective Waves ko mainly market mein consolidation periods ya price retracements ke doran dekha jata hai. Ye waves impulsive moves ke baad aate hain aur overall trend ko correct karte hain ya temporarily reverse karte hain. Corrective Waves ko three main types mein divide kiya jata hai:

- Zigzag Correction: Ye correction pattern mein price ek zigzag movement follow karta hai, jisme price ka retracement 3 waves mein hota hai, jo hote hain A-B-C. Zigzag corrections ko "abc" format mein represent kiya jata hai.

- Flat Correction: Flat correction mein price ek sideways movement dikhata hai, jisme retracement 3 waves mein hota hai, par ye waves horizontally move karte hain. Flat corrections ko "abc" format mein represent kiya jata hai, lekin ye waves normally bahut straight lines mein nahi hote, instead range-bound movement show karte hain.

- Triangle Correction: Triangle correction pattern mein price ek triangle shape form karta hai, jisme retracement 5 waves mein hota hai. Triangle corrections ko "abcd" format mein represent kiya jata hai aur ye waves typically contracting or expanding triangles ke form mein dekhe jate hain.

تبصرہ

Расширенный режим Обычный режим